Whales pump $421M into Solana – So why didn’t SOL’s price move?

Solana (SOL) 上週吸引了 4.21 億美元的淨流入,成為所有加密貨幣中最高的,儘管整體市場流出達 3.6 億美元。機構投資者正在將資金從比特幣重新分配到 Solana,受到新 ETF 推出的推動。然而,SOL 的價格仍然停滯不前,徘徊在 164 美元左右,技術信號顯示出持續的下行壓力。儘管鯨魚在積累 SOL,但散户需求正在減弱,市場尚未對流入做出積極反應,這表明資本流入與價格走勢之間存在脱節

關鍵要點

為什麼 Solana 現在吸引瞭如此多的關注?

因為上週 SOL 的淨流入達到了 4.21 億美元,超過了任何其他加密貨幣。

強勁的流入是否意味着 Solana 的價格會立即上漲?

技術信號仍然顯示短期內的看跌動能。

鯨魚們正在大量積累 Solana [SOL],儘管大多數交易者仍然保持謹慎。

僅上週,SOL 就吸引了 4.21 億美元的新投資,超過了任何其他加密貨幣。雖然散户投資者正在退縮,但機構資本正在湧入。

這種大額資金的興趣激增會很快引發強勁的價格波動嗎?

Solana 避開了流出趨勢

數字資產投資產品上週流出了 3.6 億美元,但 Solana 卻朝相反的方向發展。

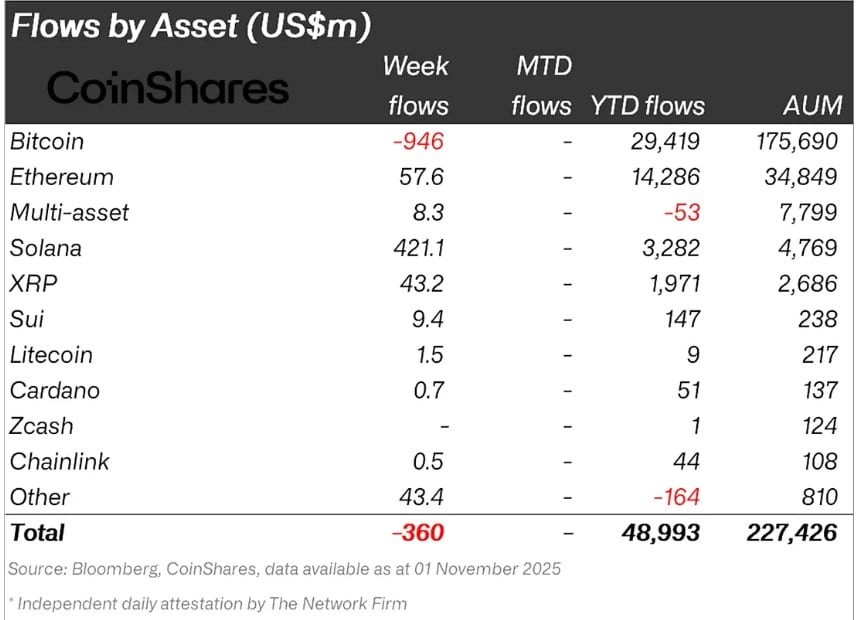

CoinShares 的數據表明,SOL 在一週內吸引了 4.211 億美元的流入(在所有資產中最高),而比特幣 [BTC] 則流出了 9.46 億美元,使 BTC 成為總流出量的主要驅動因素。

來源:Coinshares

美國本土產品是負面情緒的最大來源,流出了 4.39 億美元。Solana 的流入甚至高於以太坊 [ETH] 的 5760 萬美元。

這表明主要投資者正在將資金從比特幣重新分配到替代資產。流入的激增主要是由於新資本進入最近推出的 Solana ETF。

流入增加,價格走軟

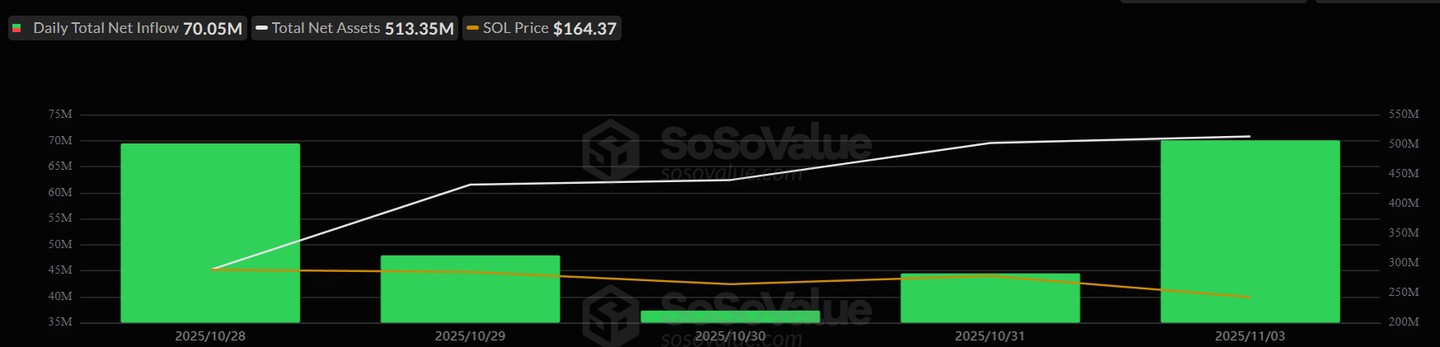

最近的數據表明,Solana ETF 的流入在過去一週持續強勁,出現了兩次約 7000 萬美元的顯著激增。這使得 ETF 的淨資產總額超過了 5 億美元。但價格並沒有隨之上漲。

SOL 在 164 美元附近徘徊,並且在同一時期實際上略微下跌。

來源:SoSoValue

與此同時,DeFiLlama 的數據表明,Solana 的總鎖倉價值(TVL)為 105.9 億美元,在 24 小時內下降了約 3%。因此,資本可能通過 ETF 的方式進入的速度超過了鏈上市場的反應。

來源:DeFiLlama

儘管散户需求降温,但大資金仍在佈局。

技術面偏向看跌

Solana 的日線圖顯示,價格在發佈時滑落至約 159 美元,賣方仍在控制中。EMA 線仍然堆疊在價格上方,顯示出持續的下行壓力。RSI 接近超賣區域。

資本流動也呈負面,CMF 低於零。

來源:TradingView

儘管 Solana ETF 的流入巨大,但現貨交易者尚未逆轉趨勢。技術面與資金流動的故事不同:鯨魚在積累,但更廣泛的市場仍未跟隨。

如果 RSI 進一步下降,可能會出現短期的反彈,但目前動能仍然疲弱。