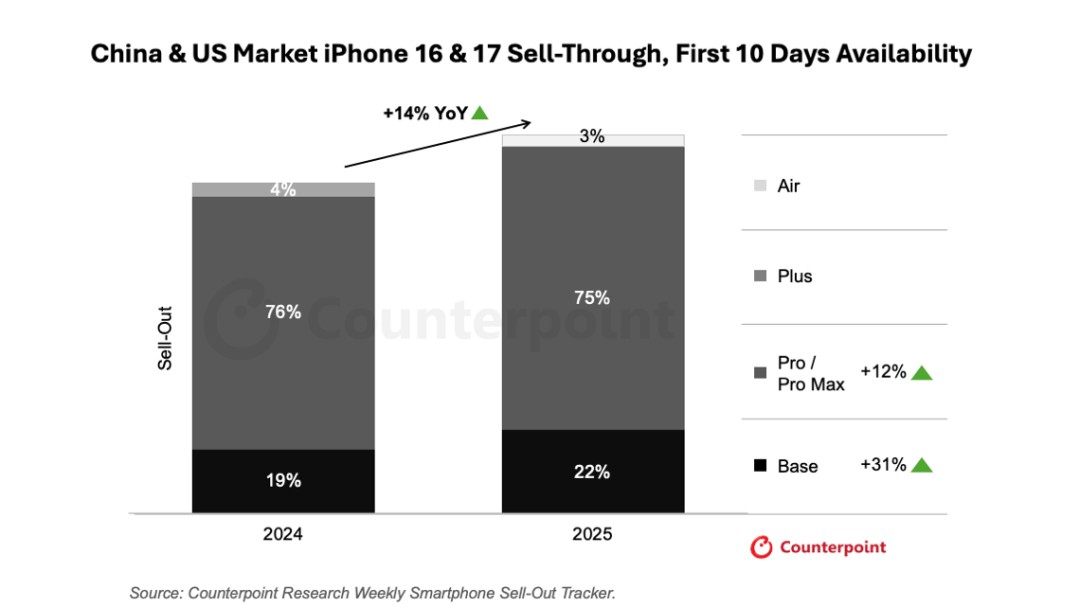

Counterpoint Research: The sales of the iPhone 17 in the first 10 days of its launch in China and the United States are 14% higher than that of the iPhone 16 series

Counterpoint Research 的報告顯示,iPhone 17 系列在中國和美國上市後的前 10 天銷量比 iPhone 16 系列增長了 14%。中國和美國是蘋果 iPhone 的主要市場。標準版 iPhone 17 因其性價比高受到消費者熱捧,尤其在中國。美國市場中,iPhone 17 Pro Max 的需求也因運營商提高補貼而顯著增長,反映出市場向超高端客户傾斜。

智通財經 APP 獲悉,根據 Counterpoint Research 發佈的《2025 年第三季度中國與美國智能手機周度銷量追蹤報告》顯示,iPhone 17 系列在中國和美國上市後的前 10 天銷量較 iPhone 16 系列增長了 14%。中國和美國是蘋果 iPhone 全球銷量的兩大核心市場,佔據其整體出貨量的絕大部分。

數據來源: Counterpoint Research 每週智能手機 Sell-Out 追蹤報告

在四款 iPhone 機型中,今年的標準版 iPhone 17 表現良好,尤其是在中國,消費者對其突出的性價比反應熱烈。高級分析師 Mengmeng Zhang 表示:“標準版 iPhone 17 對消費者非常有吸引力,物有所值。更強的芯片、更出色的顯示屏、更大的基礎存儲空間、升級的前置自拍攝像頭——而價格與去年的 iPhone 16 相同。尤其是把渠道折扣和優惠券也考慮進去之後,購買這款機型幾乎是不假思索的決定。簡而言之,它提供了極高的性價比,而中國消費者也在用實際購買行動反饋給蘋果公司。”

在美國,隨着三大運營商將最高補貼提升 10%(即 100 美元),iPhone 17 Pro Max 的市場需求漲勢最為強勁,這也反映出美國市場正戰略性向超高端客羣傾斜。高級分析師 Maurice Klaehne 評論指出:“運營商正試圖通過 24 或 36 個月的分期合約,將高額的設備補貼轉化為多年更高的月度服務收入,以最大化客户生命週期價值。對 Pro Max 的重點優惠,使這款超高端蘋果機型更易觸達消費者,既強化了高端化趨勢,也進一步鞏固了高價值用户與蘋果生態之間的黏性。”

僅支持 eSIM 的 iPhone Air 表現略優於 iPhone 16 Plus;隨着官方宣佈 10 月 17 日在中國開啓預售,關於其在華上市可得性的疑問已消除。高級分析師 Ivan Lam 表示:“這不僅是蘋果的重要里程碑,對更廣泛的 eSIM 生態同樣意義重大。不過,由於預售期更短、定價更高,而標準版 iPhone 17 在規格與功能上更為均衡、性價比更突出,預計 iPhone Air 在早期仍會保持相對小眾的定位。”