SpaceX's Moat

According to a research report by Guojin Securities, SpaceX's moat is not a single technology, but rather a deep integration of three major barriers: cost, manufacturing, and customers. Through the reusable economics of the Falcon 9, it has reduced internal marginal launch costs to about $15 million, achieving a disruptive impact on traditional military-industrial giants. At the same time, its vertically integrated manufacturing system, which is as high as 80%, and its "strategic symbiosis" relationship with the U.S. government have created a self-reinforcing business loop

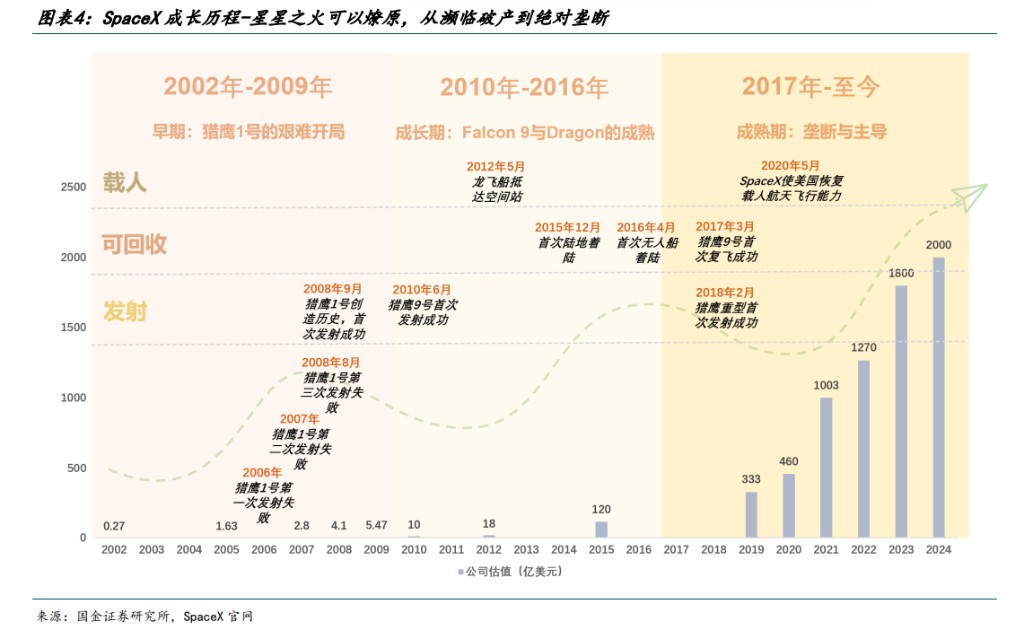

A deep research report from Guojin Securities reveals how SpaceX has transformed from a traditional aerospace manufacturer into a "space logistics and infrastructure monopoly" that applies first principles to the extreme.

The industry deep research report released by Guojin Securities on December 10 shows that the essence of SpaceX is not that of a traditional aerospace manufacturer, but rather a "space logistics and infrastructure monopoly that applies first principles (breaking the superstition that rockets must be expensive, breaking the paradigm of single-use, breaking material selection, and pursuing rapid iteration rather than perfection) to the extreme."

The report points out that its seemingly insurmountable industry barriers do not stem from a single technological breakthrough, but rather from the deep integration of three major dimensions: cost, manufacturing, and customers.

Founded by Elon Musk, the company has completely disrupted the cost structure of the global space launch market through its core product, the Falcon 9 rocket. The report analyzes that through fully reusable technology, SpaceX has "transformed space launches from 'custom crafts' into 'industrial standard products'." Its internal launch marginal cost has been reduced to nearly $15 million, and this cost structure gives it "the pricing power of dimensionality reduction" when facing traditional military giants.

More importantly, SpaceX has built a powerful "self-reinforcing business loop." The report notes that the company utilizes the unmatched launch cost advantage of the Falcon 9 to construct the world's largest space communication network—Starlink—and uses the massive cash flow generated from both to "support the grandest engineering project in human history—the Starship." This model presents investors with a unique combination of "cash flow + high growth + high options," forming the basis for its unique valuation premium.

Cost Barriers: Unmatched Reusable Economics

The core moat of SpaceX lies in its unparalleled rocket reuse technology, which is not only a technological victory but also a "dimensionality reduction of the business model," ending the "cost-plus era" of the aerospace industry that lasted for forty years.

