Lumen is climbing out of the ditch

Lumen Technologies is undergoing a significant transformation under CEO Kate Johnson, focusing on AI-driven networking and cloud-based enterprise solutions. The company has sold its consumer fiber business to AT&T for $5.75 billion, reducing its debt and improving its financial position. Lumen's long-term debt has halved since the Level 3 acquisition, while operating cash flow remains stable. The company is also refinancing high-interest obligations and expanding its fiber network, aiming to strengthen cash flow and reduce leverage as it pivots from traditional telecom to next-generation digital solutions.

The famous quote "I skate to where the puck is going to be, not where it has been," and it's attributed to Wayne Gretzky, though some sources also credit his father, Walter Gretzky. The quote means that instead of reacting to current events or the immediate past, one should anticipate future developments and position themselves to capitalize on them. This strategy involves proactive thinking and positioning yourself for the future, rather than being stuck in the present or past.

Lumen Technologies may be presenting such an opportunity for investors who chose to look forward instead of backwards.

Lumen Technologies, headquartered in Monroe, Louisiana, traces its history back to 1930 when it was founded as the Oak Ridge Telephone Company. The company grew rapidly by acquiring and integrating regional phone and telecom businesses, incorporating as Central Telephone & Electronics in 1967 and rebranding as CenturyTel in 1998. A string of major acquisitions over the following decadesincluding Pacific Telecom in 1997, Embarq in 2009, Qwest Communications in 2011, and most importantly Level 3 Communications in 2017transformed it into a national player offering a wide suite of communications, internet, cloud, and networking services.

Level 3 Communications began as a subsidiary of Peter Kiewit Sons' Inc., shifting its focus toward telecommunications by rebranding from Kiewit Diversified Group to Level 3 in 1998. That year, the company completed a record-breaking IPO and set out to build an upgradeable international fiber-optic network optimized for internet protocol (IP). Level 3 quickly became a major provider of core network transport and IP services for ISPs, enterprises, and carriers, rapidly expanding its infrastructure and influence. Through aggressive acquisitions, including Genuity, WilTel, and Broadwing, Level 3 established itself as a leader in scalable communications and media delivery networks, weathering the industry's downturns post the internet bubble and remaining one of the world's largest internet backbone providers until its integration with CenturyTel/CenturyLink in 2017.

CenturyLink officially rebranded as Lumen Technologies in September 2020 to reflect a strategic shift toward next-generation fiber, cloud, and enterprise digital solutions while divesting traditional telecom and consumer segments to focus on these higher-growth areas. Most recently, Lumen sold 95% of its Quantum Fiber consumer business to AT&T in 2025, further sharpening its focus on business-to-business networking and enterprise services.

CenturyLink had taken on a lot of debt in 2017 in connection with its acquisition of Level 3. This debt and slowing growth eventually cratered the stock price as investors lost confidence in the company's survivability. CenturyLink/Lumen Technologies' acquisition of Level 3 Communications in 2017 failed to deliver expected success largely due to several factors: the combination substantially increased Lumen's debt loadroughly doubling it to about $38 billionat a time when legacy telecom businesses were already in secular decline and industry growth was shifting toward mobile networks and newer technologies. The merger attempted to integrate enterprise-focused Level 3 with Lumen's predominately consumer-focused business, but operational synergies were limited and competition increased from more innovative and nimbler rivals. Customer service reportedly deteriorated, support quality suffered, and numerous complaints noted confusion, slow response times, and administrative dysfunction across the merged company's sprawling infrastructure and legacy divisions. Furthermore, persistent issues with compliance (e.g., antitrust violations and required divestitures) added regulatory and reputational headaches that distracted management and impeded strategic execution after the merger.

Lumen stock is down over 80% in the last 10 years.

