The DC Energy Bill Investors Are Watching Next

美國眾議院通過了《電力供應鏈法案》,這是一項兩黨支持的法案,要求能源部分析影響電力生產的供應鏈風險。該法案旨在增強電網的可靠性並支持人工智能數據中心。法案現在將提交參議院,可能對能源價格和基礎設施產生影響。該法案得到了主要能源參與者的支持,並可能影響 2026 年中期選舉

圖片來源:Unsplash

本月,全球頭條新聞從委內瑞拉的緊張局勢到烏克蘭的和平協議不一而足——這對供應鏈和能源價格可能意味着什麼。

在信息轟炸中,可能很容易錯過本週在美國眾議院通過的一項罕見且隱秘的兩黨法案。然而,從華爾街到主街,這項 “隱藏” 的法案可能在短期和長期內對基礎設施產生重要影響。

《電力供應鏈法案》是由國會議員鮑勃·拉塔(Bob Latta,俄亥俄州第 5 區)提出的立法,經過 267 票對 159 票的投票通過——這意味着超過 50 名民主黨人支持這一能源法案。在眾議院的民主黨投票中,從加利福尼亞到弗吉尼亞的代表們在黨派界限通常分歧明顯的時刻投下了 “贊成票”。為什麼?因為在許多方面,電價和人工智能的未來將在 2026 年的中期選舉中成為焦點。

全國範圍內,電價上漲超過 10%,但在一些靠近數據中心的地區,批發電價與五年前相比上漲了多達 267%。消費者和企業每天都能感受到這一點。現實是,這些上漲的成本正在轉嫁給客户和私營部門的大型用電客户。

《電力供應鏈法案》的重要性

眾議院的這項里程碑法案將要求美國能源部分析並透明報告影響電力生產和傳輸的供應鏈風險和趨勢。

正如眾議院能源和商業小組委員會主席鮑勃·拉塔所説:“《電力供應鏈法案》將增強我們電網的可靠性,擴大國內能源生產,並確保我們能夠為未來的人工智能數據中心提供電力。”

私營部門的領導者們也注意到了這一點。

國家電氣製造商協會(NEMA)——包括施耐德電氣、西門子、伊頓、ABB、GE 電網解決方案和特斯拉等關鍵能源參與者——不僅支持該法案,還發表聲明稱,該立法將幫助 “為能源部門提供關於其當前和未來能力、增長機會以及維護安全和韌性供應鏈的挑戰的更大清晰度。”

