U.S. stock index futures are mixed, spot gold has once again risen above $4,100, Brent crude oil is up 3%, and Bitcoin has rebounded

Market sentiment continues to be influenced by factors such as corporate earnings and trade tensions. S&P 500 futures rose nearly 0.2%, Nasdaq 100 futures increased by over 0.3%, and Dow futures fell by 0.06%. Major European stock indices opened lower, while gold, silver, and oil rebounded across the board, with spot gold recovering and cryptocurrencies rising

On October 23, market sentiment continued to be influenced by corporate earnings, trade tensions, and other factors. The three major U.S. stock index futures showed mixed results, European stock indices opened lower but rose, gold, silver, and oil rebounded collectively, U.S. Treasury yields increased, the U.S. dollar index stabilized, and cryptocurrencies rose.

Investors are closely monitoring corporate earnings reports from Europe and the U.S., as the financial data may play a crucial role in market trends. Pepperstone Group Ltd strategist Wu Diling stated, "The momentum trading that previously led multiple asset classes is now retreating. The greater risk comes from earnings. Strong earnings may stabilize market sentiment, but any disappointing earnings—especially from growth stocks or tech stocks—could exacerbate the current pullback."

The three major U.S. stock index futures showed mixed results. As of the time of writing, the S&P 500 futures rose nearly 0.2%, the Nasdaq 100 futures rose over 0.3%, and the Dow Jones futures fell 0.06%.

In pre-market trading, Tesla continued its downward trend, currently down over 3%. Tesla's Q3 revenue rebounded significantly, but earnings fell sharply by 31% below expectations, while Musk lowered the targets for robots and Robotaxi. Nokia's U.S. stock rose 9.7% in pre-market. Quantum computing concept stocks rose broadly, with Quantum Computing up 13%.

Major European stock indices opened lower, with Germany's DAX index down 0.6%. The UK's FTSE 100 index rose 0.93%. France's CAC40 index fell 0.62%. The European Stoxx 50 index fell 0.84%.

Volvo Cars' stock price rose 29%, with Q3 earnings exceeding expectations.

The U.S. dollar index stabilized around 99.

The yield on the 10-year U.S. Treasury bond rose 2 basis points to 3.96%.

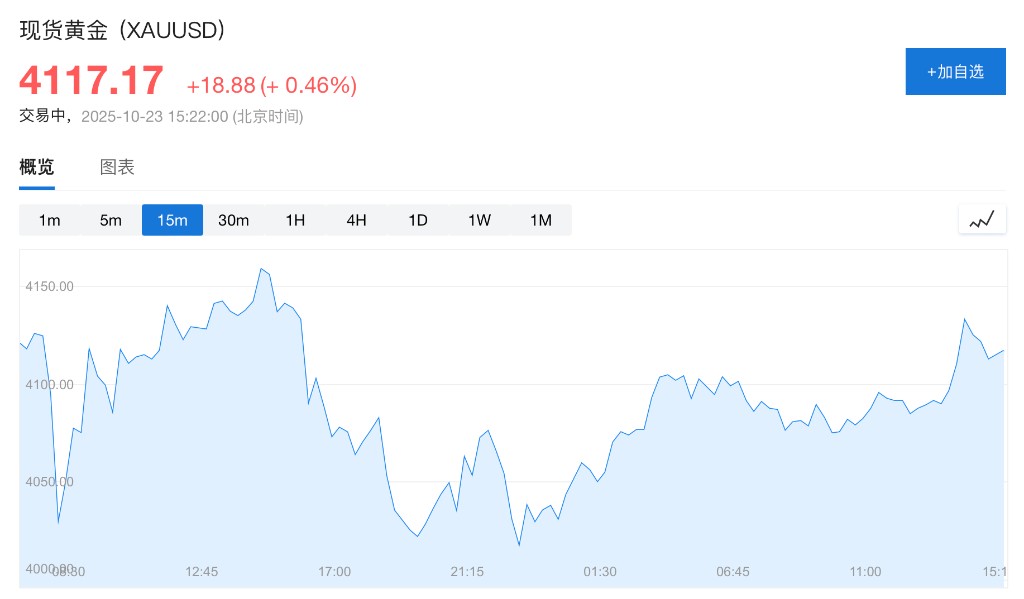

Spot gold rose nearly 0.5%, currently reported at $4,117 per ounce.

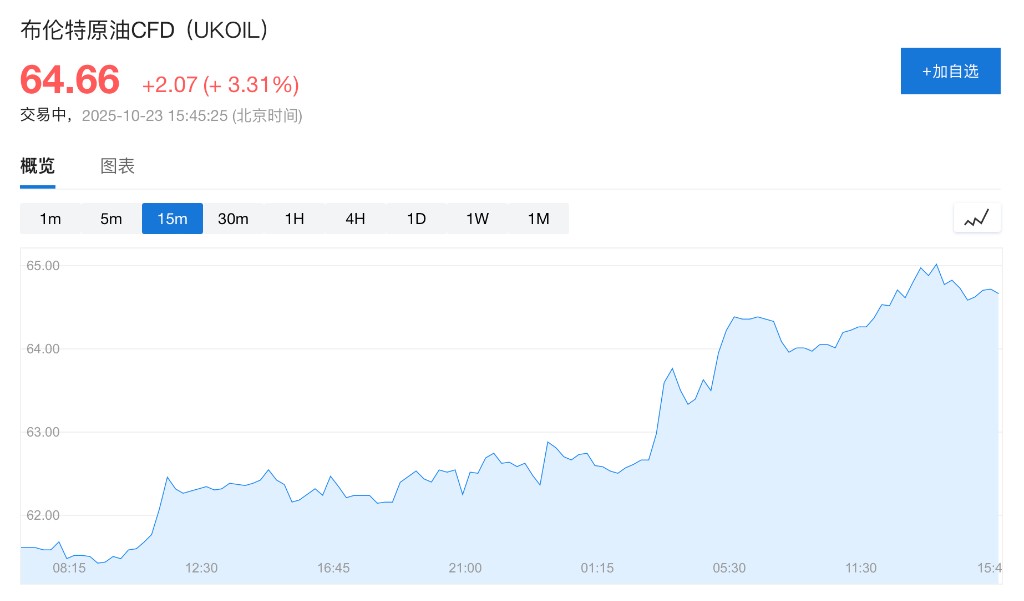

Brent crude oil rose over 3.3%, reported at $64.66 per barrel.

Bitcoin rose over 1%, and Ethereum rose over 0.1%.

The three major U.S. stock index futures showed mixed results. As of the time of writing, the S&P 500 futures rose nearly 0.2%, the Nasdaq 100 futures rose over 0.3%, and the Dow Jones futures fell 0.06%. Previously, Netflix and Texas Instruments reported weak earnings, while Tesla's sales surged, but earnings fell short of expectations, leading to concerns about corporate earnings compounded by escalating global trade tensions, which dampened risk appetite.

The market is worried about the uncertainty surrounding the current trade outlook. Ryuta Otsuka, a strategist at Dongyang Securities, stated,

"Although this may just be another TACO incident, and everyone knows how things will develop, someone still has to react until the situation calms down."

Spot gold rose nearly 0.5%, currently reported at $4,117 per ounce. The cancellation of the "Teppuku Meeting" leaves the geopolitical situation facing significant uncertainty, boosting safe-haven sentiment and driving gold prices higher

Brent crude oil rose more than 3.3%, trading at $64.66 per barrel. Trump's sanctions against Russian oil giants may currently block a significant amount of global oil supply, alleviating market concerns about an impending supply surplus, which has boosted oil prices.