U.S. Stock Market Outlook | Three Major Index Futures Rise Together, Multiple AI Leaders' Earnings Reports Coming This Week

11 月 3 日美股三大股指期貨齊漲,市場迎來新一輪 “超級周”,多家 AI 龍頭公司將發佈財報。投資者關注 ADP 私營企業就業數據及 PMI 數據。儘管市場樂觀情緒高漲,華爾街分析師 Ed Yardeni 警告看漲情緒過濃,可能發出反向信號。

盤前市場動向

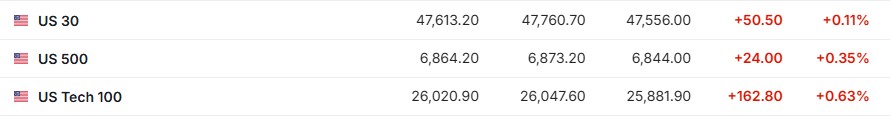

1. 11 月 3 日 (週一) 美股盤前,美股三大股指期貨齊漲。截至發稿,道指期貨漲 0.11%,標普 500 指數期貨漲 0.35%,納指期貨漲 0.63%。

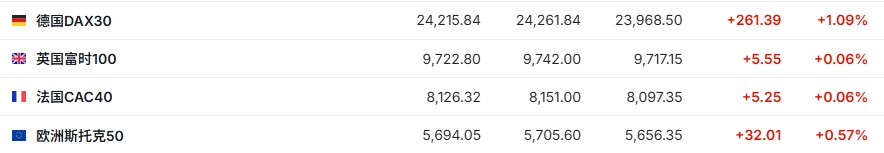

2. 截至發稿,德國 DAX 指數漲 1.09%,英國富時 100 指數漲 0.06%,法國 CAC40 指數漲 0.06%,歐洲斯托克 50 指數漲 0.57%。

3. 截至發稿,WTI 原油漲 0.00%,報 60.98 美元/桶。布倫特原油跌 0.02%,報 64.76 美元/桶。

市場消息

新一輪 “超級周” 來襲!多家 AI 龍頭財報壓軸,市場面臨 “數據荒” 考驗。在經歷今年最繁忙的交易周之後,投資者即將迎來又一個緊湊的周度日程。本週,人工智能 (AI) 主題仍將是市場焦點,Palantir(PLTR.US)、AMD(AMD.US)、超微電腦 (SMCI.US) 和 Constellation Energy(CEG.US) 等 AI 概念股將陸續發佈季度財報。經濟數據方面,持續的政府停擺可能使月度非農就業數據連續第二個月延遲發佈,因此週三公佈的 ADP 私營企業就業數據將成為本週勞動力市場最重要的參考指標。供應管理協會和標普全球發佈的製造業/服務業 PMI 數據同樣是本週關鍵看點,而密歇根大學週五公佈的 11 月消費者信心初值也將受到關注。

回調預警!美股看漲情緒過濃,華爾街堅定多頭也開始擔心了。美股市場目前瀰漫着一股樂觀情緒,投資者似乎堅信股市只會上漲。而這讓華爾街的堅定多頭之一開始擔心,所有這些樂觀情緒都在發出反向的危險信號。Yardeni Research 創始人、長期看好美股的分析師 Ed Yardeni 在經歷了近六個月的瘋狂上漲後表示,看漲者太多了,這波上漲幾乎無視了所有預警。Yardeni 預測,由於市場情緒和技術指標均已趨於超買,標普 500 指數到 12 月底可能從峯值下跌多達 5%。

64% 公司盈利爆表,市場卻冷眼相待! 高盛:投資者轉向 AI 與宏觀不確定性。截至目前,約三分之二的標普 500 指數成分股公司已公佈業績,其中 64% 的公司盈利超出市場預期至少一個標準差。高盛策略師大衞·科斯汀指出,儘管第三季度財報季呈現出近年來最強勁的利好表現,投資者對此卻反應冷淡。科斯汀稱,投資者普遍認為本季度業績對未來盈利前景的參考意義較低,並指出貿易政策波動、銀行貸款狀況及其他宏觀因素的不確定性是主要影響原因。

非農報告或再次難產!諸多信號仍顯示美國經濟保持韌性。目前美國政府停擺已超一個月,美國勞工部很可能無法按原計劃在週五發佈 10 月就業報告。這將是非農就業報告連續第二次缺席,讓投資者與美聯儲高級官員難以判斷經濟是在好轉還是惡化。不過,已有足夠零散證據顯示,美國經濟仍維持良好運轉。在缺乏常規參考指標的情況下,華爾街不得不轉向信用卡消費、企業盈利數據及各州失業申領人數等其他指標,試圖拼湊出當前經濟狀況。這些指標所反映的情況是,即便處於多重不確定性 (政府停擺、貿易摩擦、招聘大幅放緩) 的籠罩下,美國經濟仍在擴張。

