美聯儲降息預期催生投機泡沫 高風險反彈席捲未盈利科技股

Due to market expectations that the Federal Reserve will continue to lower interest rates, some high-risk technology stocks have risen significantly, with the stocks of unprofitable technology companies tracked by UBS rising 21% since the end of July. However, this rise has raised concerns that it may lead to investor losses. Experts point out that this is a "junk rebound," with extremely high risks, and a strong atmosphere of retail speculation, which may end in disillusionment. In the current outlook of interest rate cuts, speculative activities in other sectors are also increasing

According to the Zhitong Finance APP, due to market expectations that the Federal Reserve will continue to lower interest rates, some high-risk technology stocks have seen significant increases. However, this rise has raised concerns, as these stocks may quickly decline if the Federal Reserve's interest rate policy or market expectations change, leading to substantial losses for investors.

A basket of unprofitable technology company stocks tracked by UBS has risen 21% since the end of July, while profitable technology company stocks have only increased by 2.1%, and the Nasdaq 100 index has risen by 5.9%. This round of increases has pushed the stock prices of a basket of unprofitable technology companies, including SoundHound AI (SOUN.US) and Unity Software (U.US), close to their highest levels since the end of 2021—when interest rates were at their lowest and speculative asset bubbles burst the following year.

Figure 1

On Tuesday, the risk of a hard landing in the stock market became evident, with the sector falling 2.1%, underperforming the broader market. Earlier, Federal Reserve Chairman Jerome Powell reiterated that policymakers face a difficult path when weighing further rate cuts. Even if the Federal Reserve continues to cut rates twice this year, the benchmark rate may remain above 3%, far from the zero interest rate policy during the pandemic.

Ted Mortensen, a technology strategist at Robert W. Baird with over 30 years of Wall Street experience, pointed out that this is a "junk rebound," a phase of speculative over-exuberance driven by expectations of a rate-cutting cycle leading to a "revival of animal spirits." He believes that this rebound has obvious bubble characteristics and extremely high risks, with the retail speculation atmosphere on Reddit and Robinhood making it as uncertain as a casino, ultimately likely to end in disillusionment.

Mortensen also emphasized that analyzing the value of loss-making companies based on possible actions by the Federal Reserve is "extremely tricky" in the context of persistent inflation and the negative impact of artificial intelligence on the labor market.

Lowering borrowing costs is particularly important for loss-making technology companies, which need to finance their rapidly growing businesses, with valuations based on profit expectations that may take years to realize. In the current outlook for interest rate cuts, speculative activities in other areas of the stock market are also relatively active: high-risk biotech stocks have surged, and the Russell 2000 small-cap index has set a record for the first time since 2021, but technology stocks have been particularly prominent.

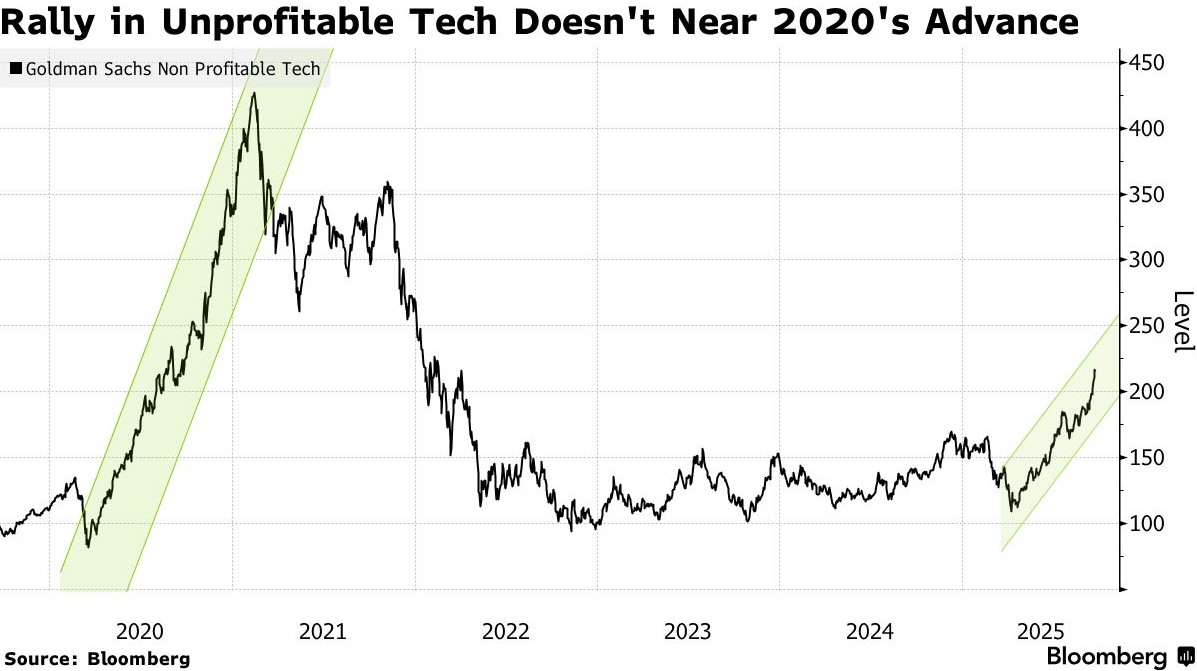

The unprofitable investment portfolio tracked by Goldman Sachs has nearly doubled since its low in April, recently reaching its highest level since February 2022.

Specifically, OpenDoor Technologies Inc., touted as a "meme stock" by Canadian hedge fund manager Eric Jackson, has seen its stock price soar over 280% since the end of July; quantum computing company IonQ Inc. has risen over 80% during the same period, while SoundHound AI, Xometry Inc., and Lemonade Inc. have all increased by over 50% Despite the recent rebound, the gains still pale in comparison to the early 2000s—Goldman Sachs' portfolio surged over 420% from March 2020 to February 2021, but most of those gains receded over the following 15 months. However, the current portfolio is still about 50% lower than its peak in 2021.

Figure 2

Some investors believe the recent rally is justified. Anthony Saglimbene, Chief Market Strategist at Ameriprise Financial Services Inc., pointed out that the technology sector has higher earnings visibility than other sectors, artificial intelligence presents a unique long-term benefit, and the interest rate environment is relatively favorable. Therefore, it is not surprising to see more risk-taking in speculative areas, as speculation is indeed a source of untapped upside potential.

However, he also emphasized that the rally in unprofitable tech stocks could easily reverse. If the economy experiences a broader recession, such stocks may face greater pressure than quality stocks. He further stated that the Federal Reserve may continue to be cautious about the interest rate path; if it begins to cut rates more aggressively, it could indicate economic problems, which would not bode well for high-risk or unprofitable tech assets. "Those who survive by the sword may also die by the sword."