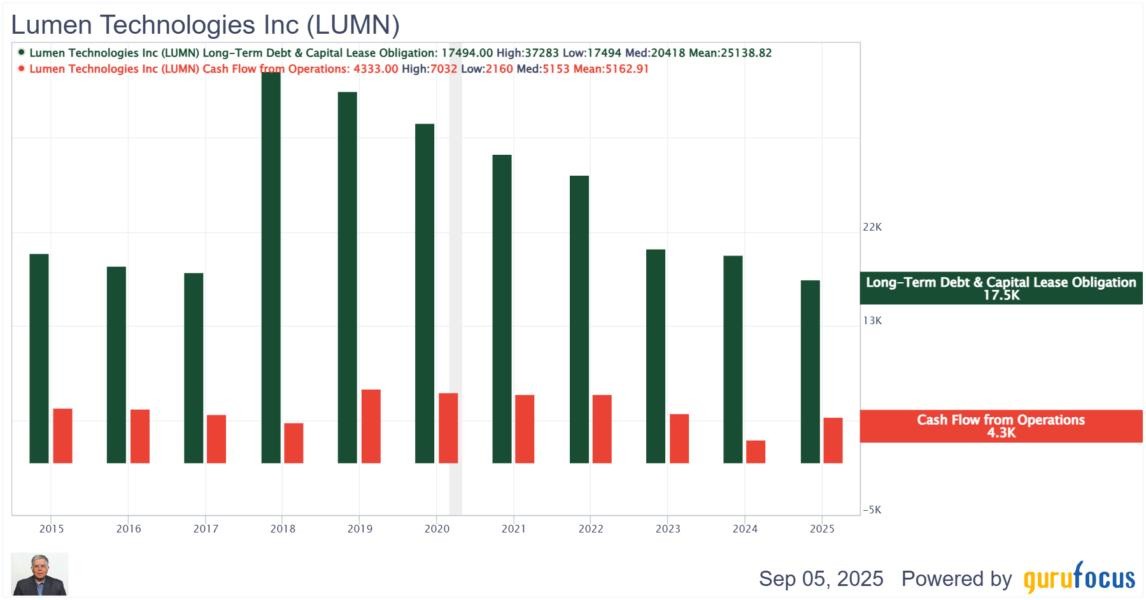

Lumen Technologies - Total long-term debt vs. Cash Flow from Operations.

Lumen's long-term debt has been cut in half in the last 8 years since the Level 3 acquisition. However, Operating Cash Flow remained relatively stable.

LUMN Data by GuruFocus

Following the recent sale of the consumer Fiber business to AT&T, refinancing and dividend reduction the company's debt profile is becoming more manageable.

The current CEO of Lumen Technologies is Kate Johnson. She has been leading the company since late 2022 and is driving a major transformation focused on pivoting Lumen toward AI-driven networking, fiber expansion, and cloud-based enterprise solutions. Johnson's leadership marks a shift from the company's traditional telecom roots to becoming a next-generation digital networking powerhouse.

Lumen Technologies is implementing a broad turnaround strategy focused on stabilizing its financial position and pivoting toward high-growth areas in AI-driven networking and enterprise solutions. Key actions include selling its consumer fiber business to AT&T for $5.75 billion to reduce debt, refinancing $2 billion in high-interest obligations, and increasing cost discipline across operations. The company is reinvesting freed-up capital into its Network as a Service (NAS) platform, expanding its 17-million-mile fiber footprint, signing $8.5 billion in private capacity fiber contracts, and launching new AI-powered infrastructure partnerships with hyper-scalers like Amazon Web Services, Microsoft, and Google. These initiatives are expected to reduce leverage, cut annual interest costs by $1.2 billion, and strengthen cash flow, with a strategic focus on next-generation connectivity, edge computing, and cloud integration to return the business to sustainable growth.

Price and enterprise value per share has begun to respond to economic progress.

LUMN Data by GuruFocus

Price to Operating Cash flow is just 1.1. This is a remarkable number for a company with a market cap of < $ 5 Billion.

