The divergence between AI investment and AI stocks may become the norm, similar to the new energy sector after 2021?

I'm PortAI, I can summarize articles.

國金證券認為,未來 AI 投資與 AI 股票表現之間的背離將成為常態,類似 2021 年後的新能源投資與股票表現。儘管本週五甲骨文和博通等美股 AI 科技股下跌,但市場對其未來業績兑現的擔憂是核心問題。投資者應關注受益於 AI 投資趨勢的宏觀效應領域,而非糾結於 AI 泡沫。

國金證券:

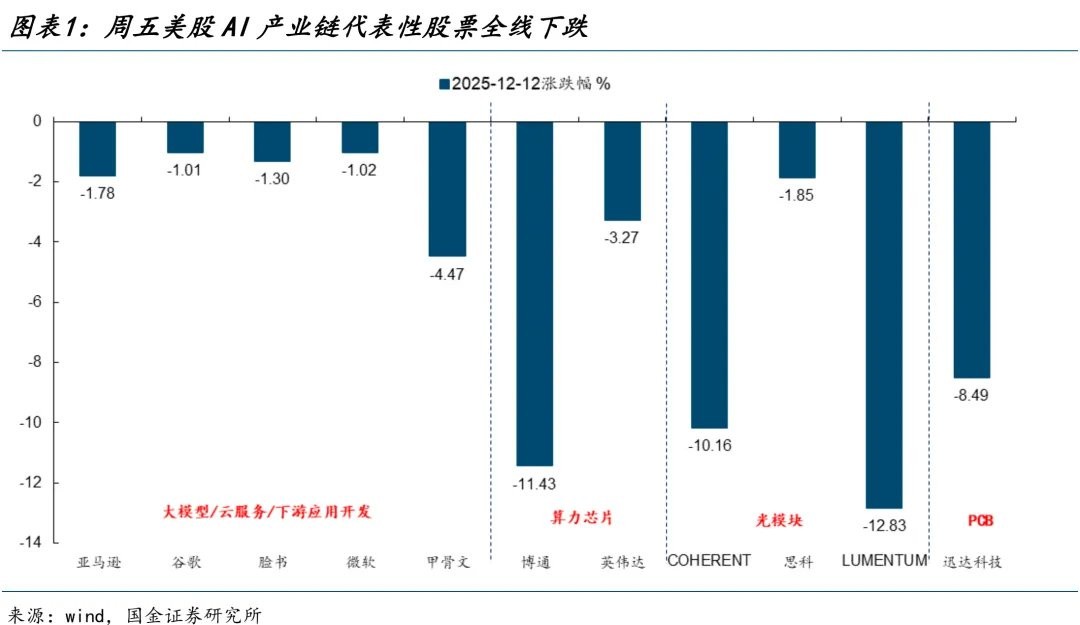

本週五(2025-12-12)以甲骨文、博通為代表的美股 AI 科技股出現了明顯的下跌,與當期業績是否超預期已經關聯不大,因為雖然甲骨文財報不及預期,但博通卻明顯超預期。

我們認為問題核心仍在於市場對於它們未來業績兑現的擔憂:包括完成訂單的可能性、增長持續性、利潤率維持以及客户的集中度等等。與此同時,雖然美國光模塊、PCB 相關的股票在本週續創新高,不過在週五也出現了大幅回落。類似 2025 年 10 月底三季報部分 AI 股票業績不及預期之後,當時 AI 的行情階段性見頂回落,市場風格出現了再均衡,與此同時廣泛受益於 AI 投資的 “泛 AI” 領域迎來了更多關注。

我們認為未來 AI 投資與 AI 股票表現之間的背離將會是常態,類似 2021 年之後的新能源投資與新能源股票的表現一樣,投資者不應該再拘泥於 AI 泡沫的討論和關注,而是應該轉向受益於 AI 投資趨勢下的宏觀效應的領域。