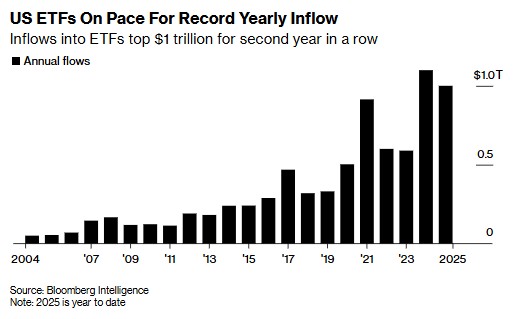

破万亿!美国 ETF 正以 “史上最快” 速度吸金

截至 9 月,美国 ETF 资金流入已突破 1 万亿美元,创下行业最快吸纳速度。每月流入规模约为常规季节性均值的 3.5 倍,分析师预测 2025 年全年流入额可能达到 1.25 万亿美元。投资者对 ETF 的青睐持续上升,主要因其交易便捷和节税优势,导致从共同基金中撤资转向 ETF。

智通财经 APP 获悉,今年市场的每一次动荡——从 4 月的关税恐慌到 9 月的科技股回调——在华尔街都引发了相同的条件反射:加大 ETF 买入。这种集体冲动如今已推动美国 ETF 的资金流入突破 1 万亿美元,创下该行业有史以来最快的资产吸纳速度。

这种最初为平稳分散投资而设计的金融工具,如今已成为市场最响亮的信心宣言,更是 2025 年牛市的 “脉搏”。资金流入速度刷新了该行业 30 年历史中的所有纪录,这一现象表明,各类交易者对这种节税型投资工具的乐观态度,已固化为一种本能反应。仅先锋集团的标普 500 指数追踪 ETF,就吸纳了约 930 亿美元资金;而与比特币、黄金及杠杆交易相关的基金,也均吸引了数十亿美元流入。

原本用于稳健资产配置的 ETF 结构,如今已演变为实时市场情绪 “晴雨表”——既是本轮自我强化式上涨行情的引擎,也是其共鸣的回响。

截至 9 月的汇编数据显示,今年 ETF 资金流入势头极为强劲,每月流入规模约为常规季节性均值的 3.5 倍。分析师预测,2025 年全年 ETF 资金流入额可能达到 1.25 万亿美元左右。

“无论是比特币、另类资产,还是更广泛的股票领域,ETF 资金流向始终紧跟市场趋势,” ETF 机构 TMX VettaFi 的行业与板块研究主管 Roxanna Islam 表示,“ETF 也已成为投资者的首选工具,为 ETF 行业资产规模扩张创造了绝佳条件。”

与此同时,投资者持续从共同基金中撤出资金,转而青睐 ETF——主要原因在于 ETF 具备交易便捷、节税高效的优势。

基金发行潮涌

资金流入并非 ETF 行业唯一值得关注的指标:2025 年新 ETF 年度发行量也有望创下历史新高。汇编数据显示,今年以来发行机构已推出逾 800 只新 ETF,这一数量已超过去年的发行纪录。

据统计,仅 9 月单月就有超过 115 只新 ETF 推出,创下月度发行纪录。机构预测,若第四季度每月 77 只的发行节奏得以保持,ETF 行业将首次实现单年新增 1000 只 ETF 的突破。

发行机构正借势各类热门市场趋势,以惊人速度推出杠杆型 ETF 及收益导向型基金。数据显示,今年新发行的 ETF 中,近三分之一包含杠杆成分。

近期两项监管进展落地后,分析师预计将有更多 ETF 涌入市场:美国证券交易委员会 (SEC) 已表示,拟允许 Dimensional Fund Advisors——未来或涵盖其他发行机构——将 ETF 作为共同基金的份额类别推出;此外,SEC 还批准了一项规则修订,允许交易所为大宗商品类 ETF(包括与特定加密货币相关的 ETF) 提供快速上市通道。

此次 “多份额类别” 规则获批,有望为市场新增数千只 ETF,并打破此前将 ETF 基本排除在美国退休体系之外的壁垒。

“ETF 行业的创纪录扩张速度,既凸显了行业的活力,也反映出竞争的激烈程度,” ETF 分析师 Eric Balchunas 在一份报告中表示,“随着产品饱和度不断提升,发行机构将越来越需要通过更低成本、更具创新性的策略实现差异化竞争。”