Lumen Technologies organizes its business portfolio into three strategic segmentsGrow, Nurture, and Harvestwhich reflect the lifecycle and strategic importance of their various products and services. The Grow segment focuses on high-growth, next-generation offerings such as security, cloud, unified communications, edge compute, and software-defined networking; these areas receive the majority of investment as Lumen aims to capture expanding market demand and modernize its platform. The Nurture segment includes mature networking products, notably VPN and Ethernet services, which continue to retain significant customer demand among enterprise and mid-market clients, but are maintained with an eye toward migrating customers to newer technologies over time. Finally, the Harvest segment manages legacy services, including traditional voice and older private line products, with minimal reinvestment, aiming to maximize cash flow and efficiently wind down these offerings as the market for them shrinks. This strategic segmentation allows Lumen to allocate resources and investment according to growth potential, helping the company transition more effectively from its legacy roots toward a modern, technology-driven future.

Economic Moat

Lumen Technologies possesses a significant economic moat built on its massive global fiber-optic network, which spans hundreds of thousands of route miles and includes on-net access to major commercial locations and data centers. This expansive physical infrastructure is extremely difficult and costly for competitors to replicate, serving as the cornerstone of Lumen's competitive advantage. The company's network underpins high-bandwidth, low-latency connectivity needs for enterprise customers, hyperscalers, cloud platforms, and government clients pursuing digital transformation and AI-driven business models. This network may be specially attractive to cloud and AI hyper-scaler's like Amazon, Microsoft, Google and Meta who want a scalable network capable of shuttling data round its dispersed datacenter's.

Augmenting this physical asset base is Lumen's suite of advanced digital services, such as cloud connectivity, managed security, and network-as-a-service offerings, all delivered over a unified digital platform. Long-standing relationships with major enterprises further reinforce customer stickiness, while ongoing investments in technology and operational excellence enable Lumen to adapt and remain relevant amid rapid industry changes. As the demand for secure, scalable, and reliable connectivity grows in the AI and cloud era, Lumen's network breadth, technology partnerships, and reputation for performance and reliability collectively form a robust barrier to entry and position the company as a key infrastructure provider for next-generation digital services.

Insider & Guru Holdings

Insider buying is quite positive with multiple substantial insider buy including by the CEO and CFO. Of the Guru investors only Renaissance Technologies (Trades, Portfolio) holds a >1% state of outstanding shares. Investor Dan Hagan has accumulated over 5% of outstanding shares.

Conclusion

Lumen Technologies' enterprise business operates a vast network of optical fiber spanning 340,000 route miles, densely connecting U.S. cities and major global interconnection points. This infrastructure was assembled through several acquisitions, most notably the 2017 purchase of Level 3 Communications. Much of the network's backbone dates to the telecom bubble over two decades ago and remains underutilized, as portions built by Level 3 feature multiple fiber conduitsmany of which have sat empty. These network assets have recently attracted significant interest from large cloud computing providers, who have committed $9 billion to utilize both existing and newly constructed infrastructure that Lumen will build to reach specific customer locations. This capital influx, along with the sale of Lumen's consumer division, has provided resources for the company to strengthen its balance sheet and address its previously high levels of debt.

Lumen is no longer a debt-ridden Frankenstein from the first tech bubble of 25 years ago. Its showing signs of coming out of the debt pit it got itself into. Lumen has now basically reversed the CenturyTel - L3 merger. The company has paid down nearly $20 billion in debt from 2018. It has made a lot of progress in the last eight years, and it is capitalizing on the second order effects from the fortuitous emergence of Artificial Intelligence. However, it still has a long way to go. It is here at the right time when the hyper-scalers like Microsoft, Google and Amazon need ready bandwidth to connect their vast AI datacenters to each other and to their customers. As the company reduces debt it can re-invest in building out its infrastructure. It may also become a desirable acquisition candidate for other telecoms or hyper-scalers desiring of a pre-built internet backbone. After the company reaches its deleveraging goals it can start rebuilding its equity and shareholder returns. Lumen stock has the potential to become a multi-bagger from its current sorry state.