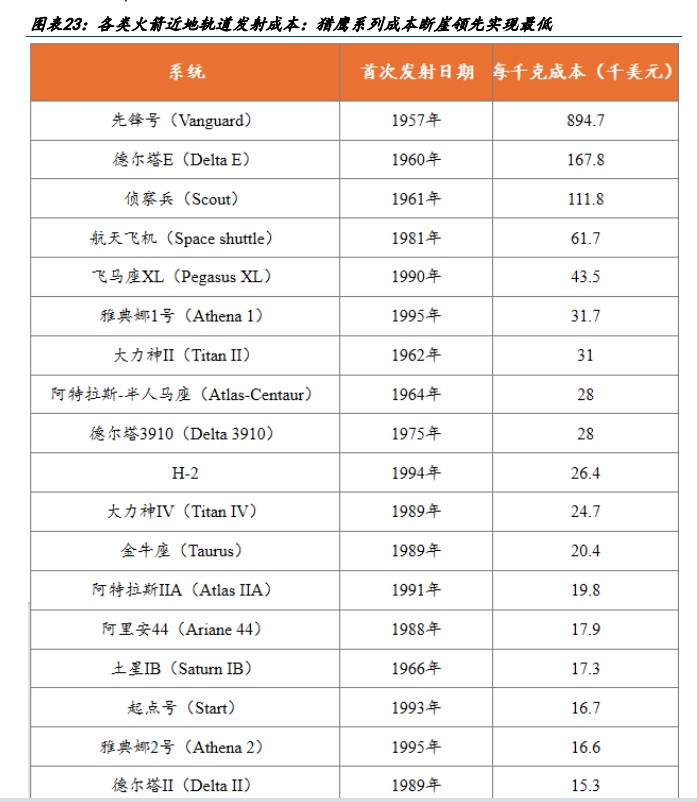

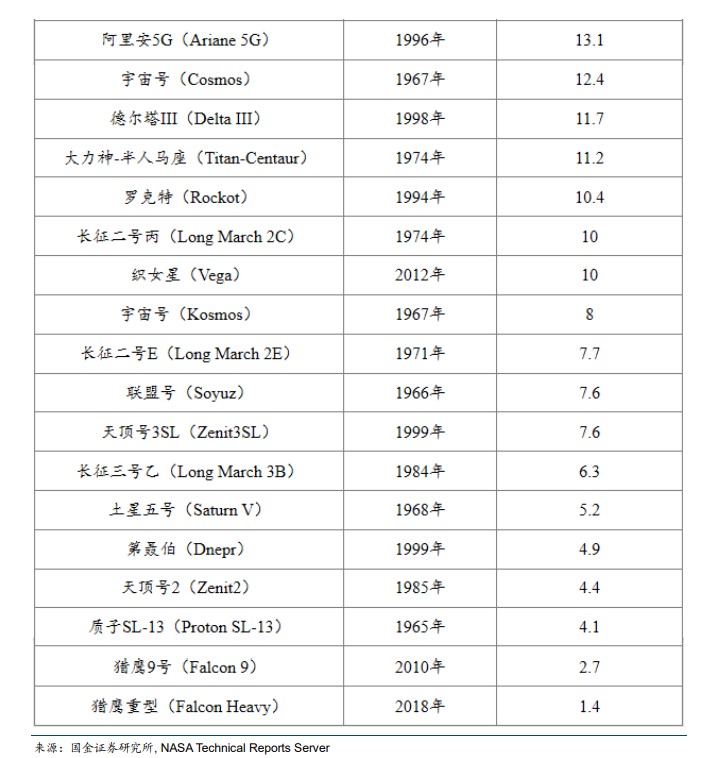

The Guojin Securities report points out that before the rise of SpaceX, the global launch market was dominated by state-owned enterprises, following a "cost-plus" contract model, where contractors lacked the motivation to control costs. The report cites comparative data, noting that the cost for NASA's Space Shuttle to send payloads into low Earth orbit was about $54,500 per kilogram, while SpaceX's Falcon 9 has reduced this figure to $2,720 per kilogram, a nearly 20-fold decrease.

The report breaks down the cost structure of the Falcon 9:

-

Manufacturing Cost: The manufacturing cost of a brand new Falcon 9 rocket is approximately $50 million. Among them, the first stage rocket, valued at about $30 million, is reusable.

-

Reuse Marginal Cost: When reusing a rocket, its marginal cost drops sharply. The report estimates that the pure marginal cost of a reused launch (mainly including the one-time second stage, refurbishment, fuel, operations, etc.) has fallen to about $15 million. Among this, fuel costs account for less than 1% of the total cost.

-

Amazing Profit Margin: Based on this cost structure, the report calculates that when a Falcon 9 rocket is reused 5 times, the gross profit margin per launch can reach about 68%. This high profit provides SpaceX with significant strategic flexibility, allowing it to use the profits from launch operations to support the development of Starship.

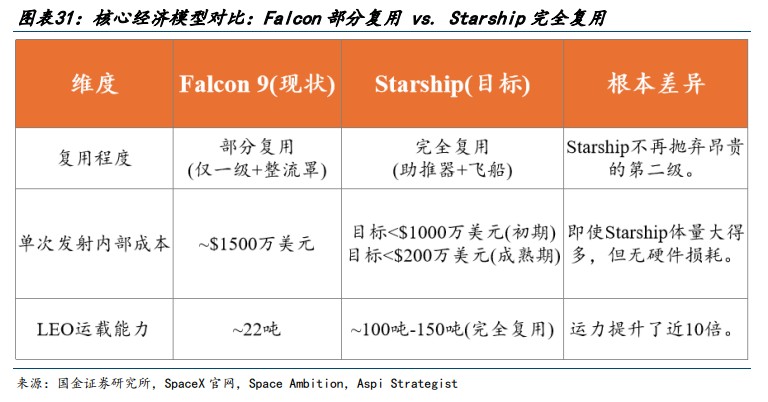

However, there is a "cost hard floor" of about $15 million for partial reuse of the Falcon 9, as its second stage rocket is expendable. This explains why SpaceX is fully committed to developing a fully reusable Starship, aiming to eliminate this cost floor and reduce space transportation costs by another order of magnitude.

