The "core contradiction" of the American economy: strong AI vs weak employment

美国消费支出和 AI 资本支出表现强劲,三季度消费支出增长接近 3%,高收入家庭财富大幅增长推动消费。然而,就业市场明显放缓,失业率上升,劳动收入增长停滞。摩根士丹利警告称,这种 “精神分裂” 的数据状况正在给资产定价带来重大挑战。

当前美国经济正发出截然不同的信号,消费和 AI 投资强劲与就业市场疲软形成鲜明对比。

摩根士丹利首席经济学家 Seth Carpenter 在最新报告中指出,这种 “矛盾信号” 的最终走向将决定资产价格的命运,市场正处于一个关键的十字路口。

一方面,消费支出数据显示经济依然稳健,第三季度消费支出增长接近 3%;另一方面,就业市场的疲软信号却在不断积累。

高盛的最新研究进一步印证了这一矛盾。该行指出,美国股市的两个主要主题基本保持不变:人工智能的持续发展推动 AI 股票篮子 (GSTMTAIP) 表现优异,而对劳动力市场的持续担忧则反映在劳动力敏感篮子 (GSXULABR) 的表现不佳上。

“总有些事情要让步”,Carpenter 说道。

消费支出与 AI 投资展现韧性

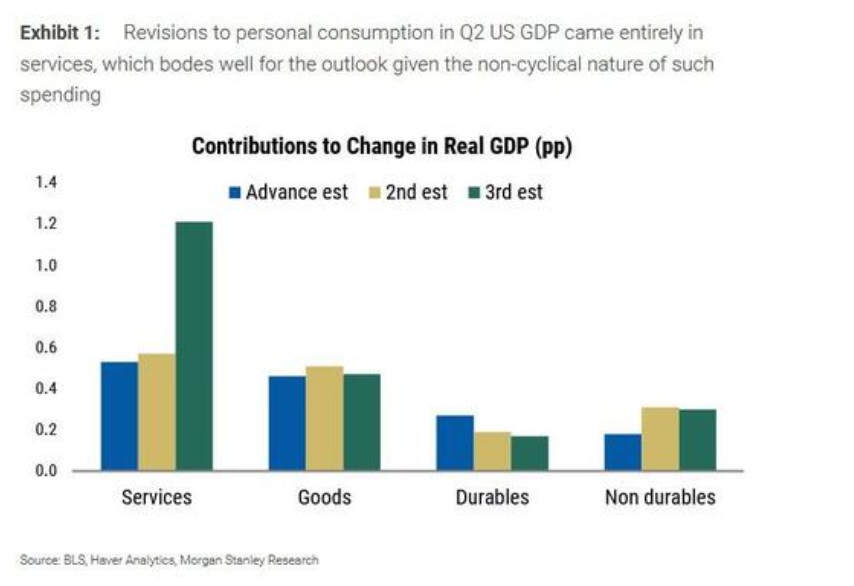

据摩根士丹利数据,经济增长最终取决于支出,而最新的支出数据显示经济稳健甚至强劲。尽管二季度 GDP 数据相对陈旧,但显示家庭服务支出有所回升,根据现有数据,三季度消费支出增长接近 3%。

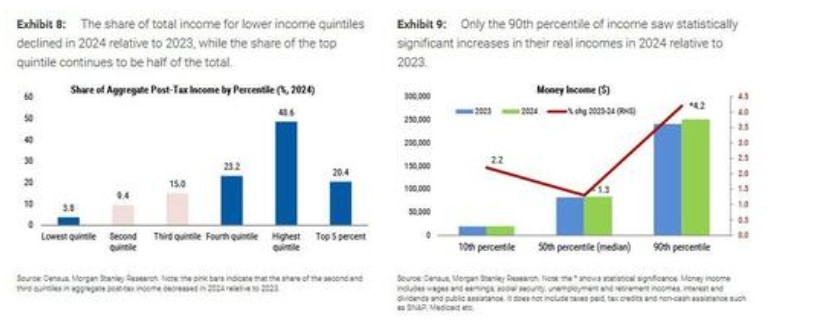

Carpenter 指出,高收入和高财富家庭在总消费支出中占据不成比例的大份额,而财富最近大幅上升。

除了消费支出外,AI 相关的资本支出也具有重要意义,这类投资对短期周期性波动相对不敏感,因为它是一个多年期的投资主题。

就业市场显现疲软迹象

然而,指向美国经济放缓的证据同样令人信服。今年就业创造明显放缓,失业率的上升,表明劳动力需求的放缓程度至少同样严重。

美国劳动收入增长已经放缓,在通胀调整后的基础上,过去一个季度基本持平或呈负增长。大部分消费支出集中在汽车领域,电动车税收抵免政策促使消费者提前购买,同时叠加了对关税的预期性消费。这些增加的支出在未来几个月应该会出现一定程度的回调。

关于关税的影响,2018-19 年的经验表明,关税对美国国内制造业产生了巨大的负面影响,持续时间超过一年,但这种拖累的开始有大约两个季度的滞后期。摩根士丹利分析师 Michael Gapen 在最近的研究中指出,有证据表明迄今为止的关税实际上相当于对生产征税。

美联储政策路径面临重大分歧

对于美联储而言,两种情形下的政策路径截然不同。失业率接近其充分就业估计值,通胀已连续四年多超过目标。经济韧性或加速增长要求实施限制性政策,因此几乎不需要更多降息。

相比之下,如果经济大幅放缓,失业率上升且增长接近停滞,则需要比当前利率市场定价更多的降息。

Carpenter 总结道:“必须有所取舍——如果经济强劲,市场对降息的预期过多;如果经济疲软,企业盈利可能不如预期那样乐观。有时,最好的预测就是各种可能情形的平均值。”