业绩超预期、上调指引,Lululemon 宣布 CEO 将离任,盘后股价跳涨 11% | 财报见闻

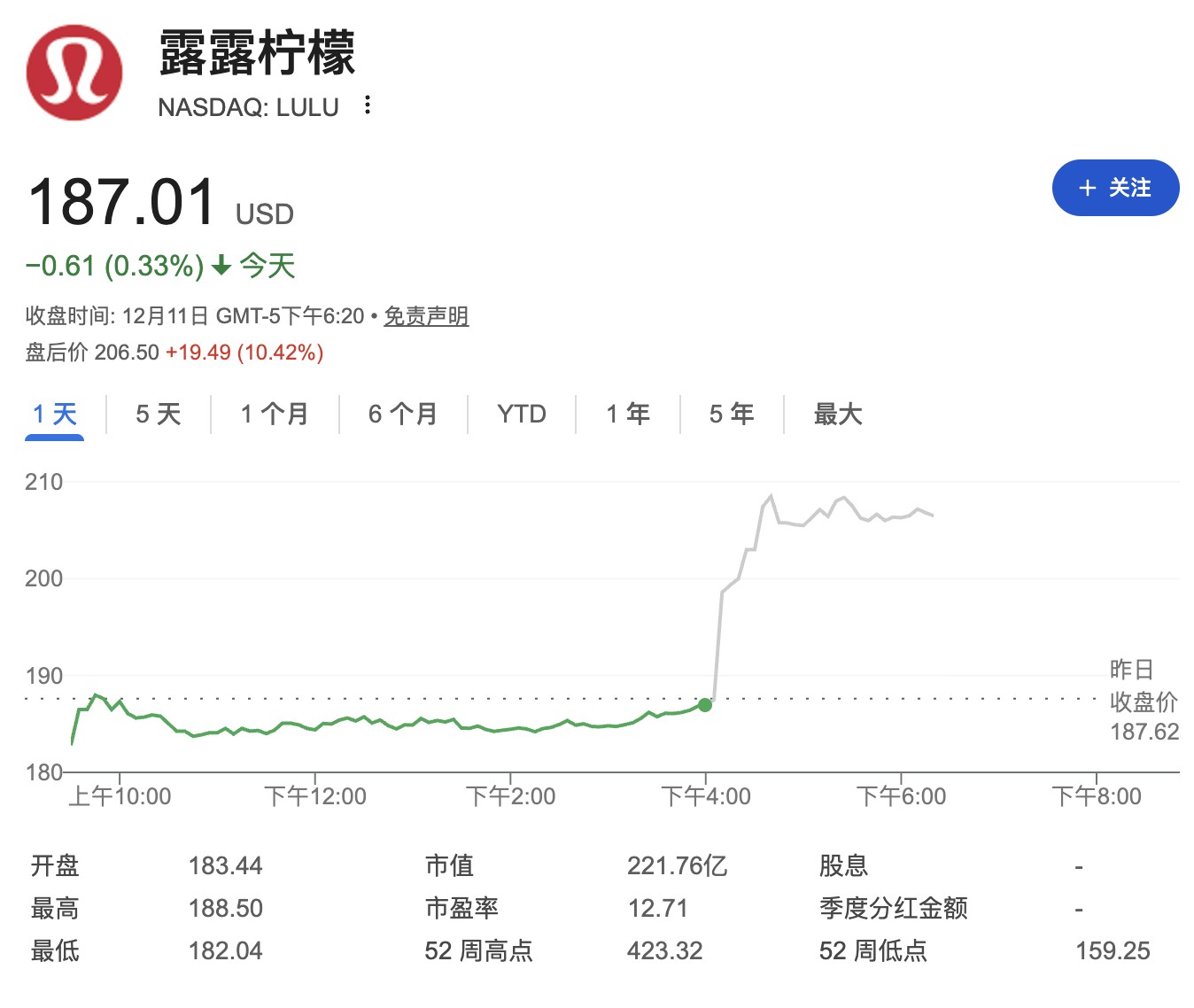

Lululemon's third-quarter revenue and earnings per share both exceeded expectations, and it raised its full-year revenue guidance for 2025. Amid intensified competition and pressure from founder, the company announced that CEO Calvin McDonald will step down on January 31. After the earnings report was released, the company's stock price surged 11% in after-hours trading

