Memory shortage tide, photonics accelerating penetration, edge AI returning... Deutsche Bank summarizes six major technology hardware trading themes for 2026

Deutsche Bank's latest research report points out that memory shortages, AI squeezing mainstream components, accelerated penetration of optoelectronics, upgrades in advanced packaging and testing, reforms in 800V power architecture, and the return of edge AI growth will become the six core themes of the European technology hardware industry in 2026. The prices of DRAM and NAND have skyrocketed and will continue to rise until 2027, with AI demand driving up investments in testing and packaging, the accelerated popularization of photonic technology in data centers, the reshaping of power device patterns by 800V architecture, and lightweight applications of edge AI initiating a new growth cycle

Deutsche Bank's report on the European technology hardware industry released on December 10, 2026, believes that the technology hardware sector will be dominated by six major themes: memory shortages, AI squeezing mainstream components, accelerated penetration of optoelectronics, upgrades in advanced packaging and testing, reforms in 800V power architecture, and the resurgence of edge AI growth.

The market is experiencing severe price fluctuations, and the memory shortage has escalated from a mere component risk to a macro-level concern. According to news from the Chasing Wind trading desk, Deutsche Bank analyst Robert Sanders' team stated in their research report that over the past three months, DRAM spot prices have skyrocketed by 300-400%, while NAND flash prices have surged by 200%, and this upward trend is rapidly transmitting to contract prices.

At the same time, AI spending continues to squeeze the supply of mainstream electronic components, with technologies such as optoelectronics, advanced packaging and testing, and 800V power architecture accelerating their emergence, while edge AI has begun to take root in multiple fields. Multiple variables are reshaping the competitive landscape of the industry.

These trends will directly impact key end markets such as consumer electronics, smartphones, and data centers, leading to delays in product iterations, adjustments in configurations, and price fluctuations, while also bringing structural investment opportunities to sub-sectors such as semiconductor equipment, power devices, and optical modules, with some leading companies' valuations expected to break through historical ranges.

Memory Shortage Continues to Ferment, WFE Spending Becomes Core Driver

Data shows that DRAM spot prices have soared by 300-400% over the past three months, with DDR4 spot prices reaching $17 per GB and DDR5 at $13-14; the spot price of the key benchmark product TLC512Gb NAND flash has also increased by 200%, significantly enhancing suppliers' bargaining power.

Contract prices are also showing a rapid upward trend. Trendforce data indicates that in the fourth quarter of 2025, PC DRAM contract prices increased by 25-30% quarter-on-quarter, while server DRAM saw a quarter-on-quarter increase of 43-48%. The contract price of wafer-level NAND in November rose between 20-60% quarter-on-quarter. The market generally expects that as channel inventories are depleted, DRAM and NAND contract prices will rise another 30-50% in the first half of 2026.

This shortage situation is expected to continue until 2027, driving wafer fabrication equipment (WFE) spending to exceed expectations, particularly benefiting DRAM-related equipment companies. Deutsche Bank predicts that the valuations of leading semiconductor equipment companies like ASML may break through the conventional 25-30 times expected price-to-earnings ratio for 2027, with ASML's target price raised by 15% to €1,150, corresponding to a 35 times expected price-to-earnings ratio for 2027.

AI Spending Triggers Component Squeeze, Mainstream Electronics Under Pressure

The explosive growth of AI spending has intensified the supply tightness of key components, posing ongoing resistance to mainstream electronic sectors such as low to mid-range smartphones and PCs. The supply of memory, passive components, optical components, and hard disk drives (HDD) is constrained, leaving OEM manufacturers with weaker bargaining power in a passive position.

The research report cites a Reuters report, stating that a relevant person from Realme indicated that the steep rise in memory costs may force the company to increase smartphone prices by 20-30% before June 2026. Dell's Chief Operating Officer Jeff Clarke also mentioned in a conference call regarding financial results that the current rate of cost increases is unprecedented Relatively speaking, the automotive industry is less impacted due to having independent production lines, but network equipment manufacturers such as Nokia and Ericsson may face supply pressures for components like passive devices. Companies like Raspberry Pi and Soitec, which are highly exposed to the smartphone industry, will face operational pressures directly.

