一张图读懂 AI 的 “软肋”

Oracle's latest financial report shows that its free cash flow has hit a record low of -$10 billion, due to operating capital drag and capital expenditures exceeding expectations. The company announced an increase in its capital expenditure forecast for 2026 to $50 billion, raising market concerns about its funding sources. Barclays had previously predicted that Oracle might run out of cash by 2026 and would require significant financing

The recently released Oracle financial report not only failed to alleviate market anxiety about AI trading but instead intensified doubts.

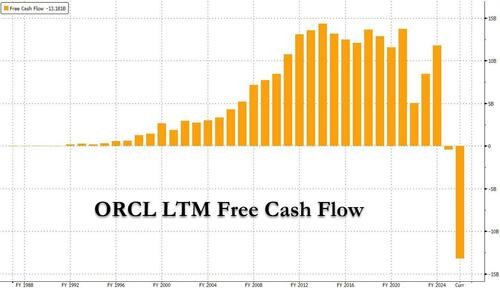

Regarded by the market as the "weakest link in AI," Oracle's free cash flow has just hit a historic low:

This quarter's free cash flow (before dividends) was -$10 billion, primarily due to operational capital drag and capital expenditures exceeding expectations. In just two quarters, the free cash flow consumption has already surpassed the market's expectations for the fiscal year 2026.

Then, during the earnings call, Oracle announced an increase in its capital expenditure expectations for 2026 by $15 billion to $50 billion to build capacity to meet the $68 billion in new contracts signed in the second quarter, a move that shocked investors.

The market's question is: how can such a company fund the upcoming massive expenditures?

Investors immediately recalled Barclays Bank's calculations from a month ago (when the bank downgraded Oracle's bond rating and recommended buying its CDS), which stated that unless circumstances change, Oracle " will run out of cash in the November 2026 quarter, indicating a significant financing need."