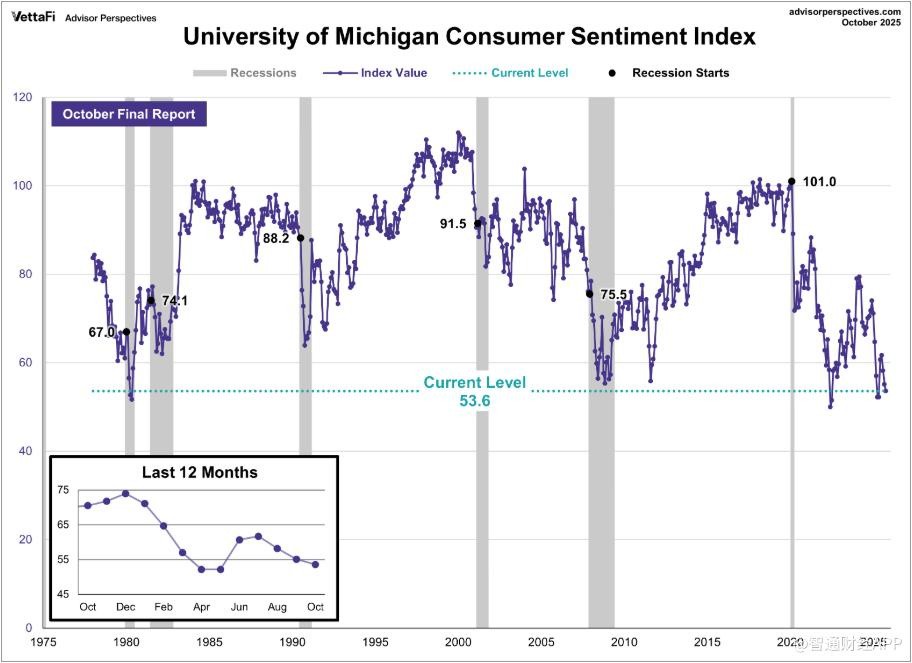

U.S. consumer confidence has plunged into extreme pessimism, dropping to levels seen during economic recessions

U.S. consumer confidence continued to decline in October, with the final value of the University of Michigan Consumer Confidence Index at 53.6, down 1.5 points from September, below market expectations, and a significant decrease of 24% compared to the same period last year. Both the current conditions index and the expectations index have fallen for four consecutive months, indicating increasingly evident signs of economic softening. High inflation and price pressures remain the main influencing factors, with consumers' expectations for future finances weakening and no significant improvement in overall economic conditions

According to the Zhitong Finance APP, U.S. consumer confidence continued to decline in October, remaining at a five-month low.

The final value of the University of Michigan's Consumer Confidence Index for October is 53.6, down 1.5 points from September, lower than the market expectation of 55, and a significant decrease of 24% compared to the same period last year. The current level of the index is 36.4% lower than the average since 1978, highlighting extremely low sentiment.

Joanne Hsu, the survey director at the University of Michigan, stated that overall confidence has not changed much this month, with a slight rebound in confidence among younger consumers, while middle-aged and older groups have seen a significant decline. Current personal financial situations have slightly improved, but expectations for future finances have weakened. She pointed out that consumers generally believe there has been no significant change in overall economic conditions compared to last month, with inflation and high prices remaining overwhelming sources of pressure. Notably, despite the ongoing federal government shutdown, only about 2% of respondents mentioned the potential impact of the shutdown on the economy, far below the 10% during the 2019 shutdown.

Historically, the current index level is below the levels corresponding to the onset of the last six U.S. economic recessions, indicating that consumer sentiment is in a typical pessimistic range before a recession.

In October, the Consumer Current Situation Index (CECI) fell for the fourth consecutive month to 58.6, reaching a three-year low, a month-on-month decline of 3.0%, and a year-on-year drop of 9.7%, weaker than the market forecast of 61. The Consumer Expectations Index (CEI) also fell for four consecutive months, reporting 50.3, the lowest since May, with a month-on-month decrease of 2.7% and a significant year-on-year contraction of 32.1%, also lower than the market expectation (51.2). The one-year inflation expectation fell from 4.7% to 4.6%. The long-term inflation expectation rose from 3.7% to 3.9%, still below the high level of April this year. The rise in long-term inflation expectations this month mainly comes from Republicans and independent voters. Both short-term and long-term inflation uncertainties have increased, indicating that consumers lack confidence in the inflation trajectory.

Overall, consumer confidence continues to be under pressure in an environment of high inflation, price stickiness, and policy uncertainty, with both current and forward-looking sentiments weakening in sync, and the index has slipped into a typical recession range, with signals of economic softening becoming increasingly evident