CINNO Research: In the third quarter, global AMOLED smartphone panel shipments were approximately 250 million units, a year-on-year increase of 11.7% and a quarter-on-quarter increase of 20.3%

CINNO Research 報告顯示,2025 年第三季度全球 AMOLED 智能手機面板出貨量約 2.5 億片,同比增長 11.7%,環比增長 20.3%。市場需求因蘋果及國內品牌發佈新機而顯著提升。韓國地區出貨量佔比 51.6%,國內廠商佔 48.4%。三星顯示 (SDC) 出貨量同比增長 7.1%,市場份額下降至 43.4%;京東方 (BOE) 出貨量增長 30.8%,市場份額上升至 15.7%。

智通財經 APP 獲悉,CINNO Research 首席分析師周華 Charley 表示,隨着第三季度傳統銷售旺季的到來,蘋果及國內主流品牌密集發佈旗艦新品,顯著拉動 OLED 面板的市場需求。根據 CINNO Research 統計數據,2025 年第三季度全球 AMOLED 智能手機面板出貨量約 2.5 億片,同比增長 11.7%,環比增長 20.3%,實現同比與環比雙增長,市場景氣度持續回升。

數據來源:CINNO Quarterly Mobile Phone Panel Value Chain Report

分地區來看,2025 年第三季度全球 AMOLED 智能手機面板韓國地區出貨量份額佔比 51.6%,同比下降 0.8 個百分點,環比上升 4.2 個百分點,環比回升主要得益於蘋果新機備貨的短期拉動;國內廠商出貨份額佔比 48.4%。

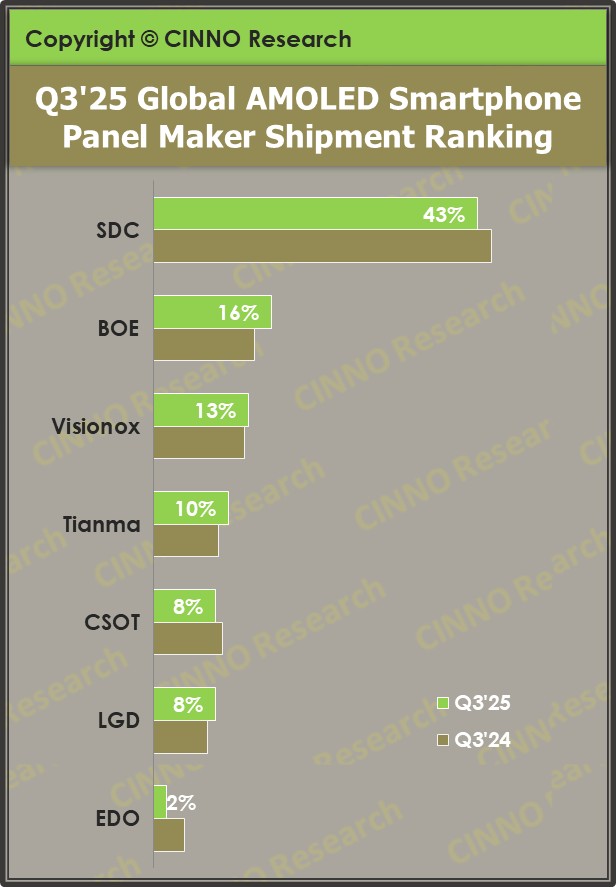

從市場格局來看,三星顯示 (SDC) AMOLED 智能手機面板出貨量同比增長 7.1%,市場份額由去年同期的 45.2% 縮窄至 43.4%,市場份額同比下滑 1.8 個百分點,儘管 SDC 在 LTPO 背板的技術優勢仍支撐其高端市場地位,但中端市場訂單流失加劇;京東方 (BOE) AMOLED 智能手機面板出貨量同比增長 30.8%,主流廠商出貨量同比增幅最大,市場份額同比上升 2.3 個百分點至 15.7%,主要得益於其中端市場規模化滲透以及高端市場的持續突破;維信諾 (Visionox) AMOLED 智能手機面板出貨量同比增長 16.7%,市場份額同比上升 0.5 個百分點至 12.7%,其上半年運營策略卓有成效,通過差異化的競爭獲得中端市場的穩定需求;天馬 (Tianma) AMOLED 智能手機面板出貨量同比增長 28.4%,表現亮眼,市場份額同比上升 1.3 個百分點至 10.0%,增長動力主要來自主力客户的穩定需求以及產線技術和良率的持續提升。

數據來源:CINNO Quarterly Mobile Phone Panel Value Chain Report

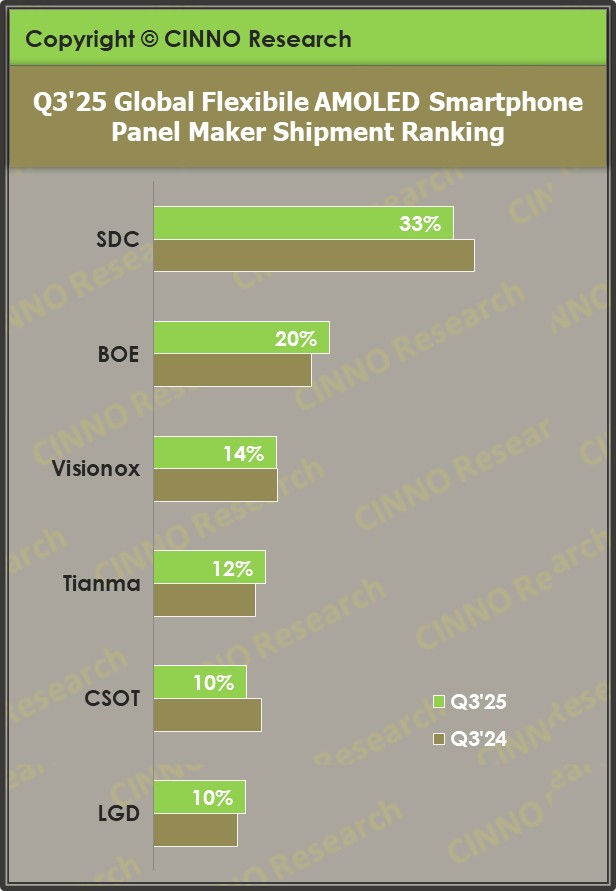

從柔性面板出貨來看,2025 年第三季度全球 AMOLED 智能手機面板中柔性 AMOLED 智能手機面板佔比 80.1%,同比上升 3.6 個百分點,環比上升 3.1 個百分點。其中,韓國地區份額佔比 43.8%,同比下滑 1.4 個百分點;國內廠商出貨份額佔比 56.2%。

2025 年第三季度,三星顯示 (SDC) 柔性 AMOLED 智能手機面板出貨量同比增長 9.3%,環比增長 40.4%,市場份額 33.5%,同比下滑 2.3 個百分點,主流廠商份額同比下滑最大,持續面臨來自國內廠商的競爭壓力;京東方 (BOE) 柔性 AMOLED 智能手機面板出貨量同比增長 30.8%,環比增長 9.3%,市場份額 19.7%,同比上升 2.1 個百分點,主流廠商份額同比增長最大,核心驅動力在於其高端柔性屏訂單的突破性增長;維信諾 (Visionox) 柔性 AMOLED 智能手機面板出貨量同比增長 16.2%,環比增長 54.2%,市場份額 13.7%,其柔性產線 Q3 稼動率顯著高於行業平均水平;天馬 (Tianma) 柔性 AMOLED 智能手機面板出貨量同比增長 28.4%,環比增長 8.3%,市場份額 12.5%,同比上升 1.1 個百分點。