GLOBAL MARKETS-Stocks hit record high on tech lift as Fed, earnings eyed

全球市場創下歷史新高,受到科技股和美中貿易緊張局勢緩解的推動。預計美國聯邦儲備委員會將降息,從而提振投資者信心。包括微軟和英偉達在內的主要美國股票均出現顯著上漲。超過 86% 的標準普爾 500 指數公司報告的收益超出預期。投資者密切關注即將發佈的主要科技公司的財報。美元對其他貨幣走弱,而由於地緣政治擔憂,原油價格下跌

本週將公佈大型企業財報

多家中央銀行即將發佈政策聲明

美國股指以創紀錄的收盤水平結束交易

(更新美國市場收盤情況)

作者:Chuck Mikolajczak

紐約,10 月 28 日(路透社)- 全球股市在週二攀升至盤中紀錄,受到美國和中國之間貿易緊張局勢緩和跡象以及科技股上漲的提振,同時投資者在等待美聯儲的政策決定並消化企業財報。

美國聯邦儲備委員會將在週三開始本週全球中央銀行的一系列政策聲明,包括日本、加拿大和歐洲。市場普遍預計美聯儲將在會議上降息,CME 的 FedWatch 工具顯示降息 25 個基點的概率高達 99.9%。

對中央銀行降息路徑的預期,以及最近美國和中國之間貿易緊張局勢緩和的跡象,幫助提升了市場的風險偏好,推動股票上漲,並使 10 年期美國國債收益率維持在多個月來的低位附近。

此外,持續的美國政府停擺導致投資者缺乏經濟數據進行分析。

風險資產的持續反彈 由於缺乏政府數據,投資者轉向其他來源以評估經濟的強勁程度。週二,ADP 國家就業報告的首次每週初步估計顯示,截至 10 月 11 日的四周內,美國私人部門新增就業崗位平均增加 14,250 個。

“考慮到所有的不確定性,波動性異常低,在某種程度上令人驚訝……但似乎非常穩定,您可以看到風險資產的持續反彈,” 巴黎銀行紐約分行美國利率策略負責人 Subadra Rajappa 表示。

“因此,尤其是在美聯儲會議上,您有低收益率、寬鬆的金融條件、通脹回落以及就業市場保持相對穩定的組合,因此對經濟的解讀變得困難。”

歐洲中央銀行和日本銀行在政策會議上普遍預計將維持利率不變。

道瓊斯指數在主要指數中領漲 在華爾街,美國股票再次以創紀錄的水平收盤,部分原因是微軟(MSFT.O)上漲 2%,因其達成了一項協議,允許 OpenAI 重組為公共利益公司,同時使這家大型企業獲得 ChatGPT 製造商 27% 的股份。此外,英偉達(NVDA.O)上漲 5%,因首席執行官黃仁勳表示,該人工智能芯片領導者將為美國能源部建造七台新超級計算機,並且該公司在其人工智能芯片上有 5000 億美元的訂單。道瓊斯工業平均指數(.DJI)上漲 161.78 點,或 0.34%,至 47,706.37 點,標準普爾 500 指數(.SPX)上漲 15.73 點,或 0.23%,至 6,890.89 點,納斯達克綜合指數(.IXIC)上漲 190.04 點,或 0.80%,至 23,827.49 點。

“動能和盈利推動市場上漲,” 斯巴達資本證券首席市場經濟學家 Peter Cardillo 表示,並補充説 “對特朗普亞洲之行的熱情” 也在推動市場。由於美國總統唐納德·特朗普和中國國家主席習近平定於週四會晤,以決定可能暫停更嚴格的美國關税和中國稀土出口限制的框架,市場對貿易戰升級的擔憂有所緩解。

本週將有 “七大巨頭” 微軟、Alphabet(GOOGL.O)、蘋果(AAPL.O)、亞馬遜(AMZN.O)和 Meta Platforms(META.O)的財報。投資者將密切關注這些結果,以判斷它們是否合理化高估值。

