When the Federal Reserve "lowers interest rates alone," while other central banks even begin to raise rates, the depreciation of the US dollar will become the focus in 2026

美聯儲如期降息 25 個基點,市場普遍預期美聯儲明年仍維持寬鬆政策,與此同時,歐洲、加拿大、日本、澳洲、新西蘭等央行卻普遍維持緊縮傾向。高盛等分析認為,這一政策分化預計將在 2026 年前後通過匯率市場顯現關鍵影響,美元貶值壓力正成為市場焦點。美元走弱可能推動歐元等貨幣被動升值,進而壓制相關地區的通脹水平,最終迫使歐洲央行等” 被迫降息”。

全球央行政策分化正加速顯現。美聯儲在延續降息路徑的同時,歐洲、加拿大、日本、澳洲、新西蘭等央行卻普遍維持緊縮傾向,甚至步入加息通道。貨幣政策的背離預計將在 2026 年通過匯率市場形成顯著影響,美元面臨的貶值壓力成市場焦點,可能成為影響歐央行政策走向的關鍵外部變量。

當地時間週三,美聯儲如預期降息 25 個基點。高盛分析師 Rich Privorotsky 最新研報指出,儘管市場因鮑威爾對中性利率的審慎表態及會議出現多張反對票而滋生鷹派預期,但本次決議實際傳遞出鴿派基調。

與此形成鮮明對比的是,歐洲央行官員明確表示不會密切關注美聯儲降息。法國央行行長維勒魯瓦·德加豪近日明確表示,“認為歐洲央行會亦步亦趨跟隨美聯儲是一種誤解”,並指出 “歐洲的貨幣政策立場已比美國更顯寬鬆”。

政策分化的核心影響預計將通過匯率渠道顯現。高盛分析強調,若美聯儲後續持續降息,而其他主要央行仍維持緊縮傾向,市場關注點將聚焦於美元可能面臨的持續性貶值壓力。

美聯儲明年將降息基本成市場共識

華爾街主要投行在決議後維持對美聯儲後續降息的預期。摩根系與花旗預測,明年 1 月將再次降息,他們判斷寬鬆週期尚未結束。高盛與巴克萊分析稱,政策聲明中的鷹派措辭旨在 “平衡” 本次降息,避免釋放過度寬鬆信號。

花旗、摩根士丹利及摩根大通均將首次降息時點指向明年 1 月,其中花旗預計 3 月將再次降息,摩根士丹利判斷 4 月跟進第二次降息,而摩根大通則認為此後政策將進入觀察期。

高盛、富國銀行與巴克萊則認為,預計降息窗口將在 3 月開啓,並可能在 6 月進行第二次降息。

美元貶值迫使歐央行最終降息?

歐洲央行多位官員在美聯儲 12 月議息會議前後密集發聲,強調其貨幣政策獨立性。法國央行行長維勒魯瓦·德加豪上週五表示,歐洲央行應保持降息選項,但 “不應因美聯儲的行動而放棄自身政策節奏”。

歐洲央行執行委員會委員伊莎貝爾·施納貝爾在接受採訪時進一步指出:“美國貨幣政策態勢的變化不會對歐洲央行產生直接影響。我們依據歐元區自身的數據和分析獨立制定政策。” 她甚至提出,歐洲央行的下一步行動存在加息可能性。

歐美貨幣政策分化並非首次出現。2024 年年中,歐洲央行早於美聯儲啓動降息週期,時任美聯儲仍維持利率不變。維勒魯瓦指出,“儘管出現政策步調差異,外匯市場已消化這一情況且未出現顯著波動,過去十年類似情形曾多次發生。”

歐洲央行短期內跟隨美聯儲降息的可能性較低。當前美聯儲將利率區間降至 3.5%-3.75%,而歐洲央行自 6 月降息後關鍵利率為 2%,雙方政策空間與通脹形勢存在結構性差異。

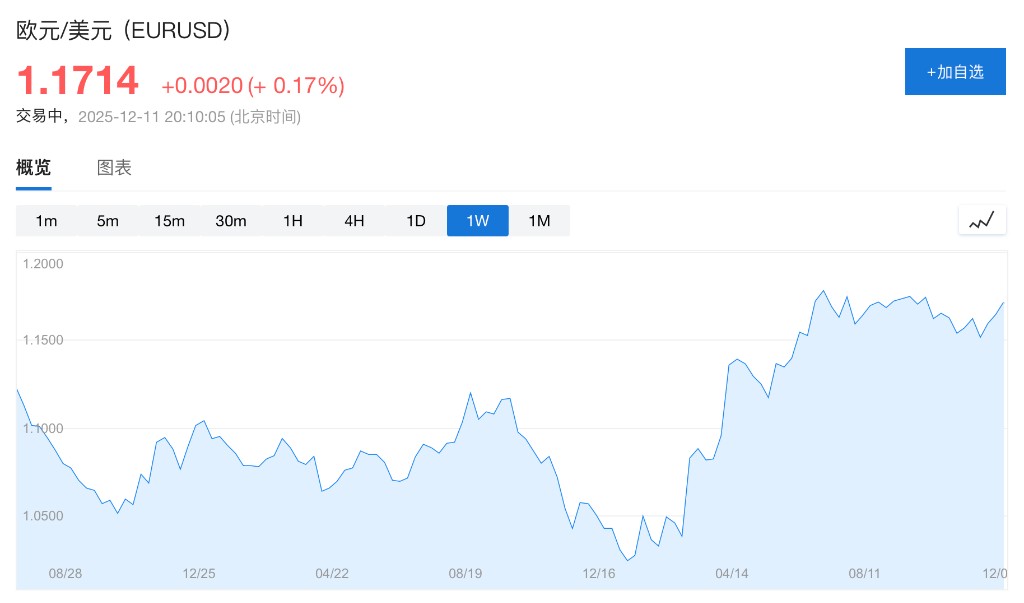

儘管歐洲央行反覆強調其貨幣政策獨立性,但匯率波動的實際傳導效應可能在事實上主導其政策走向。2025 年至今,歐元兑美元已累計升值約 12%,這一變化正在通過通脹渠道對歐央行的決策形成實質性約束。

歐洲央行首席經濟學家菲利普·萊恩近期明確指出,匯率對通脹具有顯著傳導作用。根據該行內部模型測算,歐元每升值 10%,將在三年內對通脹產生抑制作用,其中第一年影響最為顯著,屆時物價上漲速度將比其他情況下慢 0.6 個百分點。

該影響主要通過雙重渠道傳導:進口商品與服務價格直接因本幣升值而下降;同時,歐元走強削弱出口競爭力,間接抑制經濟增長與價格上行壓力。

值得關注的是,歐洲央行最新預測已將 2026 年通脹率下調至 1.7%,低於其 2% 的政策目標。若美聯儲加速降息引發美元進一步走弱,並推動歐元繼續升值,則 2027 年的通脹回升路徑也將面臨壓力。萊恩已表明,央行雖不會對 “小幅、暫時性” 的通脹偏離做出反應,但會對 “幅度較大、持續性較強” 的偏離進行政策調整。

目前,歐洲央行在預測中假設 2026–2027 年歐元匯率將大致保持當前水平。然而,若美聯儲降息節奏或幅度超預期,導致美元持續疲軟並帶動歐元被動升值,可能形成新的政策壓力。這實質上構成了一個隱性的政策傳導鏈:美聯儲降息→美元走弱→歐元升值→歐元區通脹進一步承壓→歐央行可能被迫轉向降息,意味着即便在言辭上保持獨立,匯率與通脹的傳導機制仍可能對歐央行決策形成 “事實性約束”。