The Reserve Bank of India cut interest rates by 25 basis points for the first time in six months and announced a trillion rupee bond purchase plan

印度央行將在本月購買價值 1 萬億盧比(110 億美元)的債券,並進行 50 億美元的外匯掉期操作。央行行長表示,此舉旨在應對美國高關税威脅,並支撐盧比——今年亞洲表現最差的貨幣。消息公佈後,盧比兑美元一度上漲,但隨後回落轉跌。印度 10 年期基準國債收益率下行 6 個基點至 6.45%,創 8 月 28 日以來最大降幅。

印度儲備銀行(RBI)週五降息 25 個基點並宣佈萬億盧比債券購買計劃,在通脹跌至歷史低點之際為經濟注入流動性。央行行長 Sanjay Malhotra 表示,此舉旨在應對美國高關税威脅,並支撐盧比——今年亞洲表現最差的貨幣。

本次利率決議中,印度央行貨幣政策委員會一致決定將回購利率從 5.50% 下調至 5.25%,這是六個月來首次降息。同時,央行將在本月購買價值 1 萬億盧比(110 億美元)的債券,並進行 50 億美元的外匯掉期操作。

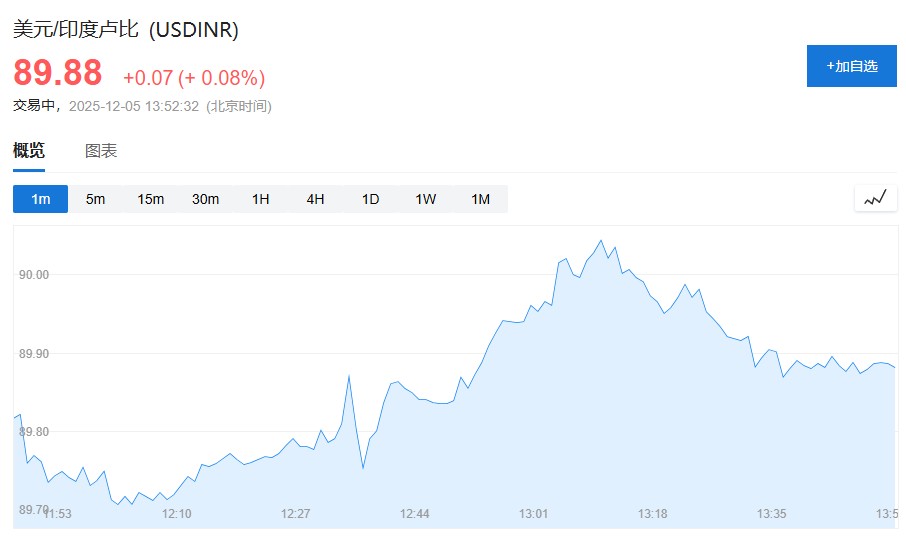

消息公佈後,盧比兑美元一度上漲,但隨後回落,從 89.78 跌至 89.92 盧比兑 1 美元,延續了今年下跌 5% 的疲弱走勢。貿易和資本流動疲軟加上美國嚴厲貿易關税,令盧比本週一度跌破 90 關口。印度 10 年期基準國債收益率下行 6 個基點至 6.45%,創 8 月 28 日以來最大降幅。

通脹跌至歷史低位為政策調整創造空間

Malhotra 表示,低通脹和強勁經濟增長意味着印度正處於"罕見的黃金期"。

央行將本財年通脹預期從 2.6% 下調至 2%,同時將增長預期從 6.8% 上調至 7.3%。10 月份通脹率跌至 0.25%,遠低於央行 4% 的目標,主要受食品價格下跌推動。

彭博調查的 44 位經濟學家中大多數預期此次降息,但部分分析師在盧比跌至歷史低點後預期央行將維持利率不變。經濟在上一季度增長超過 8%,但在特朗普對印度商品徵收 50% 關税後,出口大幅下滑。

澳新銀行經濟學家 Dhiraj Nim 表示,由於美聯儲預計將在 12 月放鬆政策,此次降息不應過度削弱盧比,因為這將保持兩個市場間的利率差。他認為這可能是最後一次降息,央行今後將主要通過流動性支持經濟。

債券購買計劃旨在對沖美元干預影響

央行的債券購買預計將抵消其在外匯市場拋售美元支撐盧比所造成的資金流失。

Karur Vysya 銀行資金主管 VRC. Reddy 表示,這一政策有利於政策傳導,將供應流動性並壓低債券收益率。他預計 10 年期收益率將在 12 月底前進一步下降至 6.40%。週五,一年期在岸遠期溢價在二級市場下跌 16 個基點至 2.37%。

央行還將進行 50 億美元的外匯掉期操作,即購入美元並在三年後賣回。

Malhotra 強調,公開市場債券購買的主要目的是注入基礎流動性,而非影響債券收益率。儘管面臨不利的外部環境挑戰,印度經濟表現出顯著韌性,通脹前景提供的空間使央行得以保持對增長的支持。