CRIC Real Estate Research: The top 100 real estate companies saw a significant year-on-year decline in performance in October, with sales operation amounts down 41.9% year-on-year

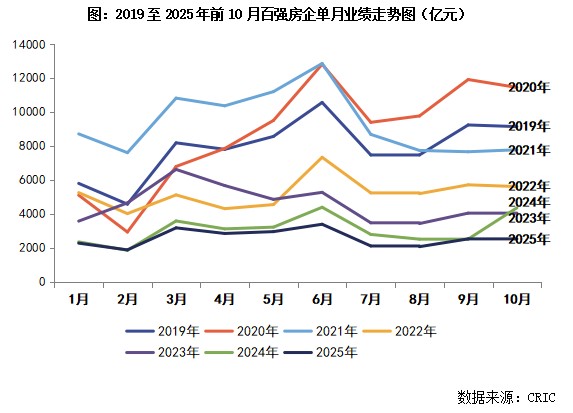

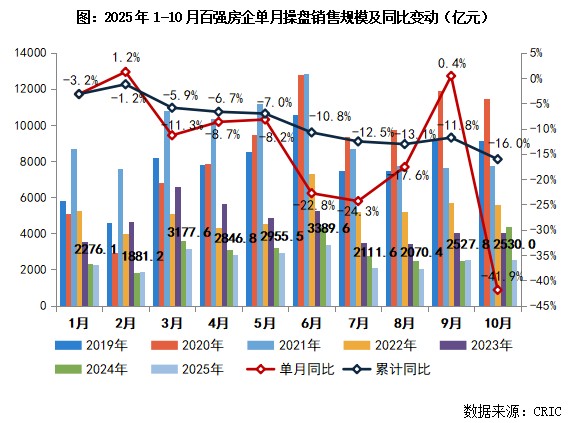

CRIC Real Estate Research released the TOP 100 sales ranking of Chinese real estate companies for January to October 2025. In October 2025, the sales amount of the top 100 real estate companies was 253 billion yuan, a year-on-year decrease of 41.9%. The supply of new homes has significantly decreased, with transaction volume down 36% year-on-year. It is expected that transactions in November will continue to fluctuate at low levels, with the decline possibly further widening. The cumulative sales amount for the first ten months was 2,576.66 billion yuan, a year-on-year decrease of 16%

According to Zhitong Finance APP, on October 31, CRIC Real Estate Research released the TOP 100 sales ranking of Chinese real estate companies for January to October 2025. In October 2025, the supply of the new housing market was "halved," with an absolute volume being the second lowest of the year (only higher than February 2025), and new home transactions increased slightly by 1% month-on-month but decreased by 36% year-on-year. In the first ten months, the cumulative transaction volume in 30 monitored cities reached 98.25 million square meters, with the year-on-year decline expanding from 2% last month to 7%.

The sales amount of the top 100 real estate companies in October was 253 billion yuan, a month-on-month increase of 0.1% and a year-on-year decrease of 41.9%. Looking ahead to November, CRIC Real Estate predicts that the absolute volume of new home transactions will continue to fluctuate at low levels, and due to the high base in November last year, the year-on-year decline in monthly transactions and cumulative year-on-year decline may further expand.

Top 100 Real Estate Companies' October Performance Decreased Significantly Year-on-Year, Nearly Half of Companies Increased Month-on-Month

In October 2025, the TOP 100 real estate companies achieved a sales amount of 253 billion yuan, a month-on-month growth of 0.1% and a year-on-year decrease of 41.9%. Cumulatively, the top 100 real estate companies achieved a sales amount of 25,766.6 billion yuan, a year-on-year decrease of 16%, with the decline expanding by 4.2 percentage points compared to the first nine months.

