Stripe-backed Tempo hits $5B valuation with $500M raise: Details

Tempo has raised $500 million in Series A funding, achieving a valuation of $5 billion. The Stripe-backed stablecoin payment platform has attracted major investors like Thrive Capital and Sequoia, and has onboarded Ethereum developer Dankrad Feist. Meanwhile, Binance's stablecoin reserves have reached a record $45.8 billion, indicating potential market movements as investors prepare to buy or hedge. The trend of stablecoins leaving exchanges suggests a shift towards on-chain activities, reflecting market maturity and strategic fund deployment.

Tempo raised $500 million in Series A funding and brought on a top Ethereum developer to scale its stablecoin payment platform.

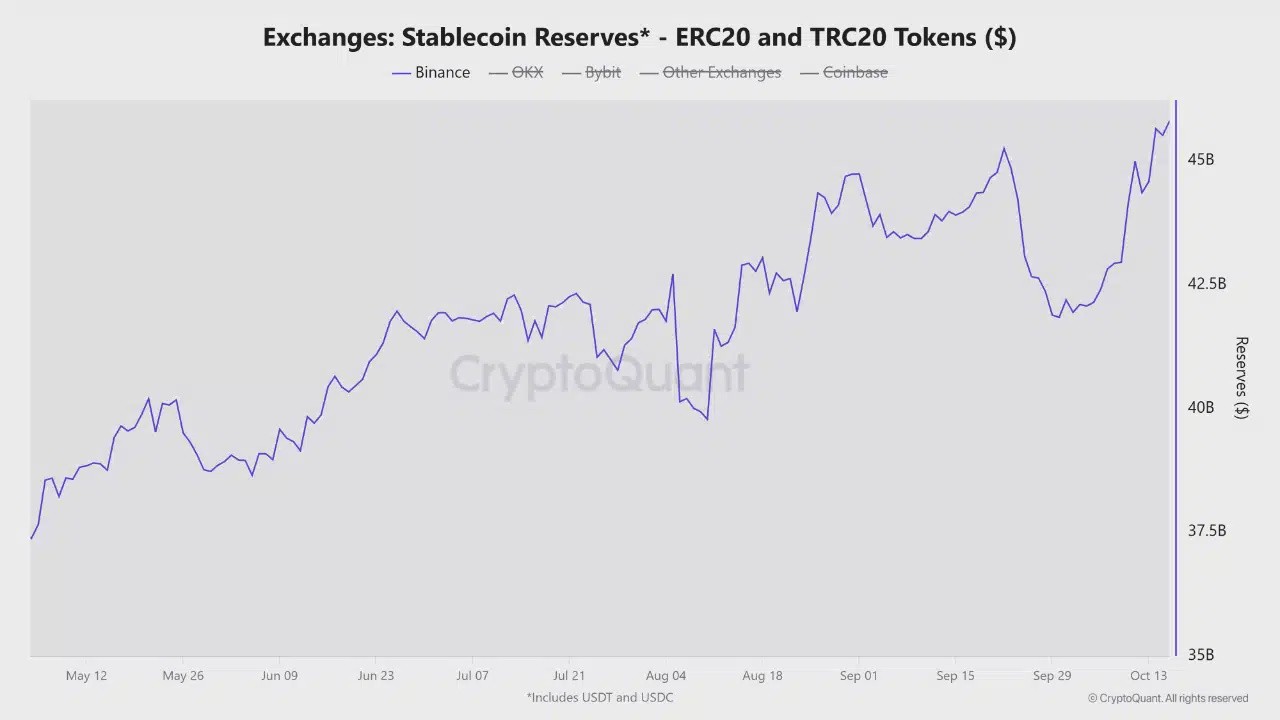

Investors are moving capital back to Binance, likely preparing to buy or hedge.

Stripe-backed Tempo has raised $500 million and brought on a leading Ethereum [ETH] developer to expand its stablecoin payments push!

Meanwhile, Binance’s [BNB] stablecoin reserves hit a record $45.8 billion, even as outflows rise. Are traders preparing for a short-term rally?

Tempo’s $500 million leap

Tempo just pulled off one of blockchain’s biggest fundraising rounds in years: a $500 million Series A that pushed its valuation to $5 billion. The Stripe-backed stablecoin payments firm is attracting major TradFi players like Thrive Capital and Sequoia.

