AI 進入 “液冷時代”,市場低估了 “轉變力度”,國產供應鏈正加速入局

機構觀點指出,AI 催生 2200 億元液冷超級週期,市場普遍低估了這一轉變的速度與規模。技術上,冷板與微通道蓋板(MCL)將分治市場;格局上,英偉達供應鏈策略的 “放權”,正為國產廠商打開進入全球核心供應鏈的歷史窗口。據測算,2026 年僅英偉達平台液冷系統需求將達 697 億元,ASIC 需求達 353 億元,國產供應鏈正加速搶食這一千億級蛋糕。

隨着 AI 芯片功耗邁入 “千瓦時代”,一場圍繞散熱的革命正悄然加速,液冷正從一個 “可選項” 迅速變為數據中心的 “必選項”。

綜合瑞銀與東吳證券近期發佈的深度報告,市場似乎仍未完全消化這場變革的顛覆性。報告明確指出,市場普遍低估了向液冷過渡的速度和規模,這並非一次普通的硬件升級,而是由 AI 芯片激烈競爭驅動的 “即時、戰略性必要之舉”。

這一結構性轉變不僅將催生一個高達 311.91 億美元(約合人民幣 2205.23 億元)的超級週期,更在重塑全球供應鏈格局,特別是為國產廠商打開了進入核心體系的大門。

“熱牆” 來襲:當風冷走到盡頭,液冷即將迎來爆發

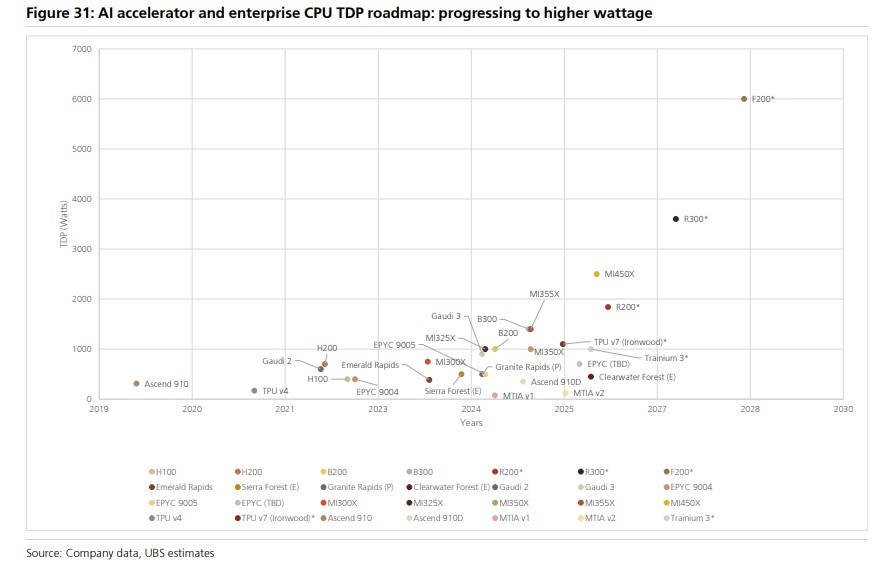

AI 算力的爆炸式增長,正將芯片推向一道 “熱牆”。據瑞銀及東吳證券報告梳理,AI 加速器的熱設計功耗(TDP)正以驚人的速度攀升。

英偉達的 GPU 產品路線圖清晰地展示了這一趨勢:從 H100 的 700W,到 Blackwell B200 的 1200W,再到預計明年推出的 VR200 的 1800W-2300W,以及 2027 年可能超過 3600W 的 VR300,直至未來 Feynman 平台可能高達 5000W-7000W 的功耗。

芯片功耗的飆升直接導致機櫃功率密度急劇攀升。一個 GB200 NVL72 機櫃的功率已達 120-140kW,而未來的 VR300 NVL576 機櫃功耗可能超過 600kW,甚至衝擊 1MW。

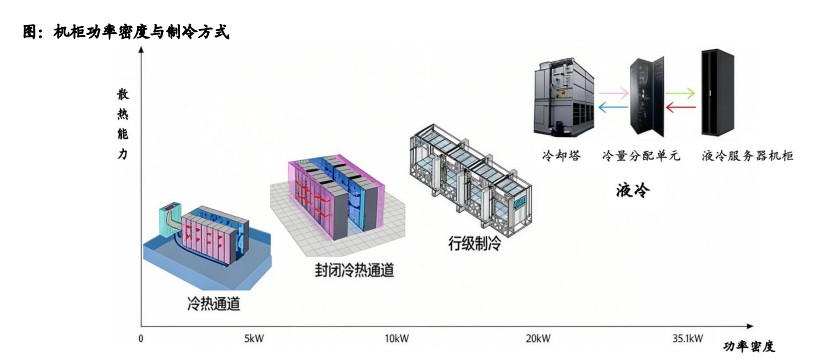

傳統風冷技術,即通過風扇、散熱片等組成的計算機房空調(CRACs/CRAHs)系統,幾十年來一直是數據中心的標準配置。然而,當機櫃功率密度超過 30-40kW 時,風冷因空氣導熱效率低下的物理特性而達到極限。