From the performance of the companies, in October 2025, 48 of the top 100 real estate companies had month-on-month performance growth, with 20 companies showing a month-on-month increase of more than 30%, including Vanke (02202), China Fortune Land Development (600325.SH), Yuexiu Property (00123), China Railway Construction (01186), Greenland Holdings (600606.SH), China State Construction Engineering Corporation, China Railway (00390), and China State Construction Intelligent Land, among others. Six of the top 10 real estate companies saw an increase in their sales amount month-on-month.

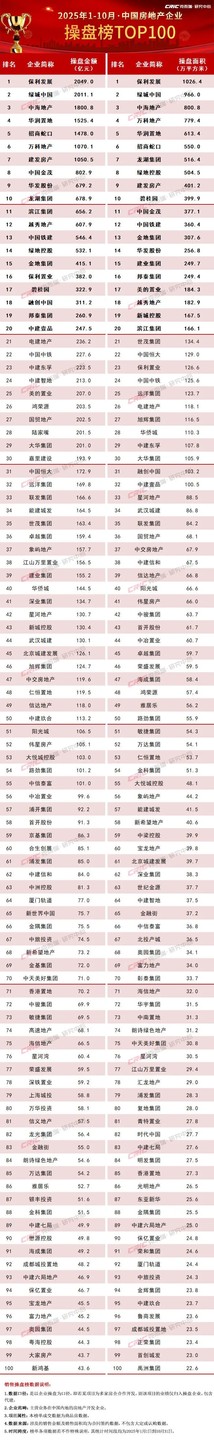

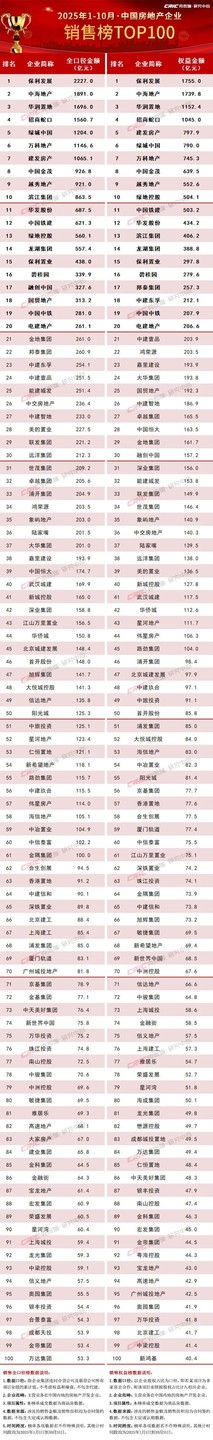

Sales Thresholds for Each Tier of Top 100 Real Estate Companies Further Lowered Compared to Last Year

In October 2025, the sales thresholds for each tier of the top 100 real estate companies were further lowered compared to the same period last year, with the threshold values dropping to the lowest levels in recent years. Among them, the sales amount threshold for the top 10 real estate companies decreased by 9.4% year-on-year to 67.89 billion yuan. The thresholds for the top 30 and top 50 real estate companies also decreased by 5.4% and 11.6% year-on-year to 19.39 billion yuan and 11.32 billion yuan, respectively. The sales amount threshold for the top 100 real estate companies was further reduced by 23.4% to 4.36 billion yuan.

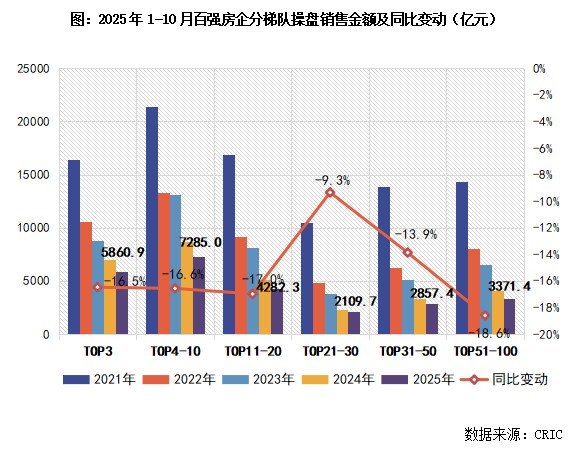

Specifically, looking at the tiered breakdown, the sales amounts of the top 100 real estate companies in each tier have been decreasing in the first ten months of 2025. The cumulative sales scale of the TOP 21-30 real estate companies has seen a relatively small decline of 9.3%, making it the only tier with a decline of less than 10%.

