Broadcom's AI chip revenue accelerated to a 74% increase last quarter, expected to double this quarter, but backlog orders are disappointing | Earnings Report Insights

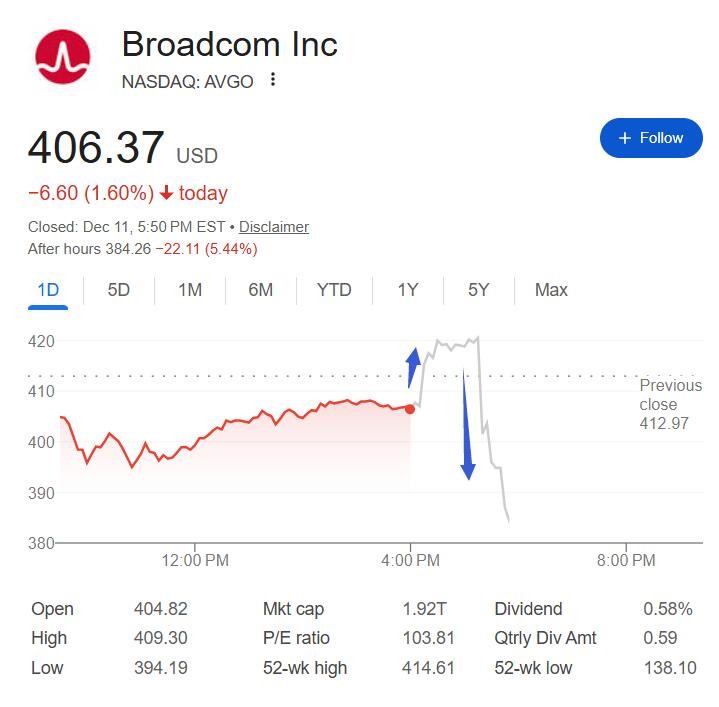

Broadcom's revenue and profit for the fourth fiscal quarter both hit record highs, increasing nearly 30% and 40% year-on-year, respectively; the revenue guidance for the first fiscal quarter remains flat compared to the previous quarter, with AI chip revenue exceeding market expectations by nearly 20%. Broadcom announced a 10% increase in its quarterly dividend for this fiscal year, setting a new all-time high for annual dividends. The CEO stated that there is a backlog of AI product orders valued at $73 billion, calling it the "minimum value," and mentioned receiving $11 billion in orders from Anthropic in the fourth fiscal quarter, but warned that total profit margins are narrowing due to AI product sales. Broadcom's stock initially rose 4% in after-hours trading but later turned to a decline, dropping over 5%

Nvidia's challenger, ASIC chip giant Broadcom, once again demonstrated through its quarterly performance and guidance just how explosive the demand for artificial intelligence (AI) data center equipment is, bringing explosive growth to Broadcom's recent performance. However, the backlog of AI orders did not meet investor expectations, and it warned that overall profit margins are narrowing due to AI product sales.

Broadcom reported that its revenue and profits for the last fiscal quarter accelerated growth compared to the previous quarter, and the revenue guidance for the current fiscal quarter exceeded Wall Street expectations. Benefiting from the hot sales of custom AI chips required for the AI infrastructure boom, Broadcom's AI chip revenue grew by over 70% last quarter, an increase of more than 10 percentage points compared to the previous quarter. Broadcom also expects AI chip revenue to double this quarter, significantly exceeding market expectations.

Broadcom's Chief Financial Officer (CFO) Kirsten Spears also announced a substantial increase in the quarterly dividend for this fiscal year, specifically for fiscal year 2026, raising it by 10% to $0.65 per share, bringing the annual dividend to a record high of $2.60 per share. This marks the fifteenth consecutive year of increasing the annual dividend since it began distributing dividends in fiscal year 2011.

After the earnings report was released, Broadcom's stock price (AVGO), which fell 1.6% on Thursday, quickly rose in after-hours trading, with gains reaching 4%, but later turned to decline, with losses exceeding 5%.

Some commentators noted that the stock price's decline was due to comments made by Broadcom CEO Hock Tan during the earnings call, stating that the company currently has a backlog of AI product orders valued at $73 billion. This order size disappointed some investors, although Tan clarified that this is just a "minimum value" and expects the actual size to be larger as more orders come in, but the market reaction remained cautious.

Before the earnings report was released, an article from Wall Street Journal mentioned that some analysts were concerned that even if Broadcom's performance was outstanding, it could trigger "profit-taking" trades. Ryuta Makino, an analyst at Gabelli Funds, predicted that regardless of Broadcom's performance or guidance, "everyone is holding long positions, and perhaps some will sell to take profits."

On Thursday, December 11, Eastern Time, Broadcom announced its financial data for the fourth quarter of fiscal year 2025 (hereinafter referred to as "Q4") ending November 2, 2025, and provided performance guidance for the first quarter of fiscal year 2026 ("Q1").

1) Key Financial Data:

Revenue: Q4 revenue was $18.02 billion, a year-on-year increase of approximately 28%, with analysts expecting $17.47 billion and the company guiding $17.4 billion, compared to a year-on-year growth of 22% in the previous quarter.

Net Profit: The adjusted net profit for Q4 under non-GAAP standards was $9.71 billion, a year-on-year increase of approximately 39%, compared to a year-on-year growth of 37.3% in the previous quarter.

EBITDA: The adjusted EBITDA for Q4 was $12.22 billion, a year-on-year increase of 34%, with a profit margin of 68%, compared to the company's guidance of 67%, and a year-on-year growth of 30.1% with a profit margin of 67.1% in the previous quarter

EPS: Adjusted earnings per share (EPS) for the fourth quarter was $1.95, a year-on-year increase of 37%, with analysts expecting $1.87, and a year-on-year increase of 36.3% in the previous quarter.