美財長拉響警報:高利率正令住房陷入衰退,美聯儲必須加快降息。美國財政部長斯科特·貝森特表示,由於利率居高不下,美國經濟部分領域——尤其是住房——可能已陷入衰退,並再次呼籲美聯儲加快降息。貝森特表示:“我認為整體經濟基本面良好,但某些板塊確實處在衰退中。美聯儲的政策也造成了很多分配層面的問題。” 他指出,高抵押貸款利率仍在阻礙房地產市場,“住房實質上處於衰退狀態,衝擊最大的是低端消費者,他們負債高、資產少”。貝森特將整體經濟環境形容為 “過渡期”,並批評美聯儲主席鮑威爾上週暗示 12 月可能暫停降息的表態。

歐佩克 + 擬明年 Q1 暫停增產,大摩上調短期油價預期。歐佩克 + 在平衡擴大市場份額的目標與日益顯現的供應過剩信號後,決定在明年第一季度暫停增產,但下個月仍將小幅提高產量。該組織決定 12 月日均增產 13.7 萬桶,與 10 月和 11 月計劃的增產量持平,隨後在明年 1 月至 3 月期間暫停增產。第一季度通常是石油需求淡季,與會代表表示,從 1 月起暫停增產的決定,反映出對季節性需求放緩的預期。摩根士丹利上調了短期油價預期。該行週一表示,已將 2026 年上半年布倫特原油價格預期上調至每桶 60 美元,較此前的 57.50 美元有所上調。

個股消息

Alphabet(GOOGL.US) 重返歐債市場,擬發行 30 億歐元債券助力 AI 及雲基礎設施投資。Alphabet 計劃今年第二次迴歸歐洲債券市場,發行多期歐元計價基準債券,以為其在人工智能 (AI) 和雲基礎設施領域的創紀錄支出提供資金支持。據媒體援引知情人士消息報道,Alphabet 正計劃發行六種歐元計價基準債券,期限從 3 年至 39 年不等,總髮行規模預計至少為 30 億歐元 (約合 35 億美元)。Alphabet 正投入創紀錄的資金,力圖推動人工智能領域的發展,並將旗下大型語言模型 Gemini 的代理和輔助功能融入到包括搜索在內的熱門產品中。

加密礦企 Cipher Mining(CIFR.US) Q3 每股收益超預期,與亞馬遜 (AMZN.US) AWS 達成 55 億美元協議。財報顯示,Cipher Mining 第三季度營收為 7170.7 萬美元,不及市場預期的 7860.2 萬美元;每股收益為 0.10 美元,好於市場預期的每股虧損 0.02 美元。此外,該公司宣佈與亞馬遜 AWS 達成一項價值約 55 億美元的 15 年租賃協議,該協議將為人工智能工作負載提供 300 兆瓦的即用型空間和電力。截至發稿,Cipher Mining 週一美股盤前漲近 18%。

盤前暴漲!IREN(IREN.US) 簽下微軟 97 億美元 AI 雲協議。微軟 (MSFT.US) 已與澳大利亞企業 IREN Ltd 簽署一項價值約 97 億美元的協議,將向後者採購人工智能 (AI) 雲算力,成為這家澳大利亞公司的最大客户。根據 IREN 週一發佈的聲明,這份為期五年的協議將為微軟提供位於得克薩斯州、基於英偉達 (NVDA.US) GB300 架構的加速器系統,用於處理 AI 工作負載。協議還包括 20% 的預付款。總部位於悉尼的 IREN 同時宣佈,已同意以 58 億美元從戴爾科技 (DELL.US) 採購所需的 GPU 及相關設備。截至發稿,IREN 週一美股盤前漲超 21%。

CompoSecure(CMPO.US) 盤前走高,傳擬斥資 50 億美元收購注塑設備供應商 Husky Technologies。由前霍尼韋爾首席執行官科特支持的金融科技公司 CompoSecure 計劃以約 50 億美元 (包括債務) 從 Platinum Equity 手中收購注塑設備供應商 Husky Technologies。報道稱,此次交易的部分資金將來自約 20 億美元的 PIPE(私人投資公開股票) 投資,預計將以每股 18.50 美元的價格出售 CompoSecure 普通股。截至發稿,CompoSecure 週一美股盤前漲超 3%。

487 億美元交易引發股價巨震!“收購方” 金佰利 (KMB.US) 大跌,Kenvue(KVUE) 大漲。金佰利宣佈達成一項交易,將以現金加股票的形式收購泰諾製造商 Kenvue 的所有流通股。根據雙方董事會一致通過的協議,Kenvue 的股東將獲得每股 3.50 美元的現金以及 0.14625 股金佰利的股票作為對價,該交易每股的估值為 21.01 美元。截至發稿,週一盤前,金佰利股價下跌超過 15%,而 Kenvue 上漲超過 20%。

重要經濟數據和事件預告

北京時間 22:45 美國 10 月 SPGI 製造業 PMI 終值

北京時間 23:00 美國 10 月 ISM 製造業 PMI

北京時間次日 01:00 2027 年 FOMC 票委、舊金山聯儲主席戴利發表講話

北京時間次日 03:00 美聯儲理事麗莎·庫克在布魯金斯學會就 “經濟與貨幣政策前景” 發表講話

業績預告

週二早間:Palantir(PLTR.US)

週二盤前:英國石油 (BP.US)、飛利浦 (PHG.US)、Spotify(SPOT.US)、優步 (UBER.US)、Shopify(SHOP.US)、輝瑞 (PFE.US)、挪威郵輪 (NCLH.US)