Specifically, looking at the tiered breakdown, the sales amounts of the top 100 real estate companies in each tier have been decreasing in the first ten months of 2025. The cumulative sales scale of the TOP 21-30 real estate companies has seen a relatively small decline of 9.3%, making it the only tier with a decline of less than 10%.

October new home transactions flat month-on-month, down 36% year-on-year Expecting further year-on-year decline in November

In October 2025, the supply of the new home market was "halved," with an absolute volume that was the second lowest of the year (only higher than February 2025). New home transactions saw a slight month-on-month increase of 1%, but a year-on-year decrease of 36%. In the first ten months, the cumulative transaction volume in 30 monitored cities reached 98.25 million square meters, with the cumulative year-on-year decline increasing from 2% last month to 7%.

The total volume in first-tier cities remained flat compared to last month, but internal differentiation intensified. According to CRIC monitoring data, first-tier cities collectively transacted 1.68 million square meters in October, remaining flat month-on-month, but the year-on-year decline reached 41%, higher than that of second and third-tier cities, which saw a cumulative year-on-year slight drop of 3% in the first ten months. Guangzhou emerged as the leader among first-tier cities, with a monthly transaction of 610,000 square meters in October, a month-on-month increase of 6%, but a year-on-year decline of 46%, indicating that the recovery foundation is not solid. Beijing saw a month-on-month growth of 19%, showing relatively positive performance, but still experienced a year-on-year decline of 19%, with demand sustainability needing observation. Both Shanghai and Shenzhen had year-on-year declines exceeding 40%, indicating that after the previous policy effects diminished, market purchasing power, especially for high-end improvement demand, remains cautious.

Second and third-tier cities have stopped declining month-on-month but are undergoing deep adjustments year-on-year. The 26 second and third-tier cities collectively transacted 7.91 million square meters, with a slight month-on-month increase of 1% and a year-on-year drop of 35%. The cumulative year-on-year decline in the first ten months was 7%. In terms of transaction scale, Chengdu's monthly transaction volume reached 800,000 square meters, leading significantly, while cities like Qingdao, Wuhan, and Xi'an maintained monthly volumes above 600,000 square meters, serving as the cornerstone for stabilizing the national market. Month-on-month, cities like Dongguan, Huizhou, Nanning, and Suzhou saw increases of over 40%, mainly due to previously low bases and the concentration of local "price-for-volume" projects being filed. Year-on-year, some second-tier cities showed resilience, such as Qingdao, which experienced a 30% year-on-year increase this month, with a cumulative year-on-year positive growth of 6% in the first ten months, demonstrating strong market risk resistance. Nanjing, Changsha, Xiamen, Foshan, Changzhou, and Xuzhou are still in a deep adjustment period. Year-on-year "halving" indicates that market confidence restoration will still take time.

Looking ahead to November, we believe that the absolute volume of new home transactions will continue to fluctuate at low levels. Based on the high base from November last year, the year-on-year decline in monthly transactions and cumulative year-on-year decline is likely to further expand.

The differentiation between cities and projects will continue to intensify: the market heat in core first and second-tier cities such as Beijing, Shanghai, Shenzhen, Hangzhou, and Chengdu is expected to decline in the short term, with significant downward pressure remaining. Changes in market heat are closely related to the supply volume and quality of new projects; cities like Wuhan, Nanjing, Suzhou, and Hefei continue to show weak recovery trends, with homebuyer confidence gradually restoring; while some weak second and third-tier cities such as Nanning, Fuzhou, and Changzhou are expected to have overall destocking rates lingering below 20%