瑞銀報告也指出,傳統風冷在機櫃功率密度超過 30-40kW 時,其效率和經濟性便難以為繼。

與此同時,政策也在 “推波助瀾”。東吳證券報告提到,中國等國家對數據中心的 PUE(電能利用效率)要求日益嚴苛,目標在 2025 年將 PUE 降至 1.3 以下。液冷技術憑藉其卓越的節能效果(可將 PUE 降至 1.2 以下)和更低的全生命週期成本(TCO),已成為滿足政策要求和實現經濟效益的必然選擇。

液冷技術是指利用液體遠高於空氣的比熱容和導熱性來轉移熱量。東吳證券報告顯示,在同等單位下,液冷散熱能力是風冷的 4-9 倍。

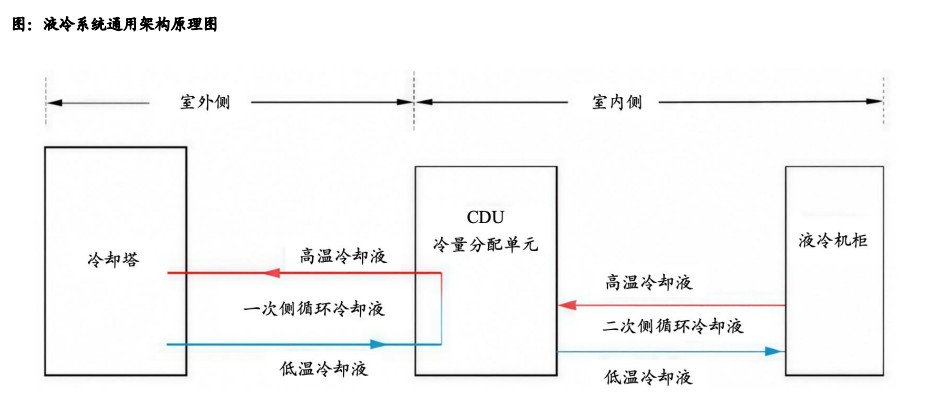

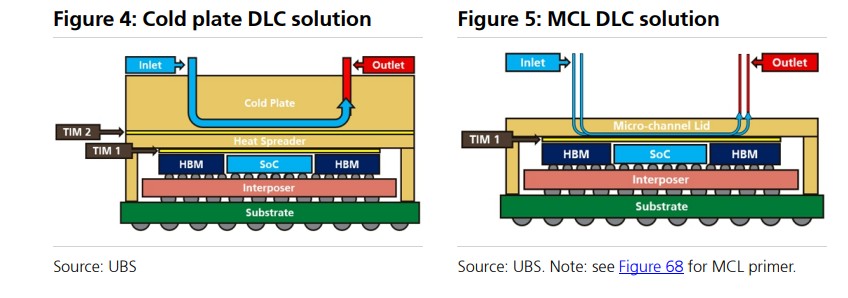

冷板式液冷(DLC)是當前技術最成熟、應用最廣的方案。冷卻液在密封的冷板(一種內部有微通道的金屬板)內流動,冷板緊貼 CPU、GPU 等發熱芯片,通過間接接觸帶走熱量。其優勢在於對現有數據中心架構兼容性強,改造成本相對較低。

技術路線分化:冷板守住主流,MCL 劍指未來

面對不同功耗的散熱需求,液冷市場正清晰地分化為兩大技術陣營。瑞銀報告指出,未來的液冷市場將出現明顯的 “分化(bifurcating)” 格局,以 3500W 的 TDP 為分界線。

對於功耗低於 3500W 的應用,冷板(Cold Plate)技術仍將是中流砥柱。

瑞銀報告認為,市場對冷板 “商品化” 和價格戰的擔憂過度了。儘管英偉達的標準化舉措可能導致 GPU/CPU 冷板價格下降約 50%,但這一下滑將被機櫃內其他部件(如 NICs、DPUs)新增的液冷需求所抵消。瑞銀分析稱,一個完全液冷的 VR200 機櫃,其整體冷板價值量相比 GB300 僅下降 1%。報告預測,到 2030 年,冷板市場規模(不含 MCL)將達到 89 億美元。

而對於功耗超過 3500W 的未來高性能芯片,微通道蓋板(Micro-Channel Lid, MCL)將成為新的標準。

這種技術將冷卻液通道直接集成到芯片的保護蓋中,消除了傳統方案中的關鍵熱阻層(TIM2),實現了 “封裝內冷卻”。瑞銀大膽預測,MCL 技術最早可能在 2026 年第四季度隨超頻版的 VR200(2300W)少量採用,並將在功耗達 3600W 的 VR300 上成為主流。東吳證券的報告也認為,對於 Rubin 架構,MCL 方案比相變冷板更具前瞻性,更能適應未來 Rubin Ultra(4000W+)的更高功耗。瑞銀預計,MCL 市場規模將在 2027 年達到 12.5 億美元,2030 年增長至 27 億美元。

