Bank of America: Rising market volatility indicates that a bubble is forming, but it is still in the early stages

美银指出,市场近期出现股价上涨与波动率上升的现象,预示资产泡沫的早期形成,尤其是由人工智能驱动的泡沫。尽管当前 VIX 指数仍在历史中位数附近,市场仍有进一步上行空间。美银建议投资者通过期权等工具参与后续上涨,以控制风险并获取收益。

美银称,市场近期出现"股价上涨、波动率上升"一幕,这是资产泡沫的早期迹象,但这轮由人工智能(AI)驱动的泡沫,其膨胀过程可能远未结束。

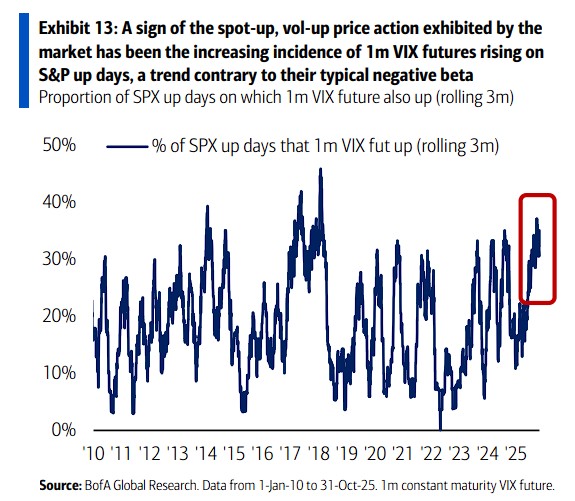

11 月 5 日,据追风交易台消息,美银全球研究(BofA Global Research)在最新研报中称,美股近期频繁出现 VIX 期货与标普 500 指数同时上涨的情况,这种"股价上涨、波动率上升"的组合历来是资产泡沫的标志性特征。

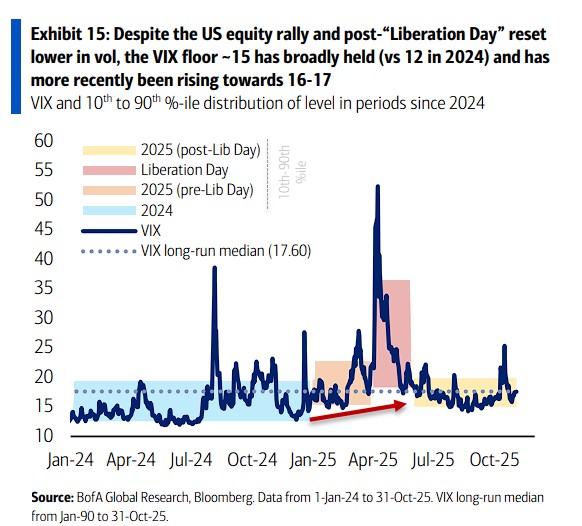

不过,该行策略师 Benjamin Bowler 团队表示,与历史上的泡沫晚期不同,当前 VIX 指数仍处于历史中位数附近,且指数的已实现波动率相对温和,这表明市场和波动率本身都还有进一步上行的空间。

分析认为, 这意味着当前市场的主要风险(pain trade)是踏空上涨行情,而非深度回调。但鉴于美联储的鹰派迹象和宏观不确定性,回调风险同样存在。因此,美银建议投资者不应完全离场,而应通过期权等非对称性工具来参与后续的上涨行情,以在控制风险的同时获取杠杆收益。

“股价与波动率同涨”:泡沫的明确信号

报告称,夏季市场那种 “风平浪静” 的价格走势似乎已被打破。一个显著的变化是,美国股市近期越来越频繁地出现标普 500 指数与 VIX 恐慌指数期货同步上涨的现象。

这与通常情况下两者呈负相关的走势截然相反。从历史经验看,这种 “现货涨、波动率涨”(spot-up, vol-up)的动态是资产泡沫形成过程中的标志性信号。

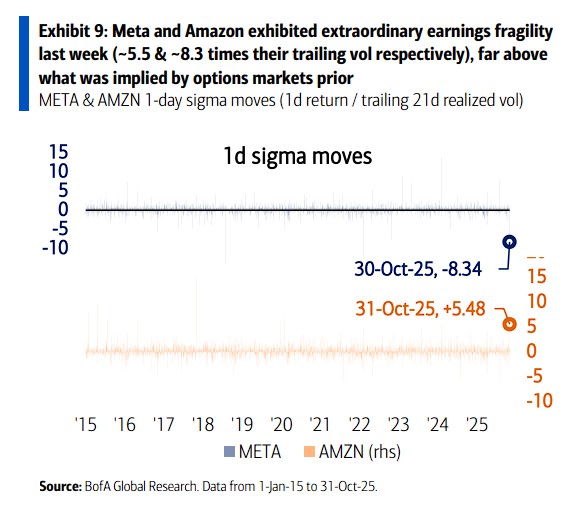

与此同时,个股层面的脆弱性正在急剧增加,尤其是在大型科技股中。报告以最近的财报季为例:

Meta 在 10 月 30 日股价暴跌 11.3%,其单日波幅是其过往已实现波动率的约 8.3 倍。

亚马逊在 10 月 31 日则大涨 9.6%,波幅是其过往已实现波动率的约 5.5 倍。

报告指出,这些剧烈波动远超期权市场事前的预期。数据显示,2025 年至今,美国科技股发生大幅波动(单日涨跌幅超过 3 倍标准差)的频率和幅度均已达到历史高位,甚至超过了互联网泡沫(dotcom bubble)时期。这表明,尽管指数稳步上行,但个股层面早已暗流涌动。

美银则在报告中明确表示,这种反常现象是市场泡沫正在积聚的标志性特征,历史上屡见不鲜。当市场情绪高涨,投资者追逐上涨势头并同时买入期权进行对冲或投机时,就可能出现这种正相关性。

为何说泡沫尚处早期?

尽管泡沫的信号已经出现,但美银强调,我们可能仍处于泡沫的早期阶段。其主要依据来源于几个关键的波动率指标:

VIX 指数水平尚不极端:尽管 VIX 指数的底部已经从 2024 年的 12 附近抬升至 15 左右,但当前水平仍接近其长期中位数 17.60。这与互联网泡沫后期 VIX 飙升至 40 以上的状态相去甚远。

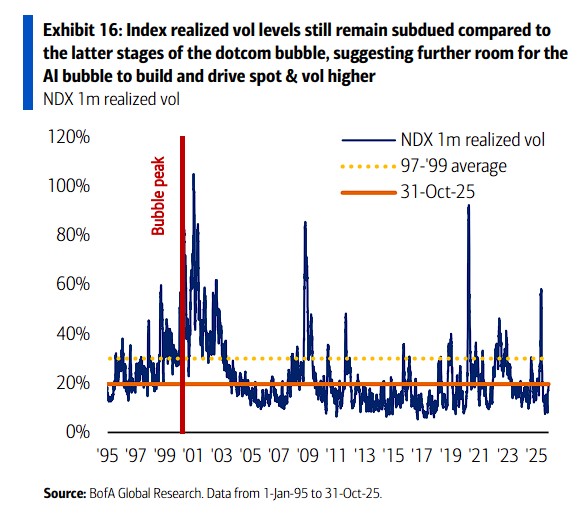

已实现波动率相对受控:报告特别指出,当前纳斯达克 100 指数(NDX)的 1 个月已实现波动率,与互联网泡沫顶峰时期的水平相比,依然 “相当温和”(sanguine)。在 1999 年末的泡沫顶峰期,NDX 的已实现波动率平均高达 93%,而当前水平远低于此。

综合来看,这些 “温和” 的指标表明,在市场达到 “非理性繁荣” 的顶峰并最终破裂之前,当前的 AI 泡沫可能还有相当大的发展空间。正如该行研报中所说的那样:

“尽管股价与波动率同涨历来是市场泡沫的标志……但目前指数的已实现波动率水平仍然温和(尤其是与科网泡沫时期相比),这表明在最终破裂前,股价和波动率可能还有进一步的上行空间。这与我们更广泛的泡沫框架分析一致。”

基于 “AI 泡沫仍将继续膨胀” 的判断,并考虑到回调风险始终存在,美银在报告中建议投资者通过期权进行非对称布局。具体策略包括:

卖出 VIX 看跌期权以零成本构建标普 500 看涨价差(call spreads),利用 VIX 的坚实底部来降低获取上行收益的成本;

以及从更长周期看,买入标普 500 向上波动率方差(up-variance),以直接做多 delta 和波动率的方式,捕捉泡沫的长期膨胀过程。

~~~~~~~~~~~~~~~~~~~~~~~~

以上精彩内容来自追风交易台。

更详细的解读,包括实时解读、一线研究等内容,请加入【追风交易台▪年度会员】

风险提示及免责条款

市场有风险,投资需谨慎。本文不构成个人投资建议,也未考虑到个别用户特殊的投资目标、财务状况或需要。用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。