Manufacturing Barrier: Vertical Integration in the Assembly Line Era

SpaceX's second core barrier lies in its manufacturing model, with its rocket-making philosophy being "closer to Tesla's car manufacturing than Boeing's aircraft manufacturing."

The report states that SpaceX has achieved a self-manufacturing rate of up to "80%", producing the vast majority of components in-house, including engines, airframe structures, electronic devices, and even spacesuits. This sharply contrasts with the traditional aerospace model where main contractors are only responsible for system integration.

Although this vertical integration strategy requires significant initial investment, it later brings "extremely high iteration speed and cost control capabilities," moving rocket manufacturing from a "workshop" to the "assembly line era."

In terms of manufacturing technology innovation, the report particularly emphasizes SpaceX's "disruptive decision" in the Starship project—abandoning expensive carbon fiber in favor of 304L series stainless steel.

In terms of manufacturing technology innovation, the report particularly emphasizes SpaceX's "disruptive decision" in the Starship project—abandoning expensive carbon fiber in favor of 304L series stainless steel.

The report cites data showing that although stainless steel is heavier, its cost is only about one-fiftieth that of carbon fiber (USD 2,500 per ton vs. USD 130,000 per ton), and it possesses excellent low-temperature strength and high-temperature resistance. More importantly, the stainless steel material allows SpaceX's Star Factory to "iterate spacecraft as quickly as shipbuilding."

Customer Barrier: Strategic Symbiosis with the U.S. Government

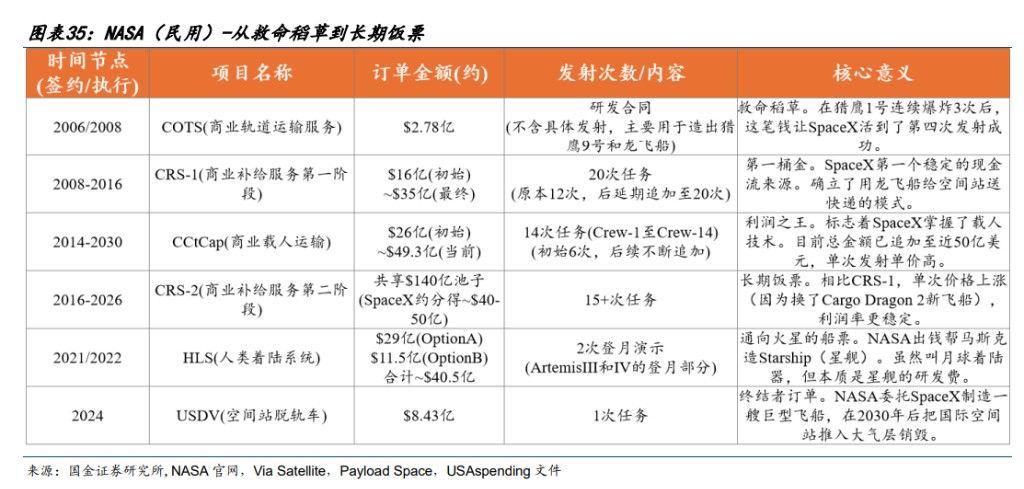

SpaceX's third moat is its "deep strategic symbiosis" relationship with the U.S. government, which goes beyond mere buying and selling. The report points out that NASA and the Department of Defense (DoD) are not only its largest customers but also its early funders for survival and technology iteration.

The report analyzes that this relationship has become a powerful moat, with NASA and DoD providing "de facto massive subsidies" for SpaceX's core R&D (especially Starship) through long-term, high-value contracts. In return, the U.S. government gains "independent, reliable, low-cost, and technologically advanced space access capabilities."

In the civilian sector, NASA's only means of sending astronauts to the International Space Station is SpaceX's Dragon spacecraft, forming a "single dependency." Additionally, through the Artemis lunar program, NASA collaborates with SpaceX to develop the lunar version of Starship (HLS), with funding "not given per launch but per progress," deeply binding the future of both parties.

In the military and intelligence community, SpaceX has grown from an "antitrust intruder" to a "core contractor." The report notes that the U.S. military is shifting from high-value, low-quantity satellites to distributed, high-quantity low-Earth orbit satellite constellations, and "only SpaceX has the sufficiently high launch frequency and sufficiently low cost to deploy the Starshield network."

The report specifically mentions that in collaboration with the National Reconnaissance Office (NRO), SpaceX's role has evolved to "both building satellites (based on the Starlink platform) and launching," indicating its deep integration into the U.S. national security system.