The early landing of 3nm and the explosive demand for DRAM, is ASML's profit reversal coming?

大摩認為,強勁的 DRAM 技術升級週期、台積電 3nm 工藝可能提前落地,以及英偉達 AI 芯片帶來的間接需求,正成為驅動光刻機巨頭阿斯麥 2026-2027 年盈利增長的關鍵催化劑。ASML 的盈利修正週期已經開始,該行將 ASML 目標價從 975 歐元上調至 1000 歐元。

走出 14 個月漫長下行週期,阿斯麥新的增長動力似乎正在浮現。

據追風交易台消息,摩根士丹利 11 月 26 日發佈的研報顯示,全球光刻機巨頭阿斯麥(ASML)正迎來 DRAM 和先進邏輯芯片需求的雙重提振,其在 2026 至 2027 財年的增長勢頭積極。

DRAM 週期強勁,EUV 光刻機需求獲支撐

大摩強調,DRAM(動態隨機存取存儲器)市場的火熱需求是顯而易見的。而 “阿斯麥在 DRAM 技術轉型中持續擁有穩固的需求”,尤其是在從 1a 和 1b 節點向 1γ/1c 節點的轉變過程中。

DRAM 技術的迭代對光刻強度的提升至關重要。報告分析,每一次技術節點的演進都將 “導致 EUV 光刻層數的增加。” 例如,“在 1c 節點上,總共需要 5-6 個光刻層”。這凸顯了 DRAM 市場對 EUV(極紫外光)光刻機系統持續的需求勢頭。

具體到客户,報告認為三星和海力士在 2026 財年的需求 “是明確的”。此外,報告補充道,商品 DRAM 的需求和 “市場見證的強勁價格上漲” 也對訂單增長有所助益。

3nm 或提前落地,AI 巨頭需求成關鍵催化劑

在晶圓代工領域,積極信號同樣在顯現。報告的一個關鍵發現是,“台積電正在測試 3nm 的原始圖形性能,其亞利桑那州工廠的採用時間可能比最初計劃的 2028 年更早。”

阿斯麥受益於台積電的 3nm 製程技術,因為台積電 3nm 的先進工藝依賴於阿斯麥的 EUV 光刻機,這使得台積電能夠生產出性能更強、功耗更低、芯片尺寸更小的芯片。

與此同時,AI 的蓬勃發展正間接為 ASML 創造需求。報告援引了英偉達創紀錄的季度營收,其首席執行官黃仁勳在電話會議上形容市場對 Blackwell 系列 GPU 的興趣 “爆表(off the chart)”。

大摩認為,這將 “為 ASML 在 2026/27 財年的晶圓代工設備供應提供了支持”,因為英偉達的強勁需求預計將推動台積電擴建 3nm 產能,從而需要訂購更多的 EUV 光刻機。

走出 14 個月漫長下行,估值重估週期開啓

報告寫道,ASML 正在走出一個漫長的下行週期。以往的週期通常會導致 ASML 的兩年遠期市盈率在 8-10 個月內從 30-35 倍壓縮至 18-22 倍。然而,受關税、貿易緊張局勢和出口限制等地緣政治不確定性影響,本輪下行週期持續了超過 14 個月(2024 年 7 月至 2025 年 9 月)。

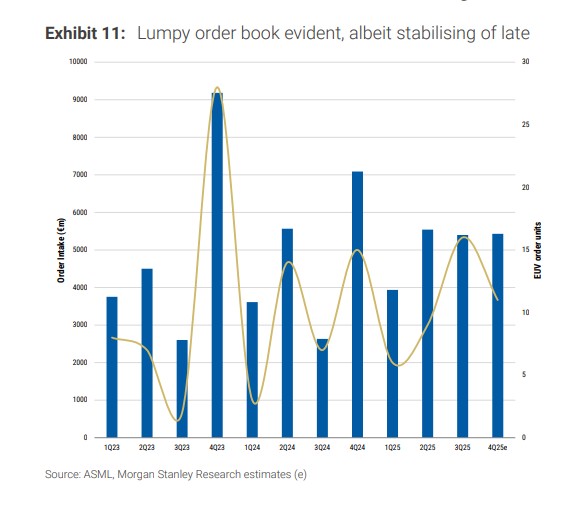

大摩指出,去年的下行主要歸因於除台積電以外(如英特爾和三星)的晶圓代工支出疲軟,以及訂單動能不足。此外,投資者對亞洲市場的擔憂,以及對光刻強度下降的恐懼也加劇了這一趨勢。但目前,關於光刻強度和定價壓力的擔憂已基本消除,大摩甚至預計 EUV 的平均售價(ASP)還將因台積電採用計算光刻技術而迎來上漲。

自夏季以來,市場情緒已發生轉變。隨着商品 DRAM 價格上漲以及三星 HBM3e/HBM4 的進展,“內存超級週期” 的證據日益增多。大摩認為,台積電穩健的業績和英偉達 Rubin 架構轉向 A16 芯片,確認了 ASML 的盈利重估週期已經正式開啓。

利潤率具韌性,但部分業務面臨放緩

儘管前景樂觀,但阿斯麥並非沒有挑戰。報告預計,DUV(深紫外光刻)業務的銷售額將同比下降,主要原因是對亞洲一個關鍵市場的需求預期減弱。大摩在模型中維持了對該市場銷售額 “約 15% 的同比下降預期”,比 ASML 管理層給出的 15-20% 的指引範圍略顯樂觀。

然而,報告強調阿斯麥的利潤率仍具韌性。分析師在與管理層討論後指出,兩大因素將支撐利潤率:其一,是 2026 財年 “更高的 EUV 銷售額”(模型預測為 48 台,而今年為 41 台);其二,是 “裝機基礎管理(IBM)” 業務的利潤貢獻。

報告認為,隨着 EUV 裝機量的增長,服務業務的利潤率將得到改善。

綜合以上因素,摩根士丹利對 ASML 的 2026 財年毛利率預測為 52.3%,僅比 2025 財年預計的 52.7% 微降 40 個基點。報告稱,“我們認為這證明了在困難的 DUV 年度裏公司對利潤率的控制能力。”

基於這些積極展望,摩根士丹利最終決定,“我們將目標價從 975 歐元上調至 1000 歐元,並維持增持評級。鑑於近期的股價下跌,認為這是一個 “有吸引力的股票切入點”,並將 ASML 提升為我們在歐洲半導體領域的首選股(Top Pick)。”

~~~~~~~~~~~~~~~~~~~~~~~~

以上精彩內容來自追風交易台。

更詳細的解讀,包括實時解讀、一線研究等內容,請加入【追風交易台▪年度會員】