对冲 AI 泡沫 美银荐黄金与中国股票

美國銀行策略師指出,在人工智能交易熱潮推高估值之際,黃金與中國股票是應對泡沫的最佳對沖工具。標普 500 指數前瞻市盈率約 23 倍,科技股權重超過三分之一。美銀團隊看好黃金和中國股票,認為它們能有效對沖經濟擴張帶來的通脹風險。中國股票今年表現優異,MSCI 中國指數上漲 33%。

智通財經 APP 獲悉,美國銀行策略師表示,在人工智能交易熱潮推高估值之際,黃金與中國股票是應對這場泡沫或繁榮的最佳對沖工具。

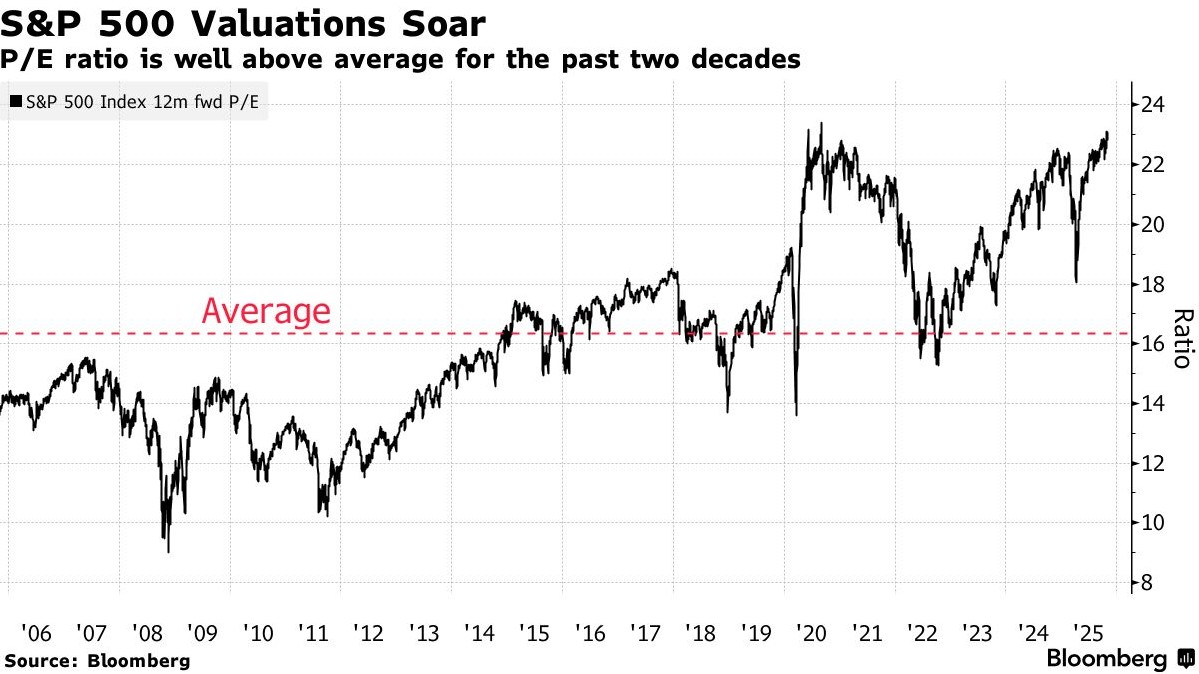

目前標普 500 指數前瞻市盈率約 23 倍,遠高於過去 20 年 16 倍的平均水平;所謂 “科技七巨頭” 在指數中的權重超過三分之一,其前瞻市盈率更高達 31 倍。

由 Michael Hartnett 領銜的美銀團隊在報告中寫道:“AI 股的領先地位眼下紋絲不動,我們看好黃金和中國股票作為最佳的繁榮/泡沫對沖。”

自 4 月初觸底以來,這一領漲板塊已推動標普 500 市值增加約 17 萬億美元。本週,芯片製造商英偉達 (NVDA.US) 成為全球首家市值突破 5 萬億美元的公司。

此外,亞馬遜 (AMZN.US) 和蘋果 (AAPL.US) 公佈的強勁財報週五提振了美股期貨;市場似乎準備反彈,此前部分下跌源於 Meta Platforms(META.US) 因投資者擔憂鉅額 AI 投資支出而暴跌。

美銀策略師指出,投資者正為 2026 年經濟穩健增長進行倉位佈局,預期美國利率將下降,且特朗普政府將推出支持市場的政策。黃金可對沖寬鬆政策與經濟擴張可能引發的通脹風險。

金價近期自每盎司逾 4300 美元的歷史高位回落,部分原因是投資者評估中美貿易休戰進展。數據顯示,全球黃金基金單週創紀錄流出 75 億美元,此前連續四個月淨流入。

今年以來,中國股票大幅跑贏標普 500 指數,MSCI 中國指數飆升 33%,得益於 DeepSeek 崛起後市場對中國生成式 AI 競爭力的樂觀預期。

在特朗普當選總統時,Hartnett 團隊曾準確押注亞洲及歐洲等國際股票,認為這些地區的寬鬆政策將推動股市上漲。