2) Segment Business Data:

Semiconductor Solutions: Revenue from semiconductor solutions, including ASIC, was $11.07 billion, a year-on-year increase of 34.5%, accounting for 61% of total revenue, with analysts expecting $10.74 billion, and a year-on-year increase of 26% in the previous quarter, accounting for 57% of total revenue.

Infrastructure Software: Revenue from infrastructure software, including VMware, was $6.94 billion, a year-on-year increase of approximately 19%, accounting for 39% of total revenue, with a year-on-year increase of 17% in the previous quarter, accounting for 43% of total revenue.

3) Performance Guidance:

Revenue: First quarter revenue is expected to be approximately $19.1 billion, with analysts expecting $18.48 billion.

EBITDA: First quarter EBITDA margin is expected to be approximately 67%.

Q4 Revenue and Profit Hit Record Highs, Q1 AI Chip Revenue Growth Accelerates

The financial report shows that Broadcom's revenue and EBITDA profit in the fourth quarter both reached record highs for a single quarter, with growth rates accelerating compared to the previous quarter. Revenue growth increased from 22% in the previous quarter to just over 28%, and EBITDA growth rose from 37% to 39%.

Chen Fuyang stated that the record total revenue in the fourth quarter was driven by AI semiconductor solutions and infrastructure software. The revenue from semiconductor solutions, including ASIC, also exceeded analysts' expectations, with its share of total revenue surpassing 60%.

Chen Fuyang specifically mentioned that revenue from AI chips grew by 74% year-on-year in the fourth quarter. This growth rate is clearly higher than the already exceeding expectations growth of 63% in the previous fiscal quarter, and also higher than the guidance Broadcom provided during the earnings call at that time. He mentioned that AI chip revenue was expected to reach $6.2 billion in the fourth quarter, which would represent a year-on-year increase of 66% and a quarter-on-quarter increase of 19%.

Based on Broadcom's performance guidance, first quarter revenue is expected to grow by approximately 28% year-on-year, matching the growth rate of the fourth quarter, with a quarter-on-quarter increase of about 6%, slowing from the 13% growth in the fourth quarter, but still higher than analysts' expectations. Analysts expect first quarter revenue to grow nearly 24% year-on-year.

Chen Fuyang stated that AI chip revenue in the first quarter is expected to double year-on-year, reaching $8.2 billion. This means that AI chips will contribute over 40% of the company's revenue, nearly 19% higher than the market's general expectation of $6.9 billion, and the year-on-year revenue growth rate will increase by 26 percentage points compared to the fourth quarter.

New Orders from Clients like Anthropic, but AI Products Pressure Profit Margins

During the conference call, Chen Fuyang disclosed that Broadcom secured an $11 billion order from OpenAI competitor Anthropic in the fourth quarter, following a $10 billion order in the third fiscal quarter. He also mentioned that Broadcom signed another $1 billion customer order, but did not disclose the identity of the client Broadcom's rapid growth in AI revenue is mainly driven by the surge in demand for custom chips and data center network chips. During the conference call, Chen Fuyang warned that the company's overall profit margin is narrowing due to AI product sales. CFO Spears stated that the profit margin in the first quarter will shrink by 1% due to AI products.

Chen Fuyang mentioned that the backlog of $73 billion will be delivered over the next six quarters. He attempted to explain to investors that the $73 billion figure is just a benchmark, and the actual scale will grow with new orders. He said, "Depending on the specific product, our delivery times may vary from six months to a year."

Google Becomes a Key Customer; OpenAI Will Not Bring Much Revenue Next Year

Broadcom's stock price has risen over 170% since hitting a low on April 4, ranking tenth in terms of growth among S&P 500 constituents during the same period. Since the release of its third-quarter financial report in early September, the stock price has increased by about 30%, bringing its market capitalization to $1.91 trillion. As of this Wednesday's close, the stock price has cumulatively risen about 75% entering 2025.

This surge has pushed Broadcom's valuation to unprecedented heights. By this Wednesday, its forward price-to-earnings ratio reached about 42 times, far exceeding the ten-year average of 17 times. Currently, Broadcom's valuation has surpassed six of the "Magnificent 7" tech giants, excluding Tesla, including the highest market cap stock Nvidia.

Broadcom's AI business heavily relies on a few hyperscale cloud service provider customers, particularly Google. Broadcom manufactures custom Tensor Processing Unit (TPU) chips for Google, and Google's recently released most powerful AI model, Gemini 3, is entirely trained on TPU chips, becoming a significant boon for Broadcom.

Shaon Baqui, a technology research analyst at Janus Henderson Investors, stated that Broadcom is "deeply tied to the Google ecosystem, and we have all seen the latest success of Gemini 3 and Google's achievements. Given the recent performance, market expectations are clearly elevated, but the reasons are well-founded."

Emarketer analyst Jacob Bourne noted, "Given Google's market position, Broadcom will benefit from the growing interest in specialized, energy-efficient chips, and its network product portfolio makes it a key supplier for large-scale data center construction supporting AI infrastructure."

Compared to traditional giants like Google, up-and-coming AI players like OpenAI and Anthropic may only be a bonus for Broadcom.

During this earnings call, Broadcom projected that OpenAI will not bring much revenue in 2026.

In the last conference call in September, Chen Fuyang revealed that Broadcom's custom AI accelerator XPU gained a qualified customer, with this fourth customer bringing in $10 billion worth of orders. At that time, media reported that this "mysterious" customer was OpenAI. A month later, on October 13, OpenAI announced an agreement with Broadcom to deploy AI custom chips developed in collaboration with Broadcom starting next year. This confirmed the addition of an important member to Broadcom's customer base