AMD's revenue greatly exceeded expectations, but the guidance failed to impress investors, leading to post-market fluctuations and declines in stock price | Earnings Report Insights

AMD's financial report shows that the company's revenue, profit, and capital expenditures for the third quarter all exceeded expectations, but the revenue guidance for the fourth quarter did not meet market expectations for being "more aggressive," and the data center business was slightly weaker. The stock price fluctuated and declined in after-hours trading, with a drop of up to 3.7%. Analysts say that although large AI orders continue to materialize, the market remains concerned that the pace of realization may not meet expectations, and it is still uncertain whether AMD can shake NVIDIA's dominance by capturing AI market share

AMD announced its financial results after the market closed on Tuesday, showing that the company's third-quarter revenue and capital expenditures exceeded analysts' expectations. However, the fourth-quarter revenue guidance failed to impress investors, and the data center business revenue was slightly disappointing, leading to a volatile decline in the company's stock after hours on Wednesday.

Here are the key points from AMD's third-quarter financial report:

Key Financial Data:

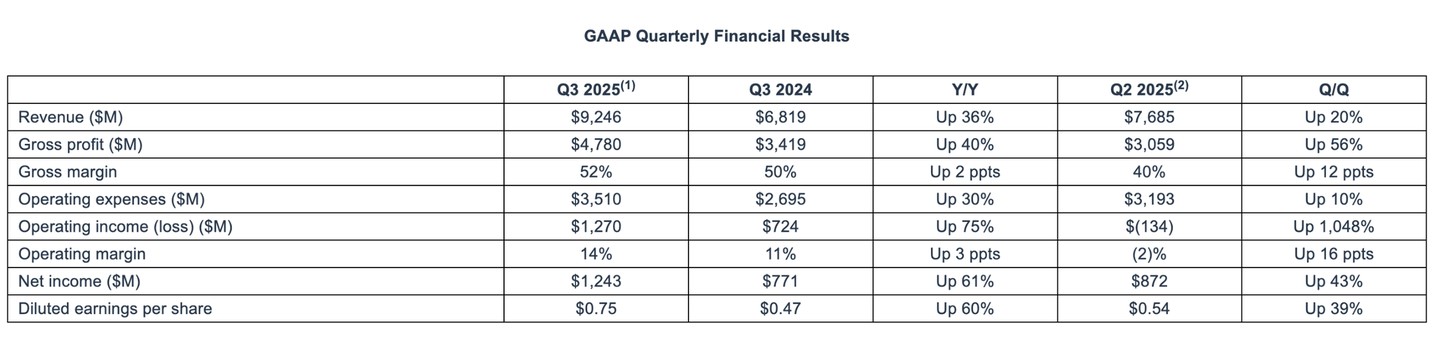

Revenue: AMD's third-quarter revenue was $9.246 billion, compared to $6.819 billion in the same period last year, a year-over-year increase of 36%, exceeding analysts' expectations of $8.74 billion.

Gross Profit: AMD's third-quarter gross profit was $4.780 billion, compared to $3.419 billion in the same period last year, a year-over-year increase of 40%; the gross margin was 52%, up 2 percentage points from the same period last year.

Operating Profit: AMD's third-quarter operating profit was $1.270 billion, compared to $724 million in the same period last year, a year-over-year increase of 75%;

Net Profit: AMD's third-quarter net profit was $1.243 billion, compared to $771 million in the same period last year, a year-over-year increase of 61%.

Earnings Per Share: AMD's third-quarter earnings per share were $0.75, compared to $0.47 in the same period last year. On a non-GAAP basis, earnings per share were $1.20, compared to $0.92 in the same period last year, a year-over-year increase of 30%, exceeding analysts' expectations of $1.17.

Capital Expenditures: AMD's third-quarter capital expenditures were $258 million, higher than the expected $219.7 million.

Segment Data:

Data Center Business: The data center business segment generated revenue of $4.3 billion, a year-over-year increase of 22%, exceeding analysts' expectations of $4.14 billion. This was primarily driven by strong demand for the fifth-generation AMD EPYC™ processors and AMD Instinct MI350 series GPUs.

Client and Gaming Business: The client and gaming business segment generated revenue of $4 billion, a year-over-year increase of 73%, exceeding analysts' expectations of $2.6 billion.

- The client business revenue set a new record of $2.8 billion, a year-over-year increase of 46%, primarily driven by record sales of Ryzen™ processors and product portfolio optimization, exceeding analysts' expectations of $2.6 billion.

- The gaming business revenue was $1.3 billion, a year-over-year increase of 181%, benefiting from increased semi-custom business revenue and strong demand for Radeon™ gaming GPUs, exceeding analysts' expectations of $1.1 billion Embedded Business: The revenue of the embedded business department was $857 million, a year-on-year decrease of 8%.

Fourth Quarter Performance Guidance:

Revenue: AMD expects revenue to be approximately $9.3 billion to $9.9 billion, with analysts' average expectation at $9.21 billion. Based on the midpoint of this revenue range, it represents a year-on-year growth of about 25% and a quarter-on-quarter growth of about 4%.

