Trending | CLSK Plummets 5% on Tuesday, Some Put options Soar 866%

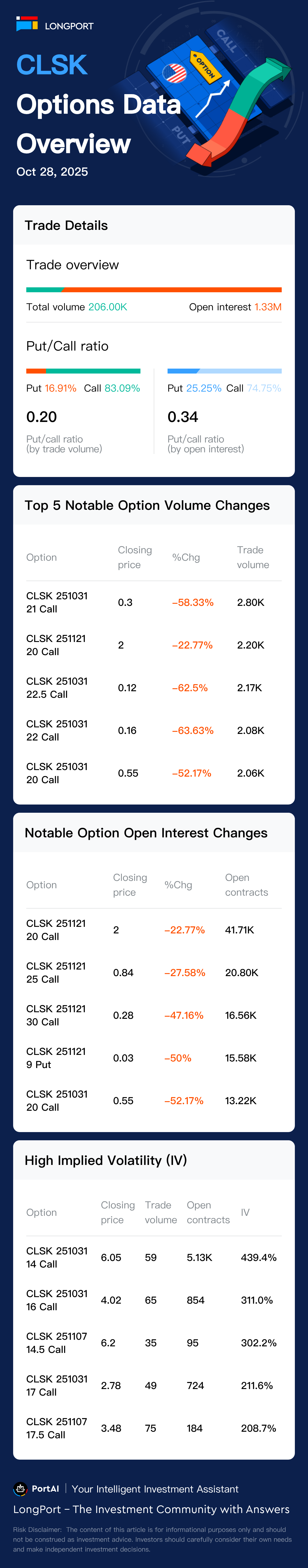

On October 28, Eastern Time, CleanSpark options saw a total of 215185 contracts traded, with calls accounting for 81% and puts making up 18%.

On October 28, Eastern Time, CleanSpark options saw a total of 215185 contracts traded, with calls accounting for 81% and puts making up 18%.

CleanSpark has 1389672 contracts outstanding, with calls accounting for 74% and puts making up 25%.

The top volume gainer was the 21 dollars Call option expiring on October 31, 2025, with 2800 contracts traded.

On the news front, Based on recent key news:

1. Oct 28, CleanSpark partnered with Submer to enhance AI data center infrastructure, focusing on liquid-cooling systems and sustainable solutions. This collaboration aims to strengthen CleanSpark's presence in North America, potentially increasing operational efficiency and market competitiveness. Source: Reuters

2. Oct 26, BTIG raised its price target for CleanSpark from $22 to $26, maintaining a 'Buy' rating. This reflects positive sentiment and confidence in CleanSpark's strategic direction, including its expansion into AI cloud services. Source: Yahoo Finance

3. Oct 26, CleanSpark's strategic shift towards AI and high-performance computing workloads is seen as a response to declining margins post-2024 Bitcoin halving. This diversification is crucial for maintaining competitiveness in the evolving Bitcoin mining sector. Source: Yahoo FinanceAI and crypto sectors show growth potential.

Please note: The chart below does not include options expiring within five days.