Lululemon athletica's third-quarter financial report released after the market closed on Thursday showed that the company's net revenue and earnings per share for the third quarter exceeded analysts' expectations, and it raised its full-year revenue forecast for 2025. The company announced that its CEO Calvin McDonald will step down on January 31. Following the news, Lululemon's stock price surged 11% in after-hours trading.

Here are the key points from Lululemon's third-quarter financial report:

Key Financial Data:

Net Revenue: Lululemon's net revenue for the third quarter grew by 7% to $2.6 billion, exceeding analysts' expectations of $2.48 billion. Comparable sales increased by 1%, and grew by 2% at constant currency.

Gross Profit: Lululemon's gross profit for the third quarter increased by 2% to $1.4 billion; the gross margin decreased by 290 basis points to 55.6%.

Operating Profit: Lululemon's operating profit for the third quarter decreased by 11% to $435.9 million; the operating margin fell by 350 basis points to 17.0%.

Earnings Per Share: Lululemon's earnings per share for the third quarter were $2.59, higher than analysts' expectations of $2.25, compared to $2.87 in the third quarter of 2024.

Store Count: The company added a net of 12 new direct-operated stores in the third quarter, bringing the total number of stores to 796 at the end of the quarter.

Inventory: Inventory at the end of the third quarter increased by 11% year-over-year to $2 billion, compared to $1.8 billion at the end of the third quarter of 2024. In terms of quantity, inventory grew by 4%.

Regional Data:

Americas: Lululemon's net revenue in the Americas region decreased by 2% in the third quarter, with comparable sales down by 5%.

International: Lululemon's net revenue in the international region grew by 33% in the third quarter, with comparable sales up by 18%.

Performance Guidance:

Fourth Quarter of 2025:

- Net Revenue: The company expects net revenue to be between $3.5 billion and $3.585 billion, a year-over-year decline of 3% to 1%, below analysts' expectations of $3.59 billion; excluding the 53rd week of 2024, the corresponding growth will be 2% to 4%.

- Earnings Per Share: Expected earnings per share are between $4.66 and $4.76, below analysts' expectations of $5.03.

Full Year 2025:

- Net Revenue: The company expects full-year net revenue to be between $10.962 billion and $11.047 billion, in line with market expectations, a year-over-year growth of 4%; excluding the 53rd week of 2024, the corresponding growth will be 5% to 6%. The company originally expected $10.85 billion to $11 billion.

- Earnings Per Share: Expected earnings per share are between $12.92 and $13.02, with analysts expecting $13 The company announced that CEO McDonald will leave at the end of January, and the company is searching for a successor. Chairman of the Board Marti Morfitt will take on additional responsibilities as Executive Chairman. During the search for a new CEO, Chief Financial Officer Meghan Frank and Chief Commercial Officer André Maestrini will jointly serve as interim co-CEOs.

The company stated in a press release that the board is working with "a leading executive search firm" to find the next CEO. McDonald will continue to serve as a senior advisor until March 31.

Meanwhile, the company has raised its full-year performance expectations. Lululemon now expects full-year net revenue to be between approximately $11 billion and $11.05 billion, higher than the previous guidance.

Lululemon's stock price rose by as much as 11% in after-hours trading. As of Thursday's close, the company's stock price has fallen by more than 50% this year. Since McDonald took office in 2018, Lululemon's stock price has increased by 37%, while the S&P 500 index has risen by 142% during the same period.

