Federal Reserve RMP = Will purchase $500 billion in short-term U.S. Treasury bonds next year? Wall Street: The Federal Reserve is very aggressive!

The Federal Reserve's RMP plan is much stronger than market expectations. Institutions led by Barclays and JPMorgan Chase expect that the Federal Reserve may absorb about $500 billion in short-term government bonds next year, making it the dominant buyer in the short-term bond market over the next year. Analysts believe that this aggressive move demonstrates the Federal Reserve's "extremely low tolerance" for financing pressure

The Federal Reserve announced a Reserve Management Plan (RMP) to purchase $40 billion in short-term Treasury securities each month, a move that far exceeds market expectations, prompting major Wall Street investment banks to revise their debt issuance forecasts for 2026.

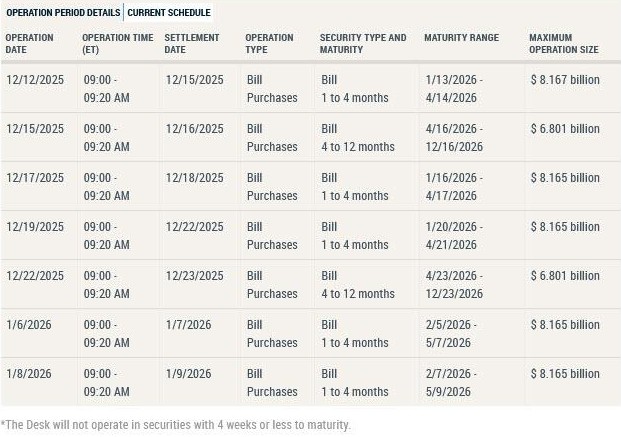

Wall Street Insight previously mentioned that on the same day the Federal Reserve announced this plan, the New York Fed stated it would release the first plan on December 11, 2025, and begin purchasing on December 12. This also means that the Federal Reserve will purchase $8.2 billion in short-term Treasury bills (T-bills) this Friday and plans to buy $40 billion in the following month to rebuild bank system reserves, aiming to alleviate short-term interest rate pressures through the reconstruction of financial system reserves.

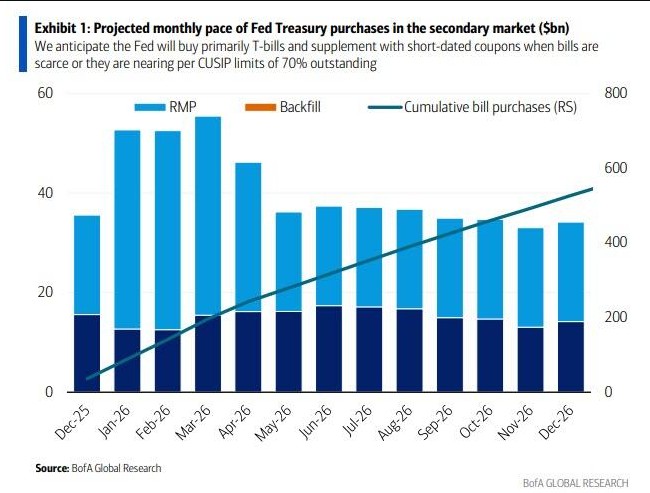

The scale of this operation not only exceeds previous expectations but will also be combined with the bank's initiative to purchase $14.4 billion in short-term Treasury securities each month starting in December to reinvest institutional debt repayments. Institutions led by Barclays and JP Morgan expect that the Federal Reserve may absorb about $500 billion in short-term Treasury securities next year, a move seen by the market as a signal of aggressive liquidity injection.

As a result of this news, market borrowing costs fell sharply. On Wednesday, trading volume in short-term interest rate futures surged, and the two-year swap spread widened to its highest level since April, indicating that expectations for pressure in the short-term financing market have significantly eased. Strategists generally believe these measures will effectively alleviate months of accumulated financing pressure after the Federal Reserve stops balance sheet reduction.

