AI concerns outweigh interest rate cut benefits, U.S. stock futures collectively decline, gold and oil under pressure, copper retreats after challenging high levels

甲骨文不及預期的財報引發市場對 AI 泡沫的擔憂,打擊了美聯儲降息帶來的樂觀情緒,美股指期貨集體下挫,亞股回吐早盤漲幅,黃金原油下跌,銅價逼近高位後回落,白銀高位震盪,加密貨幣承壓,比特幣跌破 9 萬美元后小幅反彈。

受美聯儲降息提振的全球股市上漲勢頭消退,甲骨文不及預期的財報扭轉了市場情緒。市場擔憂 AI 基礎設施的商業變現週期可能長於預期,引發廣泛獲利了結,全球股市、加密貨幣及原油等風險資產全線回調。

12 月 11 日,美股指期貨集體下挫,歐股漲跌不一,亞股回吐早盤漲幅,多數市場走低。美債價格上漲,美元小幅反彈。商品走勢分化,白銀、銅上漲,黃金、原油下跌。加密貨幣承壓,比特幣一度跌破 9 萬美元。

Global X Management 的投資策略師 Billy Leung 表示:

“雖然市場關注的焦點大多集中在美聯儲公開市場委員會(FOMC)的會議上,但隔夜市場面臨的一個關鍵風險是甲骨文公司,鑑於甲骨文公司在超大規模數據中心支出方面扮演着風向標的角色,其會議結果對人工智能基礎設施交易而言是一次關鍵考驗,並加劇了更廣泛的科技行業壓力。”

核心市場走勢如下:

- 美股指期貨集體下挫,標普 500 期貨跌超 0.8%,納斯達克 100 期貨跌超 1.1%,道瓊斯期貨跌超 0.4%

- 德國 DAX30 指數開盤下跌 0.10%,英國富時 100 指數開盤下跌 0.10%,法國 CAC40 指數開盤上漲 0.21%,

歐洲斯托克 50 指數開盤下跌 0.03%。- 日經 225 指數收盤下跌 0.9%,報 50148.82 點,日本東證指數收盤下跌 0.9%,韓國首爾綜合指數收跌 0.66%,報 4107.77 點。