Adding to the buzz, veteran Ethereum developer Dankrad Feist has joined Tempo, saying its mission aligns with Ethereum’s broader vision rather than competing with it.

Source: X

This makes Tempo a serious contender in the stablecoin infrastructure race.

Meanwhile, Stripe itself has started rolling out stablecoin payments for subscription services, a move that would support AI startups and firms with recurring revenue models.

The feature, launched in private preview for U.S. businesses, allows payments in USDC across Base and Polygon networks.

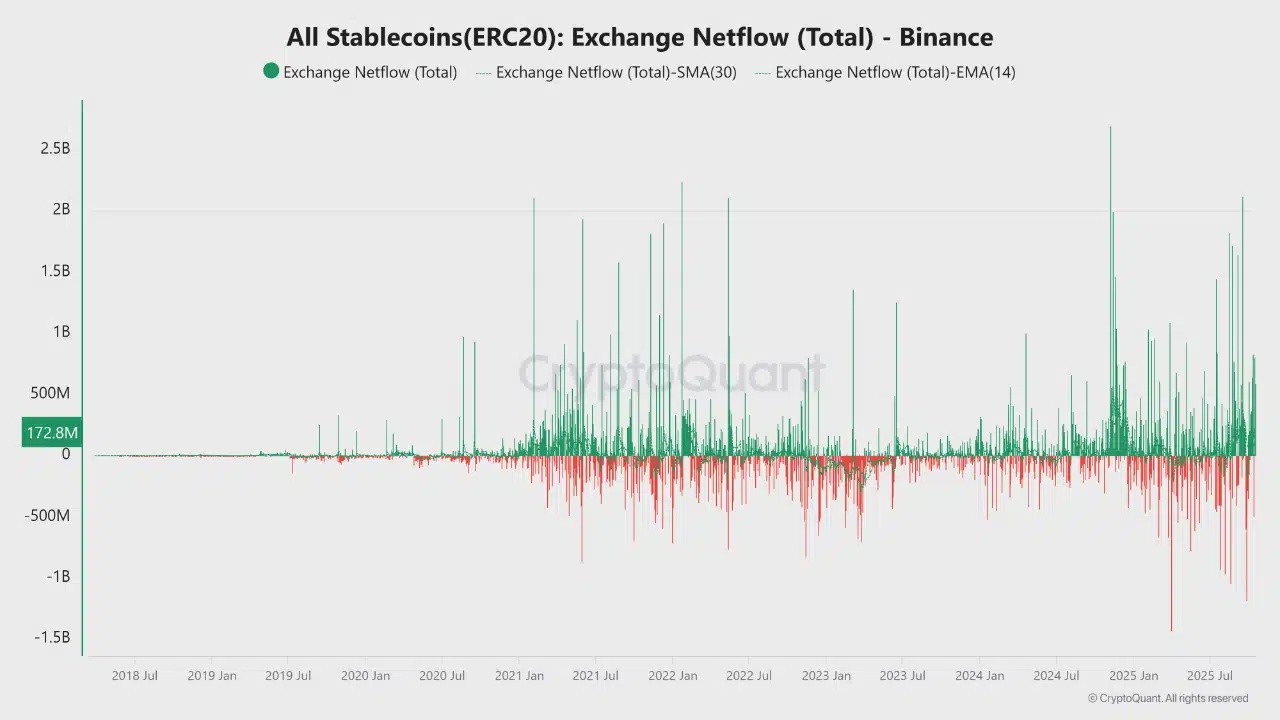

Stablecoins flowing out

Recent data showed a rising trend of stablecoins leaving exchange wallets, meaning investors are preparing to move capital elsewhere.

Moving funds to external wallets or DeFi protocols often means a readiness to take on risk, whether in Bitcoin [BTC], Ethereum, or altcoins.

Source: CryptoQuant

While this can support short-term price gains, it also reduces sell-side liquidity, making markets more sensitive to sudden buying.

At the same time, capital leaving exchanges for on-chain activities is indicative of market maturity, with investors seeking to deploy funds more strategically rather than sit idle.

Binance reserves hit a record high!

As Bitcoin dipped, Binance’s stablecoin reserves surged to a new all-time high of $45.8 billion. This is a level up from the $41.8 billion recorded at the end of September.

Source: CryptoQuant

The rise in USDT and USDC on ERC20 and TRC20 shows capital is flowing back to Binance. Investors may be getting ready to buy or hedge ahead of market moves. This could fuel a short-term rally or consolidation.