U.S. Stock Outlook | Three Major Index Futures Rise Together, Tesla and Other Tech Giants' Earnings Arrive This Week, U.S. CPI Takes Center Stage

On October 20th, U.S. stock index futures rose across the board, with the market focusing on the earnings reports of tech giants like Tesla and U.S. CPI data. Dow futures rose by 0.14%, S&P 500 futures increased by 0.27%, and Nasdaq futures climbed by 0.35%. This week marks the "earnings season for tech giants," with companies like Tesla, Intel, and Netflix set to release their third-quarter earnings reports. Goldman Sachs believes that the strong performance of tech stocks is primarily driven by fundamentals rather than irrational speculation

Pre-Market Market Trends

- As of October 20 (Monday), U.S. stock index futures are all up before the market opens. As of the time of writing, Dow futures are up 0.14%, S&P 500 futures are up 0.27%, and Nasdaq futures are up 0.35%.

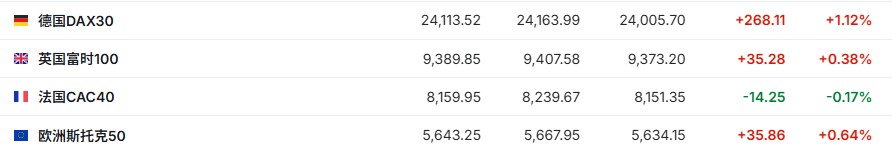

- As of the time of writing, the German DAX index is up 1.12%, the UK FTSE 100 index is up 0.38%, the French CAC 40 index is down 0.17%, and the Euro Stoxx 50 index is up 0.64%.

- As of the time of writing, WTI crude oil is down 0.84%, priced at $56.67 per barrel. Brent crude oil is down 0.85%, priced at $60.77 per barrel.

Market News

"Super Week" is coming! Tesla (TSLA.US) and other tech giants are set to report earnings, with the U.S. CPI as the grand finale. Affected by U.S.-China trade relations, the U.S. stock market has experienced five consecutive days of volatility and is about to enter the third week of government shutdown. In the coming week, investors will assess the economic situation through key economic data. The U.S. Consumer Price Index (CPI), the most closely watched inflation indicator, which was originally scheduled for release on October 15, has been postponed to this Friday (October 24) due to the government shutdown, becoming the last important economic data before the Federal Reserve's monetary policy meeting on October 28-29. The U.S. corporate earnings season is entering a busy disclosure period this week. The "Tech Giants Earnings Season" will kick off this week, with well-known companies such as Tesla (TSLA.US), long-established chip giant Intel (INTC.US), streaming leader Netflix (NFLX.US), and consumer benchmark Coca-Cola (KO.US) set to release their third-quarter earnings.

Goldman Sachs counters AI bubble rhetoric: The strong rally in U.S. tech stocks is driven by fundamentals. Goldman Sachs' analysis team recently stated that while there are some "similar signs to past bubbles" in the current U.S. stock market, the firm believes that the current rally—especially the strong performance of tech stocks—is "mainly driven by fundamental growth rather than irrational speculation." Goldman Sachs pointed out that there are several significant differences between the current environment and past periods of excessive speculation, noting that "the leading companies with the largest gains currently generally have exceptionally robust balance sheets," and that "the AI sector is still dominated by a few existing giants," rather than being driven by a large number of newly entered unprofitable groups, which is a characteristic of typical bubble markets Beware of turbulence in the US stock market! Trade concerns overshadow the market, and options traders are hedging against significant volatility at the end of the month. Due to the high uncertainty in the recent China-US trade situation, options traders are buying options to guard against significant fluctuations in the US stock market. At the end of this month, the leaders of China and the US will meet. The implied volatility of S&P 500 index futures expiring on October 31 is currently close to 20, higher than contracts around that date. The Chicago Board Options Exchange Volatility Index (VIX) curve has also shown a similar "inflection point" at the end of the month. Recently, US President Trump softened his stance on tariffs against China, alleviating concerns about further escalation of the China-US trade war. Nevertheless, given the potential for sudden changes, traders remain cautious.

Jefferies firmly believes in the logic of an AI and gold bull market. Wall Street financial giant Jefferies recently stated that the market is underestimating the likelihood of a China-US trade agreement being reached by the end of October, which would bring temporary relief to these two major economies and extend the rally of risk assets for the remainder of the year. Senior strategist Wood stated that AI infrastructure spending remains the core driver of the US stock market's rise, and the Federal Reserve's easing expectations are exacerbating this trend. After gold prices broke through $4,200 per ounce, Wood reaffirmed a long-term target of $6,600 for gold, emphasizing that the real value of the dollar has depreciated by 99% since 1971. He pointed out that the media's heated discussion of an "AI bubble" indicates that the stock market has not yet peaked, with large-scale enterprises using cash rather than debt for investment, but private credit and leveraged traders are flooding the market, exacerbating the dual excess.