- 10 年期美國國債收益率下降 3 個基點至 4.12%

- 美元指數上漲 0.03% 至 98.67,英鎊下跌 0.2%,至 1.3362 美元

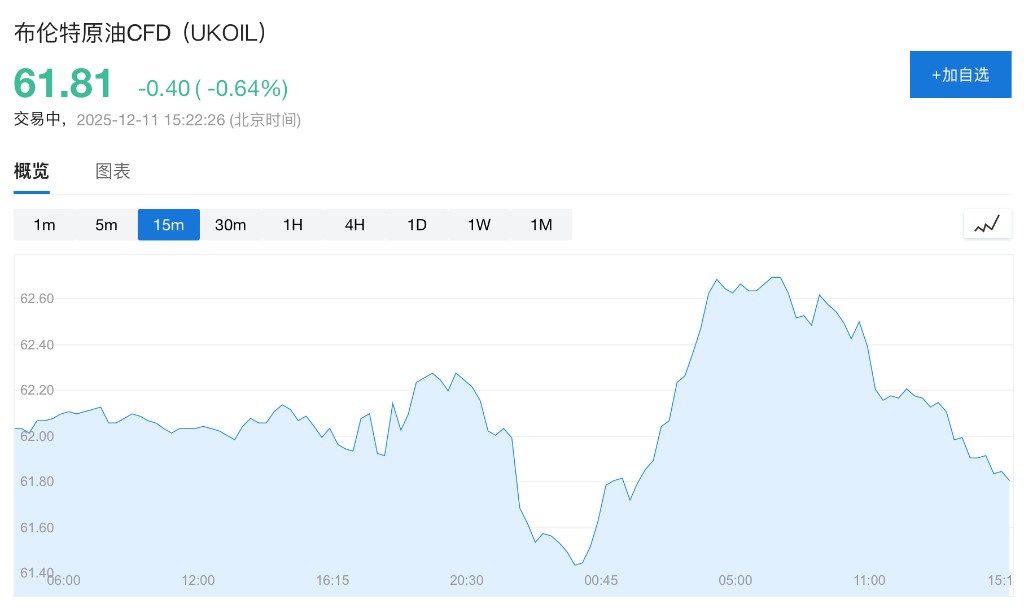

- 現貨黃金下跌 0.3%,至每盎司 4215.05 美元,現貨白銀漲超 0.3% 至 62 美元/盎司,倫敦期銅漲超 0.5% 至 11618 美元/噸,布倫特原油跌超 0.6% 至 61.84 美元/桶

- 比特幣下跌 2.3%,至 90224.89 美元,以太坊下跌 4.1%,至 3204.4 美元

美股指期貨下挫,市場情緒在隔夜大漲後迅速逆轉。一方面,美聯儲降息、啓動每月 400 億美元國債購買計劃(被市場視為 “隱性 QE”)及偏鴿派言論等利好已被充分消化;另一方面,盤後甲骨文因營收不及預期而重挫,其作為 AI 關鍵參與者所暴露的業績壓力,引發市場對 AI 領域投資回報的擔憂。

據華爾街見聞,市場原本預期美聯儲"鷹派降息",但實際結果顯示,沒有出現更多的異議者、也沒有更高的點陣圖,設想的鮑威爾強硬表態也未出現。華爾街分析師預計明年實際降息幅度可能超過點陣圖顯示的 25 個基點。新主席人事更迭和政策不確定性成為 2026 年市場波動的潛在驅動因素。

甲骨文盤後股價重挫 11%。據華爾街見聞,公司週三盤後公佈 2026 財年第二財季業績,營收與雲業務收入均低於分析師預期,季度自由現金流(FCF)為-100 億美元,預計年度資本開支將比原來預料的多出大約 150 億美元。

Emarketer 分析師 Jacob Bourne 表示,在 AI 支出前景仍存在不確定性的背景下,甲骨文因以債務驅動的數據中心擴張以及客户集中度風險,正面臨越來越多的審視。這次營收未達預期,可能會加劇原本就較為謹慎的投資者對其 OpenAI 合作以及激進 AI 支出策略的擔憂。

隨着全球股市等風險資產普遍下跌,宏觀避險情緒主導市場,油價回吐早盤漲幅。此前,受美國扣押委內瑞拉制裁油輪事件影響,市場對石油供應風險和地緣衝突升級產生擔憂,一度推高油價。

據華爾街見聞,原油供應空前過剩。但布倫特油價仍穩定在 61-66 美元,核心原因是市場難以判斷俄羅斯、伊朗等受制裁國家的原油(佔全球供應 15%)是否應計入有效供應。分析認為,制裁導致市場走向難測,一旦海上庫存轉入陸地,油價恐大幅下跌。

倫敦期銅回吐部分漲幅,現漲近 0.5% 至 11610.5 美元/噸。早盤,受美聯儲降息利好,倫敦期銅逼近歷史高位。今年以來,銅價已累計上漲超 30%,除流動性預期外,一系列礦山停產、海外供應短缺擔憂以及交易商趕在潛在關税生效前在美國市場搶購,均為銅價提供了上行動力。

甲骨文不及預期的財報帶來打擊市場情緒,比特幣大幅下跌,一度跌破 9 萬美元關口。IG 駐悉尼市場分析師 Tony Sycamore 表示:加密貨幣領域確實需要看到更有力的證據,證明 10 月 10 日那場拋售潮已經徹底結束,但目前看來,這樣的證據還並不存在。”

渣打銀行大幅下調了對比特幣到 2025 年底達到 20 萬美元的預期,將其預測值下調至 10 萬美元。渣打銀行全球數字資產研究主管 Geoff Kendrick 表示:“我們認為比特幣數字資產基金公司的購買活動可能已經結束。因此,我們現在認為,未來比特幣價格的上漲實際上將只由一個因素驅動——ETF 的購買。”