當像西門子和特斯拉這樣的公司共同發聲時,市場和政策制定者會傾聽。

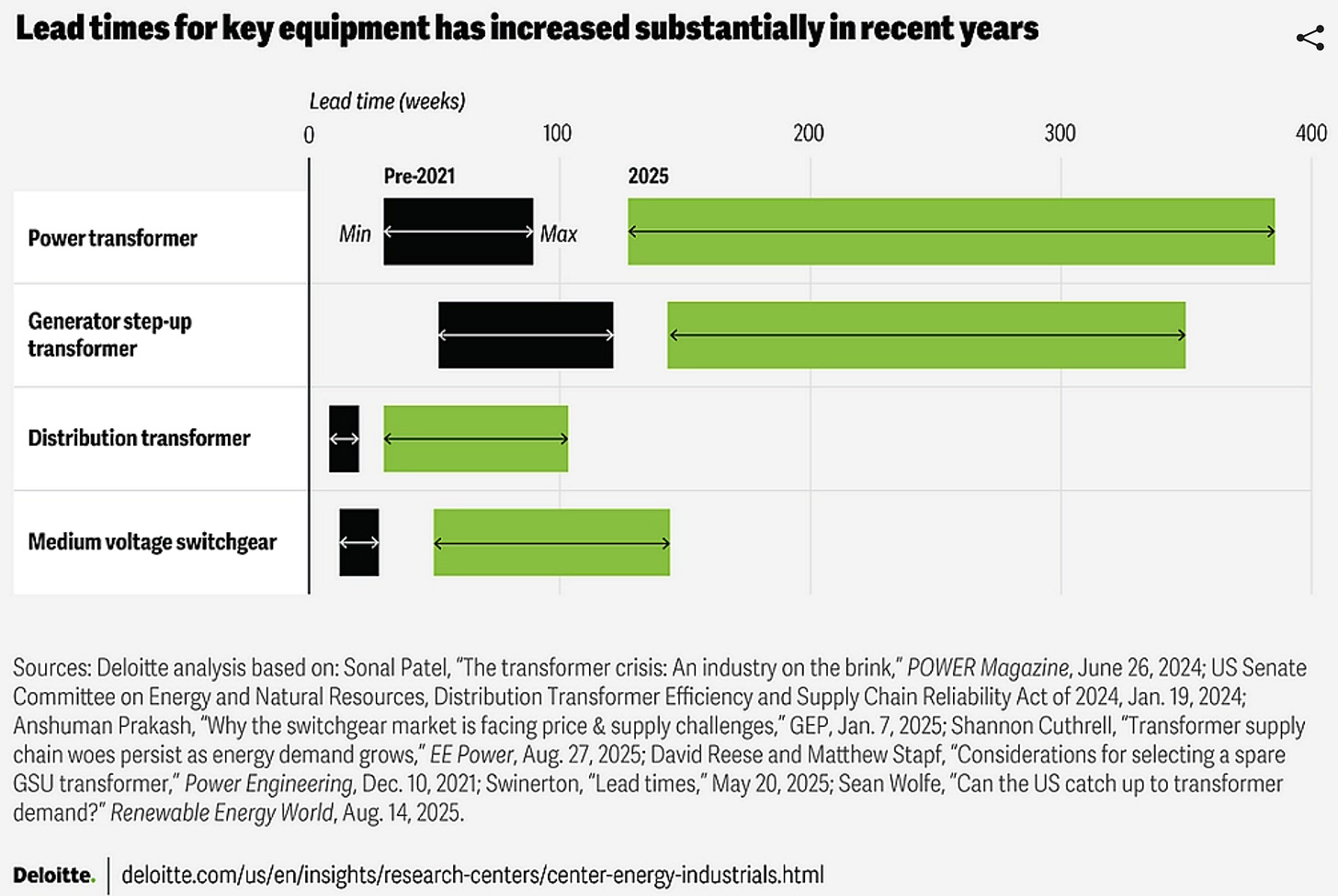

從我在國會山的對話以及與華盛頓特區政策制定者相關人士的交流中,你常常會聽到供應鏈問題仍然是一個持續的商業規劃問題。這是因為幾乎任何與能源相關的項目都必須面對獲取變壓器的漫長時間表,並且不斷面臨天然氣渦輪機的積壓問題。

(點擊圖片放大)

圖片來源:德勤

這對科技和人工智能領域的領導者們也很重要,因為他們是大型能源負荷的主要驅動者,需求不斷增加,主要由龐大的數據中心推動。

回顧過去一年多,我們詳細介紹了數據中心和能源需求不僅在增長,而且它們是大生意。在我們 2024 年 10 月的《Prinsights Pulse Premium》月刊中,我們分享了報告顯示,到 2030 年,數據中心每年可能消耗美國電力的 9%。這就像將額外的 1100 萬户家庭接入電網。

能源立法的下一步

現在,該法案將送往美國參議院,此時美國中期選舉的背景顯得尤為重要,能源需求也在激增。

那麼,它能否存活?超過四十名眾議院民主黨人能夠跨越黨派界限的信號讓人謹慎樂觀,認為該法案在參議院通過的機會很大。

需要注意的是:在眾議院通過的另一項法案(在更多的共和黨黨派中)是《可靠性和可負擔性州規劃法案》,該法案將要求 “建立關於電力可靠可用性的措施”。該法案在美國參議院面臨更為嚴峻的挑戰,但隨着我們邁向 2026 年,它也可能成為值得關注的法案。值得注意的是,該法案將對天然氣和核能等能源生產來源帶來巨大的好處。