Gross Margin: The non-GAAP gross margin is expected to be approximately 54.5%, in line with analysts' expectations.

Revenue Guidance Fails to Impress Investors, Data Center Business Slightly Underwhelming

Recently, Wall Street has become increasingly concerned about the risks of an AI bubble, and AMD's performance is under close scrutiny. Media reports state that as the only major competitor in the artificial intelligence chip market that can rival NVIDIA, AMD's revenue outlook, after a surge in stock price and a significant increase in market expectations this year, has failed to impress investors.

In a statement released on Tuesday, AMD indicated that it expects the midpoint of its fourth-quarter revenue to be approximately $9.6 billion. Although analysts' average estimate is $9.2 billion, some of the highest expectations had reached $9.9 billion.

Investors had previously held higher expectations for AMD's data center business profitability. Despite record revenue from the data center business, its operating profit was $1.07 billion, which was 14% lower than analysts' expectations surveyed by FactSet. The profit margin for the data center business fell from 29% in the same period last year to 25%.

After reaching a significant cooperation agreement with OpenAI and Oracle, investors heavily bet on AMD. The two companies plan to use AMD chips in building an artificial intelligence computing power system. The market hopes that AMD can shake NVIDIA's long-standing dominance in the AI processor market.

However, media reports indicate that the performance outlook released on Wednesday suggests that AMD may fulfill market expectations at a slower pace than some investors had anticipated.

After the earnings report was released, AMD's stock price fell by about 3.7% in after-hours trading, although the decline later narrowed. Prior to the earnings report, AMD's stock price had already more than doubled this year, closing at $250.05 on Tuesday.

In the statement, CEO Lisa Su stated that as AMD hopes to leverage AI to drive revenue and profit growth, this report marks that "our growth trajectory is clearly improving."

"We delivered a very impressive quarterly report, with record revenue and profits reflecting the broad demand in the market for our high-performance EPYC and Ryzen processors as well as Instinct AI accelerators. Our record performance in the third quarter and strong fourth-quarter performance guidance clearly indicate that our growth is accelerating, and with the expansion of our computing business and the rapid growth of our data center AI business, we will see significant revenue and profit increases." She stated in the earnings call that the company's AI business will generate "tens of billions of dollars" in revenue annually by 2027, with opportunities in AI chips exceeding $500 billion. At the same time, she noted that AMD's PC chip business is expected to grow faster than the overall PC market.

Lisa Su also mentioned that cloud demand is expected to remain strong, with the data center GPU business accelerating and enterprise EPYC sales surging.

Recent Agreements Reached

AMD's recent cooperation agreements with OpenAI, Oracle, and the US Department of Energy reflect a significant increase in market interest in its MI series AI accelerators. These products are in direct competition with NVIDIA chips and are used to create and run AI services in data centers.

Last month, AMD signed an agreement with OpenAI to provide up to 6 gigawatts (GW) of GPU computing power for its AI data center. In exchange, OpenAI agreed to purchase up to 160 million shares of AMD stock, accounting for about 10% of the company. The data center will use AMD's latest generation MI450 processors, which are expected to be released next year. AMD stated that its agreement with OpenAI is a unique structure.

According to the agreement with Oracle, AMD will deploy up to 50,000 GPUs in its cloud data center.

AMD is also one of the largest suppliers of graphics chips and central processing units in the PC and server fields. Last month, competitor Intel stated that there is strong demand in the market for the new generation of AI-supported laptops and enterprise servers. AMD is continuously eating into the market share of this long-time rival in these key areas.

Additionally, AMD is providing chips for two supercomputers being built by the US Department of Energy at Oak Ridge National Laboratory. Once completed, these systems are expected to represent $1 billion in public and private investment.

However, AMD still lags behind NVIDIA, which controls most of the AI market and recently surpassed a market capitalization of $5 trillion. In contrast, AMD's market capitalization is approximately $418 billion.

Analysts: Demand for Alternatives to NVIDIA Remains

Morgan Stanley analyst Joseph Moore wrote in a research report that AMD's MI450 chips and rack-level products will be an important part of the company's future growth strategy.

Before AMD's announcement, Moore stated:

"The rack-level solutions that AMD plans to deliver starting next year are crucial, and we are looking forward to what the company will achieve."

"It is still too early to judge market share; although the agreement with OpenAI clearly has an accelerating effect, there remains some uncertainty in pushing this 6 GW of computing power through cloud vendors. Ultimately, to achieve an increase in market share, the company needs to provide a higher return on investment than NVIDIA, and customers still have questions about this, as AMD has lower rack density and ecosystem issues that remain to be resolved." D.A. Davidson analyst Gil Luria stated:

"I believe AMD is on the verge of a potential turning point, but it depends on their subsequent execution capabilities on the operational side, and whether they can launch chips that maintain high yield and high performance in scaled scenarios. If they can do that, the orders are there, and the market has a strong demand for alternatives to NVIDIA."

On the other hand, as one of AMD's important cloud customers, Amazon disclosed in a filing submitted on Tuesday that it has sold all 822,234 shares of AMD stock it held as of September 30. Amazon established that position during the first quarter