Under various pressures from Trump, the renewable energy sector has "unexpectedly" become a big winner in the U.S. stock market

儘管面臨美國政府的政策壓力,可再生能源板塊今年卻意外跑贏大盤和石油股,成為市場大贏家。標普全球清潔能源轉型指數年內飆升 44%,全球對可再生能源的投資創下歷史新高。核心驅動力源於人工智能革命引發的爆炸性能源需求。

儘管美國總統特朗普力推其 “大石油” 議程,但清潔能源股今年卻迎來了蓬勃發展。

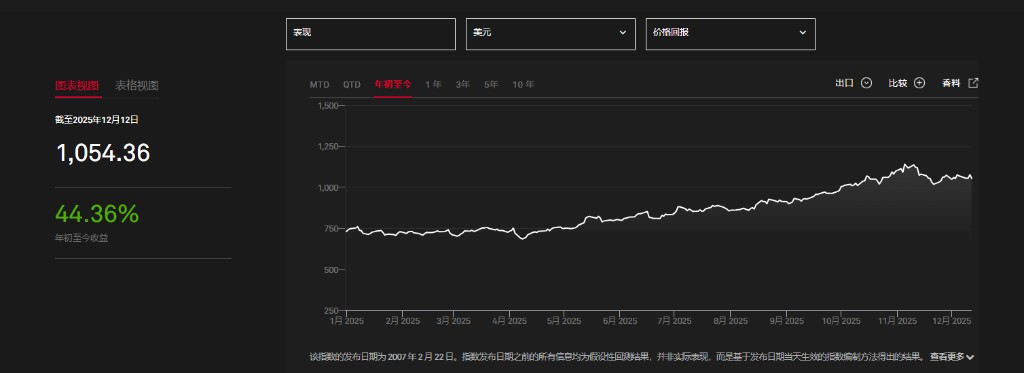

最新數據顯示,衡量該板塊表現的標普全球清潔能源轉型指數(S&P Global Clean Energy Transition Index)今年已飆升 44%,遠超標普 500 指數 16% 的漲幅。

這一表現與市場年初的普遍預期大相徑庭。當時,投資者因擔心特朗普政府會放棄綠色政策、轉而支持化石燃料而紛紛拋售太陽能和風能生產商等股票。

然而,現實是,該指數的表現甚至超過了標普全球石油指數 11% 的漲幅,這一指數曾被認為是特朗普 “鑽探吧,寶貝,鑽探吧” 議程下的主要受益者。

AI 點燃能源需求

人工智能的蓬勃發展是此輪清潔能源行情的核心驅動力。據彭博新能源財經預測,未來十年內,源自 AI 訓練和服務的電力需求將增長四倍,這將使數據中心成為全球電力消耗增長最快的領域之一。

巨大的能源缺口意味着所有形式的能源都將被需要。貝萊德國際基本面股票首席投資官 Helen Jewell 表示,能源需求正變得如此之高,以至於特朗普很可能不得不放棄他對可再生能源的 “戰爭”。

她表示:“我確信他將在 2026 年認識到對額外能源的需求,並以一種包容所有能源形式的方式來應對。這將為那些已經表現出色的股票提供額外的超級動力。”

企業層面已經開始行動。去年,微軟公司與 Brookfield Renewable Partners 簽署了一項協議,後者將從 2026 年開始在美國和歐洲提供超過 10.5 吉瓦的能源容量。這被譽為有史以來宣佈的最大的企業清潔能源採購協議。

政策分化與全球資金流向

儘管美國政府採取了試圖阻止風電場項目、並退出一項全球温室氣體減排協議等措施,但全球其他主要經濟體仍在加碼對清潔能源的投入,形成了鮮明的政策分化。

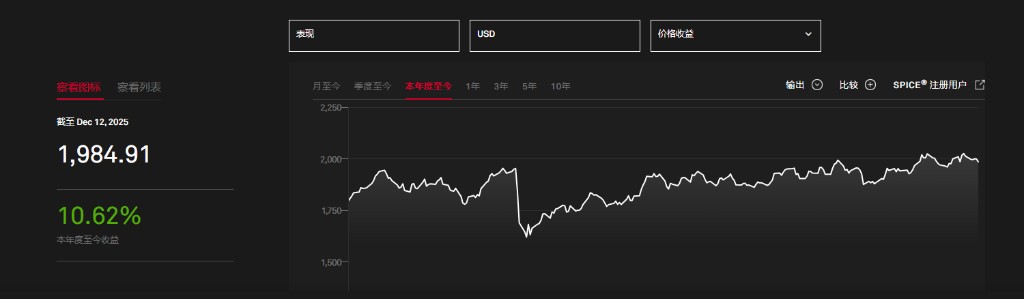

據報道,德國等國已承諾投入數十億美元用於電網開發和能源轉型基礎設施建設,為該行業提供了堅實支撐。這種支持體現在了全球投資流向上。根據彭博新能源財經的一份報告,2025 年上半年,可再生能源項目吸引了創紀錄的 3860 億美元投資,同比增長 10%。

數據顯示,儘管同期美國投資額較 2024 年下半年下降了 36%,但歐盟的投資額卻在陸上和海上風電的推動下飆升了 60% 以上。大型交易也印證了這一趨勢,例如阿波羅全球管理公司在 11 月同意向丹麥沃旭能源(Orsted A/S)運營的一個英國海上風電場投資 65 億美元。

個股表現與估值吸引力

市場的樂觀情緒直接反映在個股的驚人漲幅上。今年以來,美國燃料電池製造商 Bloom Energy Corp.的股價飆升了 328%。在歐洲,西門子能源的股價也翻了一倍多。

這些漲幅遠遠超過了包括 AI 領頭羊英偉達在內的美國科技巨頭約 30% 的漲幅。與此同時,由於特朗普推動美國生產商增產,部分導致了全球供應過剩,油價下跌了 14%。

儘管近期市場對大型科技公司在 AI 領域過度支出的擔憂,導致清潔能源轉型指數從 11 月創下的兩年多高點回落了 7.6%,但市場參與者認為,該行業的長期前景依然樂觀。從估值來看,該指數目前的遠期市盈率約為 20 倍,低於其 23 倍的五年平均水平,且仍比 2007 年的歷史高點低約 73%,顯示出潛在的增長空間。

投資與交易平台 IG 的首席市場分析師 Chris Beauchamp 表示:“雖然石油顯然不會消失,但或許投資者是時候更多地關注可再生能源了。”