2200 億元的超級週期:市場規模與價值量齊升

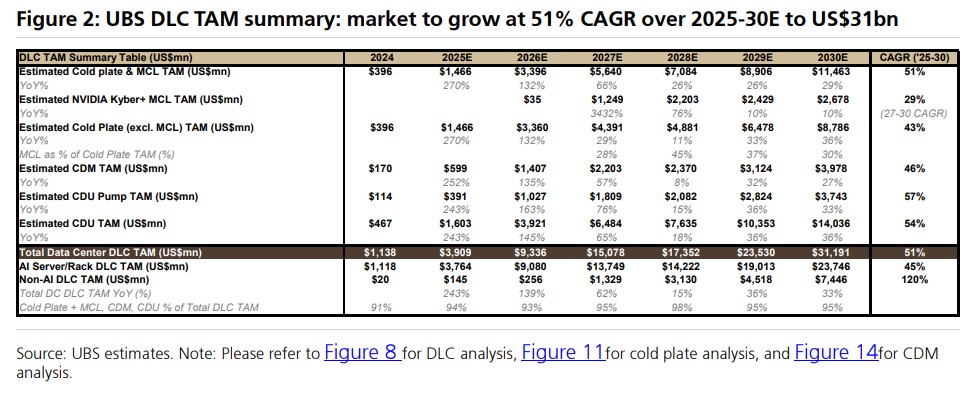

瑞銀在其報告中給出了一個驚人的預測:全球數據中心直接液體冷卻(DLC)市場規模將從 2024 年的 11.38 億美元,以 51% 的複合年增長率(CAGR)飆升至 2030 年的 311.91 億美元(約合人民幣 2205.23 億元)。

這一增長的核心驅動力在於,單個機櫃的液冷價值量(DLC content per rack)正在翻倍增長。瑞銀的測算顯示,一個英偉達 GB200 NVL72 機櫃的液冷價值約為 7.4 萬美元,而到 2030 年,這一數字預計將翻兩番,達到近 40 萬美元。

東吳證券的測算也印證了價值量提升的趨勢,指出從 GB200 升級到 GB300,機架液冷模塊的價值量增幅就超過 20%。

瑞銀進一步拆分了市場構成,預計到 2030 年,AI 服務器液冷市場將達到 237 億美元,而非 AI 服務器的液冷市場也將增長至 74 億美元。這表明,液冷革命正從 AI 領域向整個數據中心行業擴散。

英偉達 “放權”:國產供應鏈迎歷史性機遇

除了技術和市場的演變,更令投資者關注的是供應鏈格局的重塑。東吳證券的報告敏鋭地捕捉到了一個關鍵變化:英偉達的供應鏈策略正在從 “精裝交付” 轉向 “開放生態”。

報告分析指出,在 A50/H100 時代,英偉達為確保快速交付,對 CDU(冷卻液分配單元)等關鍵部件採取 “指定獨供” 模式,例如維諦(Vertiv)是 GB200 的唯一認證 CDU 供應商。但進入 GB300 及未來的 Rubin 時代,英偉達開始 “放權”,僅提供參考設計和接口規範,允許廣達、富士康等 ODM(原始設計製造商)在櫃外環節自主選擇供應商。

這一轉變意義重大。它打破了原有封閉的供應體系,為更多具備技術和成本優勢的廠商打開了進入英偉達生態的大門。東吳證券指出,國產供應鏈廠商有望藉此機會,通過作為二級供應商間接進入,或憑藉逐步成熟的產品和性價比優勢,直接成為英偉達體系內的一級供應商。

具體來説,這一 “放權” 行為,打破了原有單一供應商的壟斷格局。東吳證券分析認為,這為國產供應鏈提供了兩條關鍵的切入路徑:

- 二次供應間接進入:國產廠商可以通過為廣達、富士康等 ODM 廠商供貨,間接進入英偉達的供應鏈體系。

- 一供直接進入:隨着國產液冷系統技術成熟度和性價比優勢的提升,未來有望作為一級供應商直接進入英偉達的供應商名錄。

根據東吳證券的測算,僅 2026 年,ASIC 芯片所需的液冷系統規模就將達到 353 億元人民幣,而英偉達平台所需的液冷系統規模更是高達 697 億元人民幣。這個巨大的市場蛋糕,正因供應鏈的開放而變得觸手可及。

目前,台系 ODM 廠商在 AI 服務器組裝中佔據主導地位(據摩根士丹利數據,富士康在 GB200 出貨中佔比約 60%),其在供應鏈選擇上的話語權隨之提升。

而國產液冷相關企業,如在管路、精密結構件、温控模塊等領域已有佈局的廠商,正迎來前所未有的歷史性機遇,有望在這場千億級的液冷浪潮中分得一杯羹。