Optoelectronics/Photonics Accelerate Penetration, Data Centers Become Core Scenarios

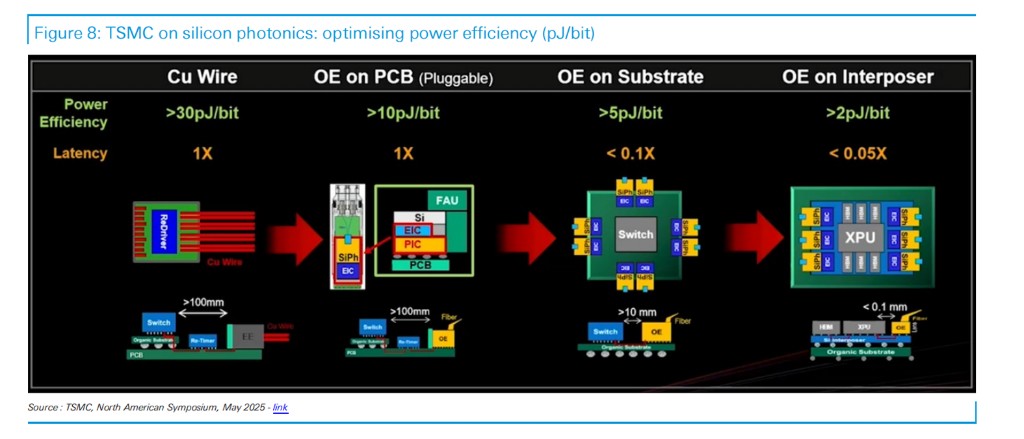

Deutsche Bank stated that the bandwidth demand for AI data centers is exploding, driving optoelectronics/photonics technology to become the core engine of industry growth. Currently, most AI data centers use Ethernet or InfiniBand paired with pluggable optical modules, and will gradually evolve towards high-speed pluggable optical modules, linear pluggable optics (LPO), and co-packaged optics (CPO) to achieve lower power consumption and latency.

LPO replaces the complete DSP with linear drivers, significantly reducing power consumption and latency; CPO deploys the optical engine close to the switch/xPU, greatly enhancing energy efficiency. Both technologies are rapidly increasing the penetration rate of silicon photonics (SiPho). Tower Semi plans to double its silicon photonics production capacity by the end of 2025 and triple it again by mid-2026, aiming for silicon photonics sales to reach $900 million in 2026, a leap from $105 million in 2024.

The research report suggests that related companies are actively positioning themselves to seize market share. Nokia has obtained its own SiPho platform through the Elenion transaction and is expanding its photonic chip factory in San Jose, with production capacity set to increase by 25 times. Its AI data center-related orders have grown threefold since the beginning of the year; Soitec's SOI wafers dominate the low insertion loss single-mode waveguide field and are the preferred solution for GFF otonix and TowerPH18 platforms.

Testing and Advanced Packaging Heat Up, Technological Upgrades Open Growth Space

Deutsche Bank stated that the increasing complexity of AI accelerators and the growth in product value are driving testing and advanced packaging to become key growth points in the semiconductor supply chain. As the number of chiplets integrated in AI accelerator packaging increases, the cost of product scrap rises exponentially, prompting companies to significantly increase testing budgets. Clients like NVIDIA are actively expanding testing coverage, promoting the adoption of high-cost testing solutions.

The research report believes that TSMC plans to expand its AI testing capacity at an 80% compound annual growth rate between 2022 and 2026, and OSATs are also actively expanding production in 2026 to alleviate capacity constraints. In the advanced packaging field, the capacity for 2.5D CoWoS remains tight, with TSMC and OSATs increasing their investments in this area, while the industry is actively migrating towards 3D packaging. Apple plans to adopt TSMC's 3D packaging solution SolC-mH for the first time in high-end laptops (M5Pro, M5Max) in 2026 The technological upgrade in the HBM field further opens up the testing and packaging market space. In 2026-2027, HBM4E and HBM5 are expected to shift from TCB processes to fluxless TCB or D2W hybrid bonding processes to support stacking of 16 layers and above. Intel's PowerVia backside power supply technology will accelerate the trend of W2W hybrid bonding. Technoprobe directly benefits from the growth in testing demand due to its advantages in the probe card field, while Besi is deeply collaborating with TSMC in the hybrid bonding field, expected to gain a larger market share in high-stacking HBM mass production.

Transformation of 800V Power Architecture, Opportunities and Risks of GaN

Deutsche Bank stated that NVIDIA is driving the transformation of AI data centers from 48V to 800V power architecture, becoming an important change in the power semiconductor field. Gallium Nitride (GaN) as a core device is ushering in development opportunities, but there are signs of excessive market optimism. Currently, the 48V architecture faces serious power loss and copper cable cost issues in high-power transmission. The 800V architecture can significantly improve efficiency and reduce copper cable usage through high-voltage low-current transmission, while simplifying the power supply chain by drawing on electric vehicle fast charging technology.

This transformation involves three key stages: grid interface, rack-level DC/DC conversion, and board-level power supply. The grid interface needs to be upgraded to a solid-state transformer (SST), using SiC switches and high-frequency magnetic components; rack-level conversion relies on high-voltage GaN, SiC, and other devices to achieve efficient step-down; board-level power supply faces competition between traditional horizontal VRM and vertical/shared packaging power supply technologies. Google has deployed vertical power supplies in TPU, reducing energy consumption by 60-65% compared to GPUs.