As regional banks in the US face turmoil, Carlyle's CEO speaks out: Credit volatility "should be a concern," but no signs of a collapse have been seen. Carlyle CEO Harvey Schwartz stated that the recent volatility in the credit market has made it onto his "worry list," but so far, there are no signs indicating that the market environment is deteriorating. Schwartz noted that, based on the situation of companies in Carlyle's portfolio, "the data shows these companies are still growing, employment remains stable, and while inflation is slightly sticky, there are no signs indicating a collapse in the short term." He also emphasized, "Nevertheless, in the late stages of the economic cycle, credit market volatility should indeed become a concern."

Individual Stock News

Amazon (AMZN.US) AWS experiences a massive outage, affecting multiple companies including Coinbase and Robinhood. Amazon's cloud service (AWS) experienced a widespread outage on Monday morning Eastern Time, causing disruptions to services for several companies, including AI company Perplexity, as well as financial platforms Coinbase (COIN.US) and Robinhood (HOOD.US). Coinbase and Robinhood stated that the AWS outage is affecting their services. Perplexity reported that the disruption has impacted the stability of its website. As the world's most popular cloud service provider, AWS supports much of the internet's infrastructure, holding about one-third of the global cloud market share, so any outage can trigger a chain reaction iPhone 17 ignites a wave of upgrades, Apple (AAPL.US) enters the fastest growth channel post-pandemic. Supply chain surveys and carrier data show that the newly designed iPhone 17 has exceeded expectations since its launch in September, driving Apple's smartphone business to achieve its fastest growth since the outbreak of COVID-19. Visible Alpha data indicates that analysts expect iPhone revenue to grow by about 4% in Apple's current fiscal year, reaching around $190 billion; the growth rate is expected to approach 5% by 2026. Despite the pressure on Apple's stock price from delayed AI features and renewed tariff threats between the U.S. and China, this optimistic outlook has boosted market sentiment ahead of the holiday season.

U.S. Antimony (UAMY.US) surges pre-market! Plans all-stock acquisition of Australian miner Larvotto to strengthen key mineral portfolio. U.S. Antimony announced that it has submitted a confidential, non-binding proposal to acquire 100% of Larvotto Resources Limited through an agreement arrangement in Australia. This acquisition aims to integrate the strengths of both parties in key mineral resources and antimony production capacity. The transaction is still subject to the signing of a final agreement and obtaining all necessary regulatory approvals. As of the time of publication, U.S. Antimony's stock rose over 16% in pre-market trading on Monday.

AstraZeneca (AZN.US) breast cancer drug Enhertu shows better recurrence prevention than competitors, promising to cure early-stage patients. AstraZeneca and Japanese pharmaceutical company Daiichi Sankyo's cancer drug Enhertu has provided better treatment outcomes for early-stage breast cancer patients. In two key trials announced at the European Society for Medical Oncology meeting held in Berlin last weekend, Enhertu outperformed Roche's Kadcyla in preventing disease recurrence, with even better results when used pre-surgery. These results could potentially allow this blockbuster drug to benefit more patients and bring it closer to achieving a cure.

Cleveland-Cliffs (CLF.US) Q3 results miss expectations. The financial report shows that Cleveland-Cliffs' Q3 revenue was $4.73 billion, up from $4.57 billion in the same period last year, but below market expectations of $4.9 billion; the adjusted loss per share was $0.45, higher than the $0.34 loss per share in the same period last year, which was roughly in line with market expectations. The company has lowered its 2025 capital expenditure forecast from $600 million to $525 million. The company stated that it has reached new, growing supply agreements with all major automotive original equipment manufacturers, as well as a memorandum of understanding with major global steel producers seeking to leverage U.S. business and trade compliance operations. The company also indicated that it will focus on potential rare earth opportunities in upstream mining assets. As of the time of publication, Cleveland-Cliffs' stock rose over 11% in pre-market trading on Monday.

Important Economic Data and Event Forecasts

Beijing time 20:30 U.S. September building permits month-on-month preliminary value

Beijing time 20:30 U.S. September new housing starts annualized month-on-month rate

Earnings Forecast

Tuesday morning: Zions Bancorporation (ZION.US)

Tuesday pre-market: GE Aerospace (GE.US), Coca-Cola (KO.US), Lockheed Martin (LMT.US), General Motors (GM.US)