Goldman Sachs raises next year's iron ore price forecast but maintains a bearish stance

I'm PortAI, I can summarize articles.

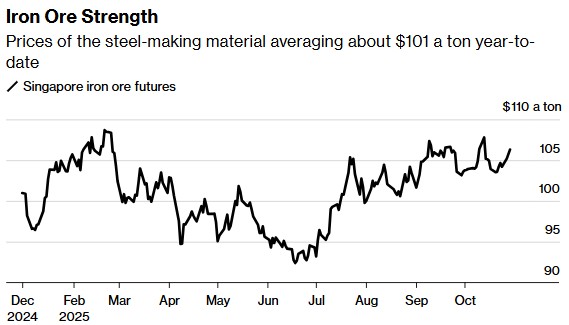

高盛上調了 2026 年鐵礦石價格預測至每噸 93 美元,但仍維持看跌立場,預計明年價格將下跌。分析師指出,受宏觀經濟支持、庫存收緊和中國鋼鐵產量強勁等因素影響,鐵礦石市場供應緊張。儘管鐵礦石期貨價格已反彈約 15%,但需求依然承壓,預計到 2026 年最後一個季度,價格將跌至每噸 88 美元。

智通財經 APP 獲悉,受宏觀經濟支持、庫存收緊和中國鋼鐵產量強勁等因素影響,高盛上調了 2026 年鐵礦石價格預測,但仍預計明年價格較當前水平將下跌。包括 Aurelia Waltham 在內的分析師在一份報告中表示,高盛預計 2026 年鐵礦石的平均價格為每噸 93 美元,比之前的預測高出 5 美元。

分析師在報告中表示:“近幾個月鐵礦石市場供應比我們預期的更加緊張。” 他們表示,中國鍊鋼生產強勁,過去兩個季度港口庫存保持平穩,加上人民幣升值,支撐了鐵礦石價格。

鐵礦石期貨連續第三天上漲,截至發稿,上漲 0.7%,至每噸 106.45 美元。隨着中國採取措施減少工業過剩產能,鐵礦石期貨價格已較 6 月中旬的低點反彈約 15%。

儘管鋼鐵出口強勁,但需求依然承壓。高盛表示,前景依然不容樂觀,預計到 2026 年最後一個季度,鐵礦石價格將跌至每噸 88 美元,儘管這一數字高於此前預測的 80 美元。

供應方面,高盛表示,本季度迄今為止全球鐵礦石出貨量同比增長 15%,這可能會加劇港口庫存的季節性增加,並使庫存在 2026 年全年持續上升。