From a market perspective, the power consumption of AI processors is expected to grow from 7GW in 2023 to 70GW in 2030, creating a huge market space for GaN and SiC. Infineon expects its addressable market size for AI power to reach €8-12 billion by 2030.

However, Deutsche Bank warns that Aixtron's stock price has risen 28% since the Kerrisdale report was released on November 3, 2025, and is facing two broker upgrades. The current market's optimistic expectations for GaN may have been excessive, and if the deployment of the 800V architecture is delayed due to technical setbacks or other factors, related companies will face valuation adjustment risks. In contrast, Infineon, with its advantage of being the first to achieve 300mm GaN mass production, is expected to continue increasing its market share in the data center field.

Edge AI Breaks the Silence, Lightweight Deployment Opens a Trillion Market

After years of dormancy, edge AI is expected to see moderate growth in 2026, becoming a new growth point that cannot be ignored in the technology hardware industry. Edge AI refers to lightweight AI processing conducted on terminal devices or local edge nodes without relying on heavy cloud computing. Its core advantages lie in ensuring data privacy, reducing transmission latency, and significantly saving on data center construction and operational costs.

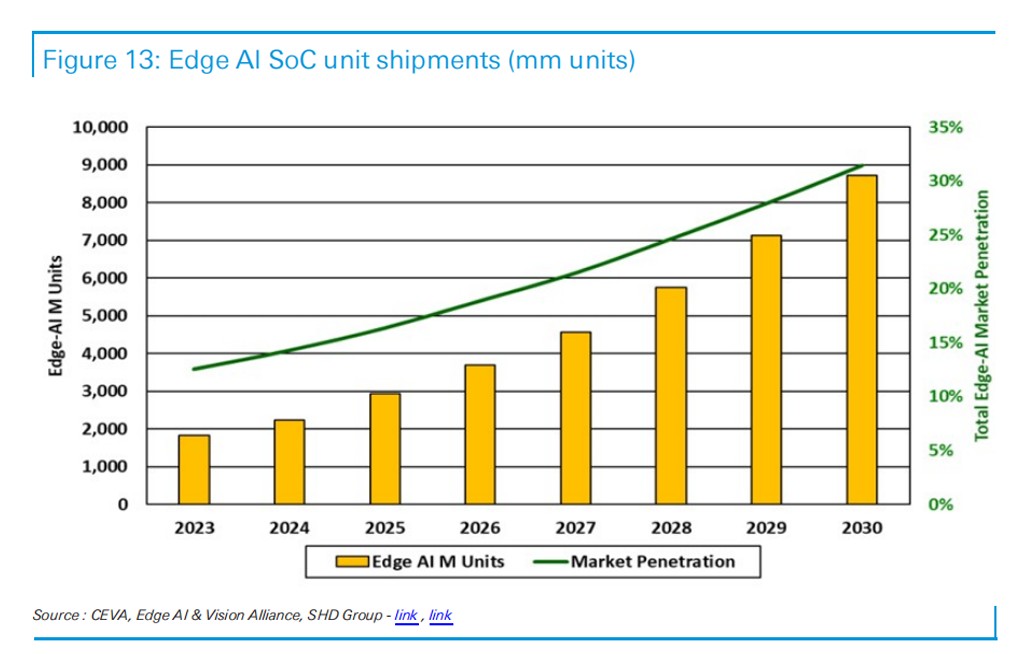

Deutsche Bank's research report indicates that, from the application scenario perspective, edge AI has formed a landing situation in multiple fields. Automotive ADAS systems, video security devices, and industrial control terminals have become core application scenarios. Rockwell recently launched a dedicated small language model (SLM) based on NVIDIA's NemotronNano, relying on open-source models and NVIDIA's Nemo technology Providing edge generative AI capabilities for industrial environments; Ambarella revealed that its edge AI business involving device-side AI processing will account for 80% of the company's revenue by 2025. Consumer electronics, wearable devices, smart home, and other fields have become potential growth poles, collectively occupying about 70% of the opportunity space in the edge AI device market.

The market size is expected to achieve rapid expansion, SHDGroup predicts that by 2030, revenue from edge AI devices will reach $103 billion, with a compound annual growth rate of up to 21% from 2025 to 2030; CEVA further estimates that the addressable market size for its physical AI and edge AI will exceed $170 billion by 2030. The iteration of lightweight distilled models provides key support for industry growth. The HuggingFace leaderboard shows that models with parameters less than 3 billion, such as MicrosoftPhi-3.5-mini-Instruct and DeepSeek-R1-Distil-Owen-1.5B, have strong practicality, promoting the popularity of edge AI on low-computing-power devices.