End-of-2025 sprint! Hedge fund net leverage soars to a high of 99%, aggressively increasing positions in global stock markets for 7 consecutive weeks, with U.S. stocks taking the majority

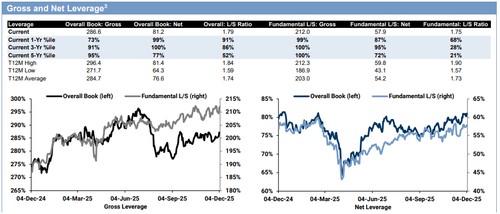

With only 16 trading days left until the end of 2025, hedge funds have net bought global stocks for the seventh consecutive week, and CTA strategy funds have shifted from net sellers to buyers. Goldman Sachs' model shows that this week, $9 billion was invested in global stocks, raising the overall exposure to $110 billion. According to Goldman Sachs Prime Brokerage data, the total gross leverage ratio of hedge funds increased by 1.5% to 286.6%; the net leverage ratio rose by 0.4 percentage points to 81.2%, reaching the 99th percentile level for the past year. All major regions, except for emerging markets in Asia, saw net buying, with North America leading the way

With only 16 trading days left until the end of 2025, the S&P 500 index is just 30 basis points away from its historical closing record, with multiple market forces reshaping the investment landscape. This Wednesday's Federal Reserve meeting has become the focus, with market consensus shifting from "unlikely to cut rates" to "100% probability of a rate cut," and now to expectations of a "hawkish rate cut."

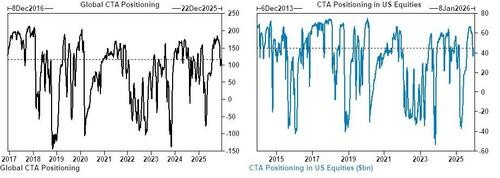

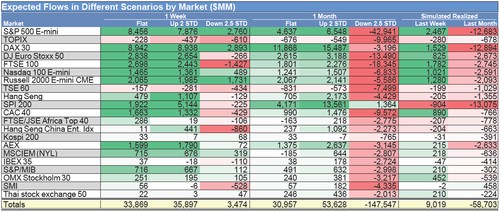

According to Goldman Sachs Prime Brokerage data, hedge funds have net bought global stocks for the seventh consecutive week, with the ratio of long buying to short selling exceeding 1.3 to 1. CTA strategy funds have shifted from net sellers to buyers, with Goldman Sachs models indicating a purchase of $9 billion in global stocks this week, raising overall exposure to $110 billion. Corporate buyback activity is exceptionally active, with trading volume 80% higher than the daily average level in the same period of 2024.

Sector rotation is significant, with funds flowing out of defensive sectors into cyclical stocks. Utilities fell by 4.83%, Real Estate Investment Trusts (REITs) dropped by 2.58%, while cyclical stocks rose by 5.01% relative to defensive stocks. Quantum computing concept stocks saw a five-day increase of 14.61%, and non-profitable tech stocks rose by 9.61%.

Hedge Funds Continue to Increase Holdings in Global Stocks

According to Goldman Sachs Prime Brokerage data, the total leverage ratio of hedge funds rose by 1.5% to 286.6%; the net leverage ratio increased by 0.4 percentage points to 81.2%, reaching the 99th percentile level for the past year. The net leverage ratio for fundamental long-short strategies is at 57.9%, in the 87th percentile for the past year.

All major regions, except for emerging markets in Asia, saw net buying, with North America leading the way. Individual stocks have been net bought for the seventh week in a row, with net inflows recorded in 12 of the past 13 weeks. Financials, healthcare, and communication services have seen the most net buying globally, while consumer discretionary, consumer staples, and utilities faced net selling.

The European market shows signs of a rebound in risk appetite, with new long positions exceeding new short positions. Goldman Sachs reports that Europe is overweight in the MSCI Global Index by 1.44%, down 0.35 percentage points from the previous week, while North America maintains a low allocation of 9.42%.

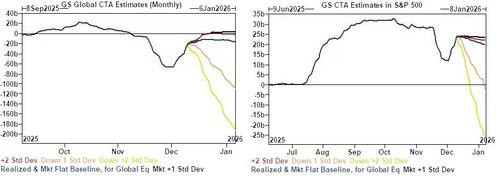

CTA Strategies Shift to Full Buying

Goldman Sachs models indicate that CTA strategy funds will become buyers under various market scenarios. In the coming week, it is expected to buy $29.8 billion under flat conditions, $31.2 billion under rising conditions, and only sell $2.9 billion under falling conditions.

In terms of key technical levels, the short-term trigger level for the S&P 500 is at 6754 points, the medium-term important trigger level is at 6512 points, and the long-term support level is at 6070 points. The model predicts that these strategies will reach their target exposure levels in the coming days.

In terms of key technical levels, the short-term trigger level for the S&P 500 is at 6754 points, the medium-term important trigger level is at 6512 points, and the long-term support level is at 6070 points. The model predicts that these strategies will reach their target exposure levels in the coming days.

It is noteworthy that the expected deployment of funds for one week and one month under a flat market scenario is basically the same, indicating that CTA strategies may soon reach a balanced state.

Corporate Buybacks and IPO Supply-Demand Dynamics

Corporate buyback activities have entered a peak period. Goldman Sachs' buyback trading desk data shows that as of the week ending November 21, trading volume was 80% higher than the average daily level in 2024 and 100% higher than the same period in 2023, mainly concentrated in the financial, consumer discretionary, and technology sectors.

Currently, we are in the peak period of corporate open windows, with companies actively responding to market weakness through buybacks. This open window is expected to last until December 19. Typically, buyback activities in the fourth quarter increase significantly as companies seek to meet their annual buyback targets.

In terms of IPOs, this week, the new issuance and additional issuance scale in North America reached $9.95 billion, with a cumulative total of $390.2 billion year-to-date. The supply-demand dynamics continue to favor stock price support.

Investor Sentiment Indicators Warm Up

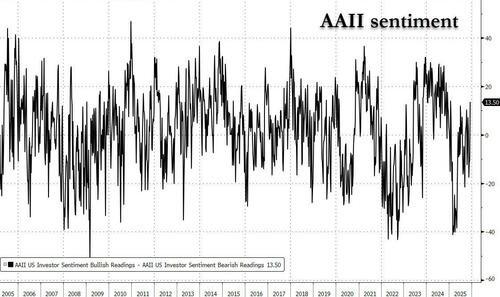

Retail investor sentiment has significantly improved. The AAII sentiment survey shows that as of the week ending December 3, the bull-bear difference rebounded to the second-highest level of the year. The bullish percentage rose by 12.3 percentage points to 44.3%, while the bearish percentage fell by 11.9 percentage points to 30.8%.

The CNN Fear and Greed Index rose from 18 a week ago to 40, the highest level since the end of October. Goldman Sachs' sentiment indicator has rebounded from negative territory in previous months to neutral territory, with the latest reading at +0.1.

Net inflows into mutual funds have slowed but remain positive, with global equity funds seeing a net inflow of $8 billion, down from $18 billion the previous week. Inflows into technology sector funds turned negative, while UK equity funds saw a net inflow following the budget announcement