Major financial institutions currently agree that the Federal Reserve will become the dominant buyer in the short-term Treasury market over the next year. Analysts point out that this move by the central bank will significantly squeeze the supply of notes available to private investors, thereby creating long-term benefits for swap spreads and the basis trade between the secured overnight financing rate (SOFR) and the federal funds rate.

Wall Street Significantly Raises Bond Purchase Expectations

According to Bloomberg, as the Federal Reserve announced its aggressive purchasing plan, several major Wall Street banks quickly adjusted their estimates of the supply and demand relationship for Treasury securities in 2026.

Barclays' strategists Samuel Earl and Demi Hu now estimate that the total amount of short-term Treasury securities purchased by the Federal Reserve in 2026 could approach $525 billion, significantly higher than the previous forecast of $345 billion. This means that the net issuance available to private investors will plummet from the previously estimated $400 billion to $220 billion.

The bank believes that the Federal Reserve's aggressive move demonstrates a "very low tolerance" for financing pressure, and expects the purchasing pace to remain high in the first quarter of next year, potentially decreasing from $55 billion per month (including MBS reinvestment) to $25 billion by April.

JP Morgan has also raised its expectations. Strategists Jay Barry and Teresa Ho expect the Federal Reserve to maintain a purchase scale of $40 billion per month until mid-April, then reduce it to $20 billion per month. Combined with approximately $15 billion in MBS reinvestment each month, the total amount purchased by the Federal Reserve in the secondary market in 2026 will reach $490 billionThis will result in a net issuance of only $274 billion in short-term Treasury bonds next year.

Gennadiy Goldberg and Jan Nevruzi from TD Securities also expect that the Federal Reserve will purchase $425 billion in notes through RMP and MBS reinvestment in fiscal year 2026, absorbing the vast majority of net supply.

Aggressive Strategy Alleviates Liquidity Concerns

The Federal Reserve's action is widely interpreted as a preemptive measure against volatility in the repurchase market.

Blake Gwinn and Izaac Brook from RBC Capital Markets acknowledge that they previously underestimated the Federal Reserve's "discomfort" with fluctuations in repurchase rates within the month, noting that the Fed seems to be more focused on absorbing Treasury issuance rather than simply increasing reserves. Matthew Raskin and Steven Zeng from Deutsche Bank point out that the Fed has initiated this process earlier than in 2019, indicating a more cautious approach in managing the transition to abundant reserves, which will help further stabilize the repurchase market.

Bank of America strategists Mark Cabana and Katie Craig warn that the Federal Reserve may need to maintain high levels of purchasing for a longer period. They estimate that the current RMP size can only replenish about $80 billion of excess cash by mid-April, while achieving ideal results may require replenishing $150 billion. The bank also noted that if the Fed perceives that note investors are adversely affected, it may expand the purchase range to include Treasury bonds with maturities of three years.

Market Volatility Not Completely Eliminated

Although the Federal Reserve's intervention is seen as positive, some analysts remain cautious about market stability in the short term.

Angelo Manolatos and Mike Schumacher from Wells Fargo state that although the monthly scale of $40 billion is at the expected upper limit and constitutes a "significant tailwind" for the SOFR and federal funds rate spread as well as the widening U.S. swap spreads, it is not a "cure-all" for liquidity by the end of the year. They expect that the financing market will still face some pressure around the end of the year.

CIBC strategists express a similar view, believing that these measures cannot completely eliminate volatility, as the Fed's purchase volume in December is unlikely to exceed the overnight funding demand accumulated by the end of the year, when banks typically restrict repurchase market activities to strengthen their balance sheets.

Joseph Abate from SMBC Nikko adds that the Federal Reserve is attempting to actively manage the issue of excess bank reserves, and the success of this strategy will depend on the willingness of market participants to utilize the Stand Repo Facility