United Therapeutics (NASDAQ:UTHR) CEO Martine Rothblatt Sells 8,000 Shares

聯合治療公司首席執行官馬丁·羅斯布拉特以每股 398.55 美元的價格出售了 8,000 股,總計 319 萬美元,減少了她的持股比例 98.4%,剩餘 130 股,價值 51,811.50 美元。該交易已向美國證券交易委員會(SEC)披露。該公司的股票開盤價為 396.50 美元,市值為 178.9 億美元,市盈率為 15.48。分析師的評級意見不一,普遍目標價為 438.85 美元,反映出 “適度買入” 的評級

聯合治療公司(NASDAQ:UTHR - 獲取免費報告)首席執行官馬丁·羅斯布拉特於 9 月 9 日星期二出售了 8,000 股該股票。股票的平均售價為 398.55 美元,總交易額為 3,188,400.00 美元。出售完成後,首席執行官在公司持有 130 股,價值 51,811.50 美元。這代表着他們持有的股票減少了 98.40%。該交易已在與證券交易委員會的法律文件中披露,具體內容可通過此鏈接查看。

聯合治療價格表現

- 世界頂級對沖基金的三大股票推薦

UTHR 股票在星期四開盤價為 396.50 美元。該公司的 50 日簡單移動平均為 314.12 美元,200 日簡單移動平均為 306.91 美元。該公司的市值為 178.9 億美元,市盈率為 15.48,市盈增長比率為 6.16,貝塔值為 0.62。聯合治療公司的 12 個月低點為 266.98 美元,12 個月高點為 436.95 美元。

聯合治療(NASDAQ:UTHR - 獲取免費報告)最近一次公佈財報是在 7 月 30 日星期三。該生物技術公司報告本季度每股收益(EPS)為 6.41 美元,低於分析師一致預期的 6.80 美元,差額為 0.39 美元。聯合治療的股本回報率為 18.73%,淨利潤率為 40.36%。該公司本季度的收入為 7.986 億美元,而分析師預期為 8.0213 億美元。去年同期,該公司每股收益為 5.85 美元。與去年同期相比,該公司的收入增長了 11.7%。整體來看,賣方分析師預計聯合治療公司今年將發佈每股收益 24.48 美元。

對沖基金對聯合治療的看法

- Liquidia:法院勝利是行業巨頭的覺醒?

大型投資者最近買入和賣出了該股票的股份。Chung Wu Investment Group LLC 在第二季度購買了聯合治療的新股份,價值 29,000 美元。WealthCollab LLC 在第二季度將其在聯合治療的股份增加了 55.9%。WealthCollab LLC 現在持有 106 股該生物技術公司的股票,價值 30,000 美元,此前在該期間內又購買了 38 股。Rakuten Securities Inc.在第二季度將其在聯合治療的股份增加了 76.7%。Rakuten Securities Inc.現在持有 106 股該生物技術公司的股票,價值 30,000 美元,此前在該期間內又購買了 46 股。SVB Wealth LLC 在第一季度購買了聯合治療的新股份,價值 32,000 美元。最後,Geneos Wealth Management Inc.在第一季度將其在聯合治療的股份增加了 141.7%。Geneos Wealth Management Inc.現在持有 145 股該生物技術公司的股票,價值 45,000 美元,此前在該期間內又購買了 85 股。對沖基金和其他機構投資者持有該公司 94.08% 的股份。

華爾街分析師的看法

最近,一些分析師對該股票發佈了報告。摩根大通將聯合治療的目標價格從 350.00 美元下調至 330.00 美元,並在 7 月 8 日的研究報告中對該股票給予了 “增持” 評級。美國銀行將聯合治療的目標價格從 314.00 美元上調至 463.00 美元,並在 9 月 2 日的研究報告中給予該股票 “中性” 評級。瑞銀集團將聯合治療的目標價格從 415.00 美元上調至 560.00 美元,並在 9 月 4 日的研究報告中給予該股票 “買入” 評級。Oppenheimer 將聯合治療的目標價格從 510.00 美元上調至 575.00 美元,並在 9 月 5 日的研究報告中給予該股票 “跑贏大盤” 評級。最後,Jefferies Financial Group 將聯合治療的目標價格從 432.00 美元上調至 564.00 美元,並在 9 月 2 日的研究報告中給予該股票 “買入” 評級。九位投資分析師對該股票給予了買入評級,四位分析師對該公司的股票給予了持有評級。根據 MarketBeat.com 的數據,該公司目前的共識評級為 “適度買入”,共識目標價格為 438.85 美元。

- 分析師表示這兩隻中型生物技術股具有兩倍潛力

查看我們對聯合治療的最新分析

聯合治療公司簡介

(獲取免費報告)

聯合治療公司是一家生物技術公司,致力於開發和商業化產品,以滿足美國及國際上慢性和危及生命疾病患者的未滿足醫療需求。該公司提供 Tyvaso DPI,一種通過預填充和一次性使用的藥筒吸入的乾粉;Tyvaso,一種通過超聲霧化器吸入的溶液;Remodulin(特雷普坦)注射劑,用於治療肺動脈高壓(PAH)患者以減輕與運動相關的症狀;Orenitram,一種特雷普坦的片劑形式,用於延緩疾病進展並改善 PAH 患者的運動能力;以及 Adcirca,一種口服 PDE-5 抑制劑,用於增強 PAH 患者的運動能力。

推薦故事

- 五隻我們更看好的股票超過聯合治療

- 現在購買的三隻最佳藍籌股

- 油價空頭頭寸擁擠,三隻可能引發擠壓的股票

- 什麼是納斯達克股票交易所?

