This Stock Is Up 400% in 2025, and With a Brand New CEO, It Could Keep Climbing

Opendoor Technologies 的股票在 2025 年飙升了 400%,这主要归功于新任首席执行官 Kaz Nejatian 的任命,他旨在利用人工智能来增强公司的房屋翻转商业模式。尽管近期股价上涨,但 Opendoor 尚未实现盈利,并面临与其向人工智能驱动运营转型相关的重大风险。投资者被建议保持谨慎,因为股票的快速上涨可能并未反映出基础业务的改善,而 Nejatian 的战略成功仍然不确定

Opendoor Technologies(OPEN 14.24%)的股价在 2025 年迄今已惊人上涨了 400%。其中大部分涨幅是在过去几个月内实现的,这段时间对公司来说发生了巨大的变化。

其中最大的变化之一是新任首席执行官,他一直在谈论利用人工智能(AI)来改善 Opendoor 的业务机会。

Opendoor Technologies 的业务是什么?

从大局来看,Opendoor Technologies 是一家房屋翻转公司。它基本上为房屋卖家提供一个低价报价,快速成交,并减轻了在出售前进行房屋改进的需求。

如果达成交易,Opendoor 会投入时间和资本来改善房产,然后以高于购买价格的价格上市出售。希望所有 Opendoor 购买的房屋都能迅速且具有成本效益地转手,从而在房屋成本(包括在装修期间的持有成本)和 Opendoor 出售价格之间创造出较大的利润空间。

图片来源:Getty Images。

这是一种通常由小型投资者在当地进行的商业模式。通常,小型投资者会自己进行装修工作,以降低成本。

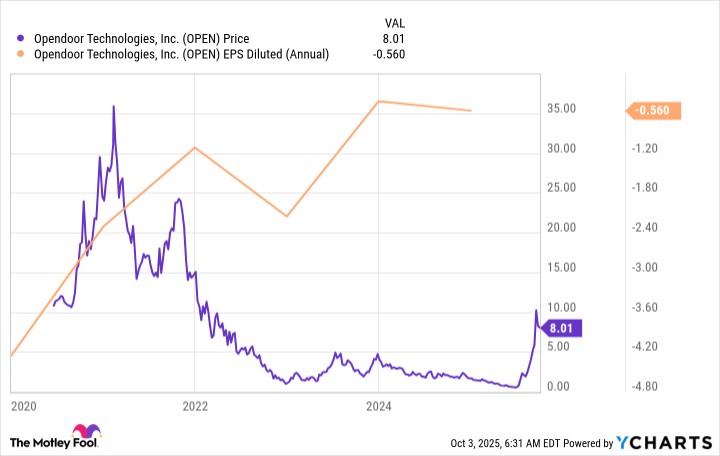

房屋翻转可以非常盈利,但尚未在大规模上复制。值得注意的是,Opendoor 的损益表尚未看到全年盈利,股票也从几年前的历史高点大幅下跌。随着投资者意识到该公司实际上只是一个亏损的初创企业,早期的兴奋感逐渐消退。

数据来源:YCharts。

Opendoor 的前景可能会变得有趣

在过去几个月中,随着一位激进投资者的介入并有效地推动首席执行官下台,Opendoor 的氛围发生了剧烈变化。最近宣布,前 Shopify 高管 Kaz Nejatian 将接任 Opendoor 的首席执行官。因此,股价飙升。

Opendoor 的业务在选择房屋时高度依赖技术。新首席执行官计划利用人工智能,目标是降低成本(包括裁员)并做出更强的购房/售房决策。

如果 Nejatian 是正确的,Opendoor 的业务可能最终会实现盈利,并有可能扩展到目前运营的有限市场之外。这里有一个巨大的潜在机会可以挖掘。

但有一个问题:Nejatian 是否正确尚不清楚。从今天到他设想的未来需要进行许多昂贵的变革,无论他是否能够将 Opendoor 转变为一个可持续盈利的企业。

如果他错了,那么这可能意味着业务的终结,因为在向人工智能过渡的过程中,重建将会失去的人类知识基础可能会非常困难。这里存在大量特有风险,首席执行官看似激进的商业改革的成功将决定未来的走向。

投资者正在定价大量好消息

目前,投资 Opendoor Technologies 的投资者必须退后一步,考虑风险/回报的平衡。此时,该公司在几个月内从面临退市风险的便士股变成了飙升的火箭,尽管在业务层面几乎没有变化。

股票会继续上涨吗?绝对会,特别是因为新首席执行官正在采用一种在华尔街上备受追捧的技术。

一旦投资者对一个好故事产生迷恋,就无法预测股票能涨多高。但大多数投资者此时可能更好地选择在旁观望,等待 Nejatian 的长期计划是否真的如预期那样有效的确凿证据。