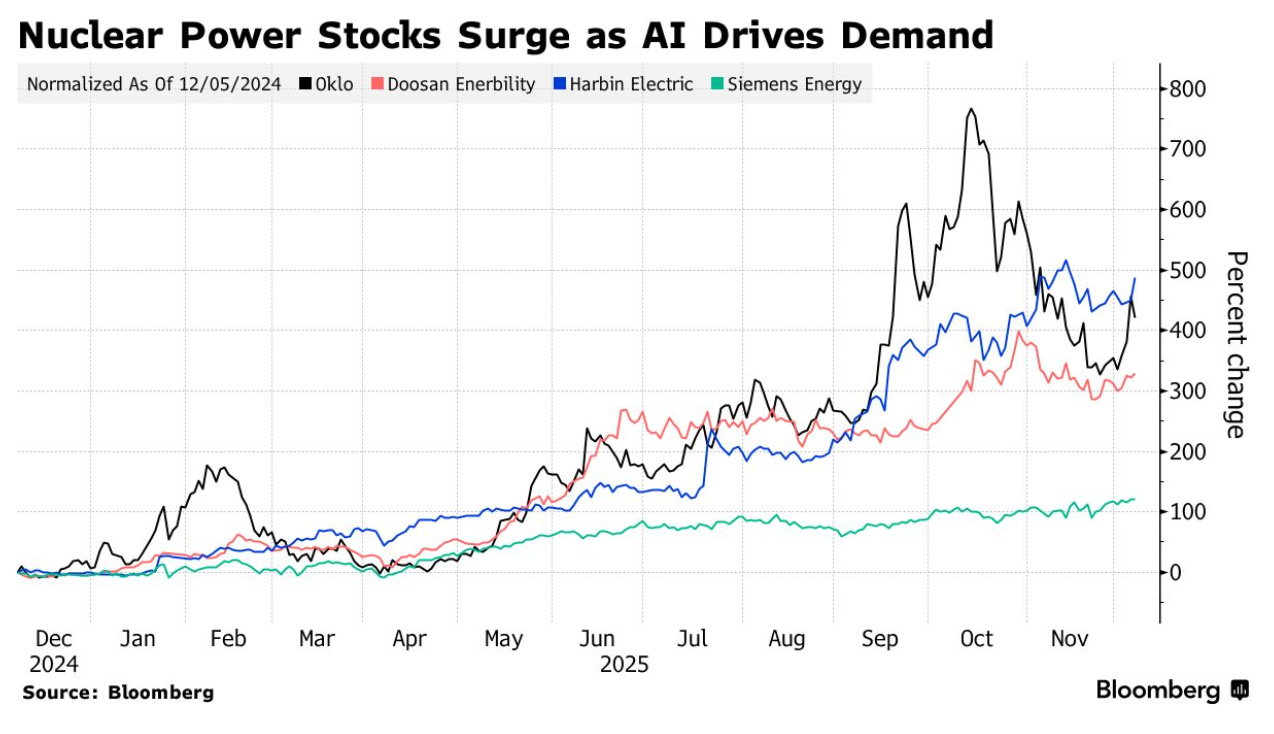

對於戰略投資者和公用事業家庭而言,能源立法意味着公司有機會提升並擁有更可預測、可靠和韌性的能源未來。華爾街已經在尋找核能投資以獲得可觀回報。

(點擊圖片放大)

圖片來源:彭博社

隨着我們結束 2025 年並探索 2026 年的下一步,能夠以支持數據驅動決策的方式同時利用能源傳輸和生產的公司將處於有利位置。能夠微調能源負荷和預測的測量可以幫助提升投資者信心,同時推動潛在的創新,增加能源領域的回報潛力。

關注像《電力供應鏈法案》這樣的能源相關法案,可以為尋求在所有人工智能頭條噪音中獲得優勢的戰略投資者提供非常明確的信號和機會。

這也是為什麼我們本月的下一期 Prinsights Pulse Premium 將聚焦於一位在能源可靠性方面處於核心地位的能源領袖,並且正在進行戰略投資,許多人因此期待其帶來可觀的收益。我們迫不及待想與您分享我們的最新研究和關鍵的可行建議。

更多來自此作者的文章:

沒有人談論的黃金供應危機

新的貨幣地圖:黃金是錨

物質現實:為什麼硬資產勝出,無論人工智能炒作如何