- 俱樂部的一部分:Robinhood 和 AppLovin 因納入 S&P 500 而飆升

- 選舉股票:選舉如何影響股市

- 儘管回調,火箭實驗室仍然看起來準備突破

此即時新聞提醒由敍事科學技術和來自 InsiderTrades.com 的金融數據生成,旨在為讀者提供最快和最準確的報道。此故事在發佈前已由 InsiderTrades.com 的編輯團隊審核。請將有關此故事的任何問題或評論發送至 [email protected].

聯合治療公司是否有內部買入或賣出?

註冊接收 InsiderTrades.com 關於聯合治療公司及相關公司的每日內部買入和賣出報告。

來自我們的合作伙伴

他在 1.10 美元時推薦了 Nvidia。現在,他説這隻股票將…

原始的七大奇蹟回報了 16,894%——將 7,000 美元變成了 118 萬美元。現在,這位預測 Nvi...的人

牛津俱樂部

巴菲特、蓋茨和貝索斯拋售股票

全球最富有的人正在進行鉅額資金操作。沃倫·巴菲特剛剛清算了...

Banyan Hill Publishing

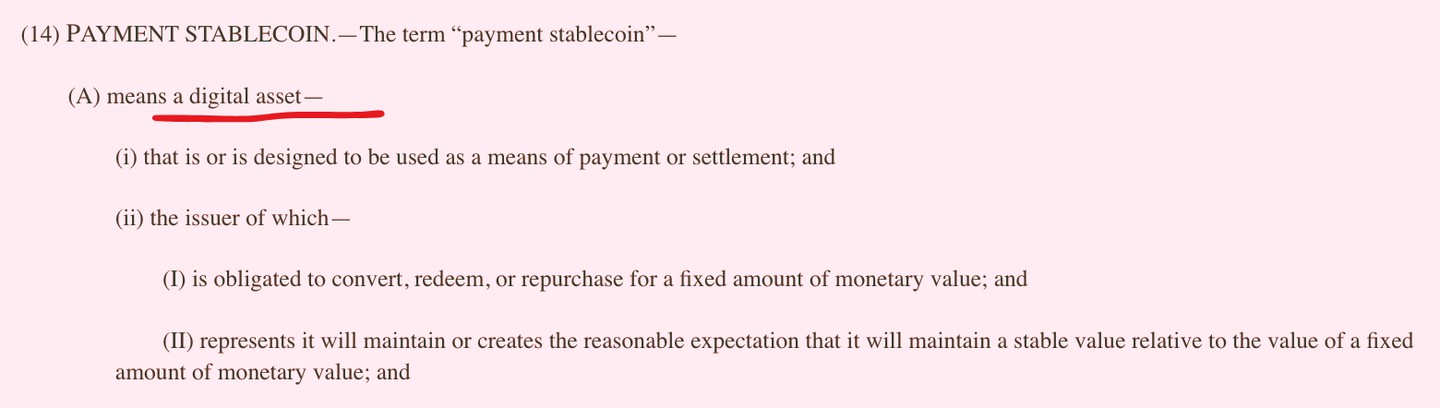

為什麼特朗普的 “智能美元” 可能會重寫規則

必須觀看:唐納德·特朗普對美國美元的激進改革國會剛剛批准特朗普總統的最新...

Stansberry Research

GENIUS 法案:奪取你的現金的陰謀?

一項名為 GENIUS 法案的新法律可能會悄然引發美國金融數十年來最激進的轉變。B...

Priority Gold

通過這些新的月度收入 ETF 舒適退休?

太多退休人員夜不能寐,擔心他們的儲蓄無法維持。傳統建議和微薄回報讓人...

Investors Alley

“在財報前賣出 Nvidia”

埃裏克·弗賴剛剛發佈了他最具爭議的呼籲之一:“賣出 Nvidia。” 儘管華爾街一直在...

InvestorPlace

2013 年比特幣礦工揭示他的交易系統(免費)

當其他人都在賭博於迷因幣或追逐下一個 “100 倍的月球飛行” 時,我們的成員正在系統化...

加密交換利潤

在美國鬼鎮發現的 100 萬億美元 “人工智能金屬”

傑夫·布朗最近前往美國沙漠中的一個鬼鎮…調查可能會...

Brownstone Research