UBS predicts: Micron's traditional memory DDR gross margin will exceed HBM for the first time

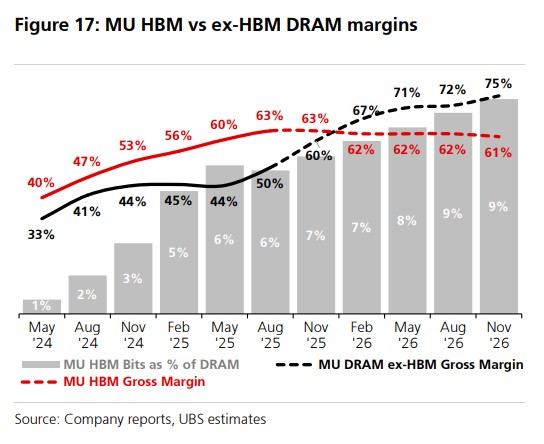

UBS believes that as the industry's production capacity shifts significantly towards HBM, the supply of the traditional DRAM market continues to tighten, while demand remains robust, leading to a significant enhancement in pricing power due to supply-demand mismatch. Micron's traditional DRAM gross margin is expected to reach 67% in the second quarter of 2026, surpassing HBM's 62% for the first time. This advantage will continue to expand, with the traditional DRAM gross margin reaching 71% in the third quarter and as high as 75% in the fourth quarter

UBS stated that despite the high market attention on Micron's HBM business, traditional DDR memory is experiencing an unprecedented profit margin explosion due to capacity constraints.

According to the Wind Trading Desk, UBS mentioned in its latest report that the memory industry is undergoing a structural transformation. Amid the global AI boom, due to capacity constraints, Micron's "old era" DDR memory business is about to surpass the profitability of its star product HBM (High Bandwidth Memory).

Specifically, UBS indicated that the latest statements from management show that the supply tightness has intensified and prolonged compared to three months ago, which will continue to support pricing power, with traditional DRAM gross margins expected to reach a historical high of 67%.

UBS expects the gross margin for the second quarter of fiscal year 2026 to reach 60.8%, 260 basis points higher than the company's guidance. Additionally, UBS reiterated its "Buy" rating on Micron and maintained the target price at $275.

Traditional DDR Gross Margin Expected to Surpass HBM in Q2 2026

The market generally views HBM as the profit engine for memory chip manufacturers, but UBS has identified a new trend through supply chain surveys. As the entire industry allocates most of the new capacity to HBM, traditional DRAM supply has become extremely tight, thereby increasing its pricing power. UBS boldly predicts that this supply-demand mismatch will trigger an inversion of profit structures in early 2026.

UBS stated:

Data shows that in the first quarter of fiscal year 2026, traditional DRAM revenue is expected to reach $8.22 billion, with a quarter-on-quarter shipment growth of only 1%, but the average selling price is expected to surge by 16% quarter-on-quarter. More critically, traditional DRAM gross margin is expected to reach 60%, while HBM gross margin is at 63%, with the gap between the two narrowing sharply.

By the second quarter of 2026, this historic reversal will occur, with traditional DRAM gross margin expected to reach 67%, surpassing HBM's 62% for the first time. This advantage will continue to expand, with traditional DRAM gross margin reaching 71% in the third quarter and as high as 75% in the fourth quarter.

The fundamental reason for this reversal lies in the fact that as industry capacity shifts significantly towards HBM, the supply of traditional DRAM continues to tighten while demand remains robust, leading to a significant enhancement in pricing power due to the supply-demand mismatch. Meanwhile, HBM faces challenges in cost reduction due to technological complexity and yield issues.

HBM Business: Slowing Growth but Strong Valuation Support Remains

Although HBM remains the core of Micron's growth story, UBS expects the revenue growth rate of HBM to slow slightly due to capacity constraints. In the first quarter of fiscal year 2026, HBM revenue is expected to grow approximately 35% quarter-on-quarter, lower than the growth rates of previous quarters.

For the full year, UBS expects Micron's HBM revenue to reach $13.05 billion in fiscal year 2026, further increasing to $21.24 billion in 2027. The proportion of HBM business in total revenue is expected to rise from 17% in fiscal year 2025 to 26% in 2027 UBS report further emphasizes that the persistence of this semiconductor cycle may far exceed market expectations. The core logic lies in the enormous consumption of wafer capacity by HBM, which essentially creates an "exclusion effect" on the traditional storage market. This structural supply shortage provides giants like Micron with a more enduring moat.

UBS analysts point out: "We reiterate our long-term hold view that this cycle will be structurally more durable, as HBM is crowding out the traditional storage market, with most of the industry's capacity increment through 2027 (if not all) flowing into HBM."

Earnings guidance significantly ahead of Wall Street expectations

Based on this improvement in pricing power, UBS's short-term performance forecast for Micron is far more optimistic than the management's guidance and market consensus. UBS's model shows that Micron's revenue for the first quarter of fiscal year 2026 (ending in November) will reach $13.2 billion, with an EPS of $4.27, and this growth is almost entirely driven by price increases.

UBS report concludes: "Our revenue/EPS model forecast for the first quarter of fiscal year 2026... is far above Micron's guidance, and is indeed driven entirely by better pricing—this has been confirmed through our industry checks and conversations with management throughout the quarter."

UBS maintains its forecasts for Micron's capital expenditures in 2026 and 2027, believing that as profit margins rise, the company's fundamentals remain robust. Based on the sum-of-the-parts (SOTP) valuation method, UBS continues to maintain a target price of $275, believing that the current supply-demand dynamics provide Micron with an extremely favorable risk-reward ratio