Facing Intensified Challenges

Media reports indicate that over the past year, Lululemon's business has faced pressure, including tariff impacts, weak U.S. consumer demand, and its product mix no longer attracting customers as it once did. Data shows that sales growth is nearing the lowest level since the company went public in 2007.

Known for its high-priced leggings and having almost created the "athleisure" category in the market, Lululemon is now facing fierce competition from lower-priced new brands like Alo Yoga and Vuori. Company executives expressed disappointment with their performance and product execution in the U.S. market in September.

Analyst forecasts indicate that Lululemon's growth has slowed in recent quarters, and this trend is expected to continue. To drive growth and attract more consumers, Lululemon has been working to expand its international business and offer a broader product range. In addition to activewear, the company has expanded into footwear, outerwear (such as coats and jackets), and casual pants suitable for the workplace.

The company's overall business is still growing, but primarily driven by international market growth and new store openings. Its largest market, the Americas, is declining.

Andrew Rocco, a stock strategist at Zacks Investment Research, stated:

"The era of Lululemon's rapid growth is clearly over and cannot be changed in the short term. However, as valuations have dropped to low levels, the CEO transition, and a good start to the holiday season, some 'bottom-fishing investors' are beginning to buy the stock."

Founder Pressures CEO to Step Down

McDonald's departure occurred after pressure from billionaire founder and shareholder Chip Wilson. Wilson called for adjustments at the board level and a renewed focus on the products themselves. Two months ago, he took out a full-page advertisement in The Wall Street Journal, stating that the company was "plummeting" and needed to "stop sacrificing customers to appease Wall Street."

During McDonald's tenure, Lululemon entered new categories such as athletic shoes, attempting to challenge brands like Nike and Adidas. The company also expanded its size range and entered into partnerships with Fanatics Inc. and the National Hockey League (NHL) to launch fan apparel.

In a press release, McDonald stated:

"Serving as CEO of Lululemon has been the highlight of my career, and I am incredibly proud of what the team has achieved over the past seven years. Together, we have transformed the athletic apparel industry, and Lululemon has tremendous opportunities ahead. I believe that the exceptional product portfolio we have built, along with the action plans already implemented, will yield positive results and create value for shareholders in the months and years to come."

Neil Saunders, Managing Director of GlobalData, stated that Lululemon's disappointing performance was due to a weakening athleisure market, increased competition, and the company's failure to differentiate its products from competing brands.

In his email comments, he stated:

"Lululemon is now a ship without a captain, and it desperately needs a clear direction at this time. While the market and investors may welcome change, this adjustment seems very sudden and rushed. Lululemon must appoint a new CEO as soon as possible or develop a very clear transition strategy to help the company get back on track."

Heavily Affected by Tariffs

The company is working to enhance product appeal and accelerate product development cycles. During the earnings call, company executives stated that the market feedback for special edition training gear has been positive. They also mentioned that the company had previously allowed some products' lifecycles to last too long.

During the earnings call, interim co-CEO Frank stated that Lululemon would increase marketing investments in the fourth quarter to help boost foot traffic and strengthen brand awareness. Additionally, the company expects discount levels to rise as it works to clear excess inventory.

Lululemon has been particularly affected by tariffs during President Trump's administration and has raised prices on some products in response to changes, including the elimination of the de minimis exemption, which previously allowed the company to ship e-commerce orders under $800 from Canada to the U.S. without incurring taxes.

In September of this year, the company stated that tariffs are expected to reduce annual profits by $240 million, with most of the costs coming from the elimination of the de minimis exemption.

Frank stated that the company expects gross margins to decline in the fourth quarter, primarily due to tariffs and the elimination of the de minimis exemption. The company plans to cut costs and improve efficiency to help offset the impact. Analysis suggests that the changes in senior management also reflect a series of significant adjustments in the management of retailers recently. Retailers are trying to attract younger and more cautious consumers while addressing supply chain and operational issues. The company has also approved an increase of $1 billion to its stock repurchase program