超過五分之四的標準普爾公司超出預期

截至週二上午,180 家標準普爾 500 公司中有 86.7% 超出了分析師的預期,數據來自 LSEG。MSCI 全球股票指數(.MIWD00000PUS)上漲 21.18 點,或 0.12%,至 1,013.68 點,曾觸及紀錄高點 1,015.73 點,而泛歐 STOXX 600 指數(.STOXX)收盤下跌 0.22%。

基準美國 10 年期國債收益率(US10YT=RR)下降 2.1 個基點,至 3.976%。美元指數(=USD)衡量美元對一籃子貨幣的匯率,下降 0.07%,至 98.70,歐元(EUR=)上漲 0.11%,至 1.1656 美元。美元對日元(JPY=)貶值 0.52%,至 152.07,因日本一位部長和美國財政部長 Scott Bessent 的評論緩解了對該國更大財政和貨幣政策的擔憂。

英鎊(GBP=)貶值 0.45%,至 1.3275 美元。美國原油(CLc1)下跌 1.89%,至每桶 60.15 美元,布倫特原油(LCOc1)下跌 1.86%,至每桶 64.40 美元,因投資者評估美國對俄羅斯兩大石油公司的制裁以及 OPEC+ 可能提高產量的計劃的影響。

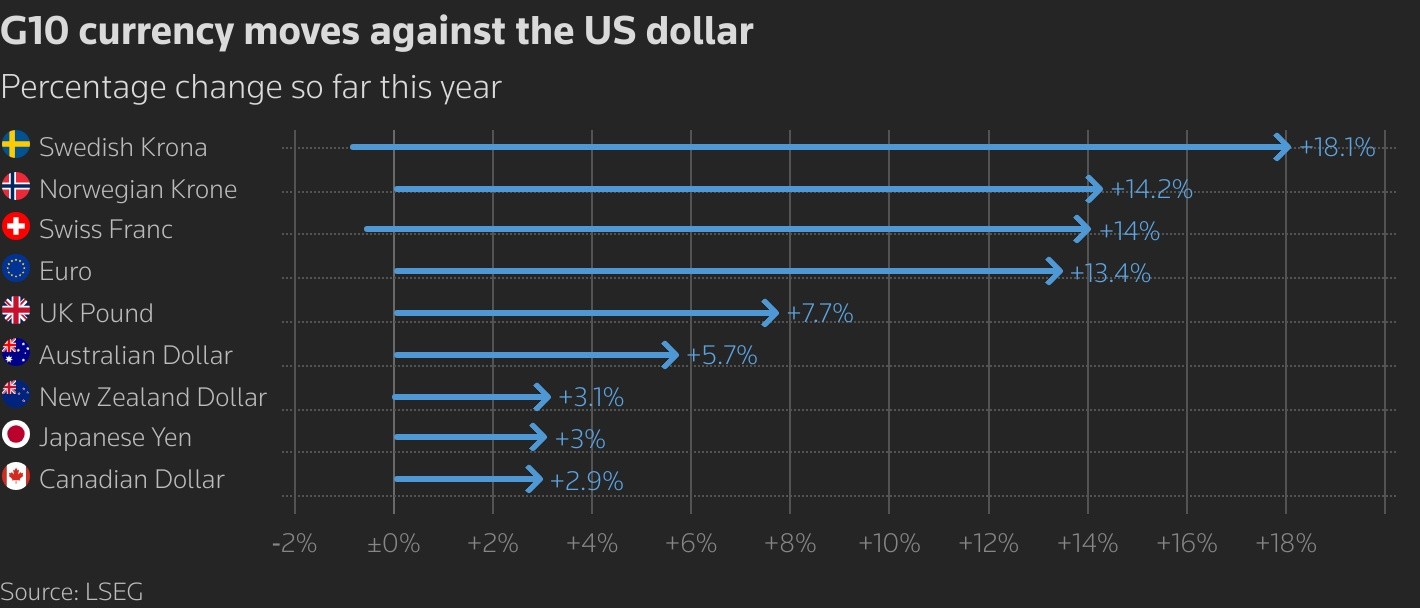

G10 貨幣對美元的走勢