Wall Street is abuzz! A "key official" from the Federal Reserve, who accurately predicted the path of tapering and interest rate hikes, has proposed a historic reform

Federal Reserve Bank of Dallas President Lorie Logan proposed abandoning the federal funds rate as the primary policy tool, sparking heated discussions on Wall Street. Logan is regarded as a market expert, and her views are interpreted as a signal that the Federal Reserve may take action. Her proposal marks a significant shift in the Federal Reserve's policy tools, which could impact future interest rate decisions

According to the Zhitong Finance APP, last week, a proposal from a Federal Reserve official surprised Wall Street; she suggested abandoning the federal funds rate, a benchmark that has served as its primary policy tool for decades. The fund rate and the stagnant market it relies on. What is striking is not the idea itself—market participants have long argued that policymakers should move away from the federal funds rate—but that this viewpoint came from Dallas Fed President Lorie Logan, rather than the New York Fed President, who is responsible for implementing Federal Reserve policy measures. Furthermore, this viewpoint was quickly interpreted as a signal that the Federal Reserve might soon take action on this matter.

This reaction highlights Logan's significance in the eyes of Wall Street: before becoming the Dallas Fed President in 2022, she was responsible for managing the balance sheet at the New York Fed. Among senior Federal Reserve officials, she is regarded as one of the top market experts. She is also seen as a potential successor to New York Fed President John Williams, who will reach the mandatory retirement age in 2028. Additionally, the Trump administration viewed her as a potential candidate for a position on the Federal Reserve Board.

Gennadiy Goldberg, head of U.S. interest rate strategy at TD Securities, stated, "Logan is an authoritative expert on the Federal Reserve's balance sheet policy and front-end rates, which is why we pay close attention to her remarks."

Wall Street has long maintained a two-way communication with the New York Fed. The New York Fed is a core financial institution in the U.S. financial center. Experts from both sides discuss issues and test ideas together, especially regarding how the market reacts to central bank policies.

However, this situation has changed in recent years, with Logan now at the helm of the Dallas Fed. Since then, she has frequently commented on market operations, the Federal Reserve's balance sheet, and financial conditions—all core topics of interest to market participants.

Some Fed chairs are academic economists, while others have business backgrounds, or, like Logan, have market backgrounds. The last two individuals who served as Dallas Fed presidents also had extensive market backgrounds, but their influence was not as significant as Logan's.

Goldberg noted, "This indicates that the influence of some leadership thoughts is no longer confined to the New York Fed but has become more decentralized."

Senior Field

For Logan, this is a familiar territory. She has worked at the New York Fed for most of her life, starting as a junior analyst and eventually becoming one of the most senior officials at the institution. Although she often discusses monetary policy and the economic outlook, market participants are more focused on her detailed speeches about the world they inhabit.

Goldberg remarked that last week's comments were just the latest in a series of prescient speeches by Logan that have had a significant impact on market trends.

At the beginning of last year, when the Federal Reserve accelerated the reduction of its balance sheet, Logan was the first policymaker to publicly advocate for slowing this process—at a time when there were no signs of stress in the financial markets. Coupled with previous reports that officials had discussed this topic at the December 2023 meeting, this situation drew market attention. Four months after Logan's speech, policymakers announced a plan aimed at initiating the process of reducing quantitative easing In terms of monetary policy, the same is true. Logan was the first to propose the idea of the Federal Reserve "skipping" interest rate hikes in 2023, and the Fed indeed did so in June (pausing rate hikes), followed by another rate increase in the subsequent meetings.

Federal Funds Rate Outdated

Fed watchers are beginning to ponder whether Logan is sparking an important discussion. Moreover, they believe this discussion should have occurred long ago.

The federal funds trading market, which was once conducted between banks, unsecured, and only for overnight periods, has significantly shrunk. Over the past 15 years, it has been replaced by the repurchase agreement market. Repurchase agreements are a form of short-term borrowing, also known as "repos." This market is open to a broader range of financial participants and can more accurately reflect the transmission of monetary policy in the market.

As suggested by Logan, shifting from the federal funds rate to tracking a benchmark rate based on repo transactions would allow the Fed to operate in a more stable and mature market, potentially enhancing the effectiveness of monetary policy.

However, there are concerns that any actions taken outside the realm of unsecured funding could undermine the stability of the overnight funding market.

Joseph Abate, interest rate strategist at SMBC Nikko, stated, "They need to decide what to do next, and Logan's point is correct that they don't have much time left."

Abate added that the money market and the federal funds market are rapidly changing, while the federal funds market has failed to keep pace with this change.

Officials discussed the state of the federal funds market in 2018 but made no adjustments. Logan's speech may reopen this dialogue, while also sounding the alarm for a sluggish institution—one that often acts slowly—this trait is pragmatic at times, but can also lead to policies lagging behind the situation.

Given Logan's understanding of the balance sheet, her colleagues at the Fed take her remarks very seriously.

Richmond Fed President Barkin said in an interview last week after Logan made her proposals, "I think Logan is a very thoughtful, detail-oriented, and articulate person, and with her professional training, she is very familiar with these topics. I take any of her views on this matter very seriously, and I will study them in depth."

For Logan, it is crucial to initiate a serious discussion about how the Fed implements policy at this time, as the federal funds market remains relatively stable.

This proactive attitude is also an important characteristic of her career. Early in her career, she was influenced by the events of September 11, 2001. At that time, as a young trader at the New York Fed, the bank where Logan worked was only three blocks from the World Trade Center, and she witnessed firsthand the importance of emergency planning Logan stated, "Some may argue that since everything is normal at the moment, there is no need to take action. However, if the transmission mechanism between the federal funds rate and other money markets is disrupted, we need to quickly find a new reference indicator. Moreover, I believe making important decisions under time pressure is not the best way to promote a strong economy and financial system."

Logan listed various ways the Federal Reserve ensures that interest rates remain within the specified range, but he indicated that the Tri-Party General Collateral Rate (TGCR) might provide the greatest benefits.

TGCR is one of three rates associated with overnight repurchase agreements (in addition to the widely used Secured Overnight Financing Rate (SOFR)), and it is overseen by the New York Fed. Market participants believe that TGCR would be an ideal alternative to the federal funds rate because it represents a more robust lending market.

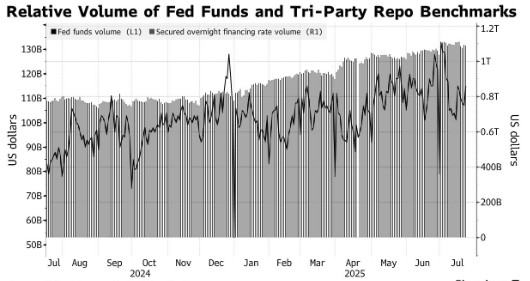

Logan pointed out that the daily trading volume covered by TGCR exceeds $1 trillion, so any fluctuations can be smoothly transmitted in the money market. Currently, the average trading volume of federal funds is less than $100 billion.

The federal funds market was once the primary venue for overnight loans between financial institutions. Therefore, changes in the financing conditions reflected by this market can influence long-term loan rates for businesses and consumers. The design goal of the federal funds rate is to fluctuate within a range of 25 basis points, but until this week, it had hardly fluctuated over the past two years unless the Federal Reserve itself adjusted its interest rate policy.

In contrast, TGCR fluctuates daily. Logan stated that as long as its fluctuation remains within the 25 basis points range set by the Federal Reserve (if it becomes the primary policy tool), this mode of fluctuation is acceptable