Concerns over AI impact lead to a broad decline in Japanese and South Korean stock markets, while gold, silver, and copper prices rise

Due to increasing concerns over the high valuations of technology companies and massive AI expenditures, Asian stock markets declined, with the South Korean stock market dropping nearly 3% at one point, Samsung Electronics falling over 3%, and the Nikkei 225 index decreasing by more than 1%. Market risk aversion has risen, leading to an increase in gold prices, which is expected to achieve its best annual performance since 1979, while LME copper continued to rise by over 1%. The market is also closely monitoring the policy meetings of major central banks, including the Bank of Japan, this week

Concerns surrounding the prospects of AI are impacting global markets, leading to pressure on Asian stock markets on Monday, while safe-haven asset gold continues its upward trend.

On Monday, December 15, influenced by last Friday's sell-off of tech stocks on Wall Street, the MSCI Asia-Pacific stock index fell by 0.7%. As a typical representative of this year's AI investment boom, the South Korean stock market led the decline, with its Seoul Composite Index opening down 2.7%, and Samsung Electronics dropping over 3%.

The S&P/ASX 200 index in Australia fell by 0.7%, while the Nikkei 225 index opened lower and dropped over 1%.

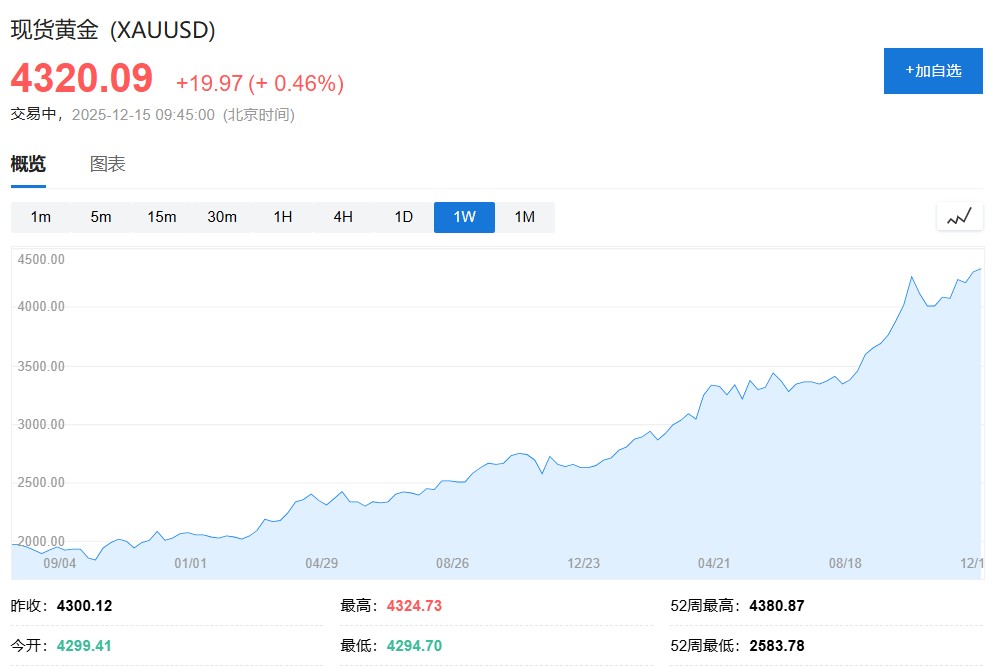

The shift in market sentiment has driven funds towards safe-haven assets. Gold prices are expected to rise for the fifth consecutive day, having increased by over 60% this year, and along with silver, which has doubled in price this year, is on track for its best annual performance since 1979. Spot gold is currently up about 0.5%, priced at $4,320 per ounce. Spot silver is up 0.9%.

Meanwhile, LME copper continues its upward trend, rising over 1%, with the latest price at $11,659 per ton.

Although U.S. stock index futures saw a slight rebound on Monday, suggesting that the market may stabilize, concerns about an AI bubble have become the dominant issue in the market. From Nvidia's recent stock price correction to Oracle's significant drop in stock price due to the disclosure of soaring AI expenditures, signs of skepticism regarding AI-related investments are increasingly evident.

The performance of major Asian assets is as follows:

Nikkei 225 Index opened down 0.9% and then expanded its decline to 1.4%.

Korea's Seoul Composite Index opened down 2.7%, with Samsung Electronics dropping over 3%.

Taiwan Stock Exchange Weighted Index fell 1.3% to 27,829.83 points.

Australia's S&P/ASX 200 Index fell 0.7%.

MSCI Asia-Pacific Stock Index fell 0.7%.

FTSE China A50 Index futures opened down 0.33%.

LME Copper continues its upward trend, rising over 1%, with the latest price at $11,659 per ton.

Spot Gold is currently up about 0.5%, priced at $4,320 per ounce

Spot silver rose 0.9%. New York silver rose over 1%.

Concerns about AI bubble intensify, Asian tech stocks under pressure

Global risk appetite is weakening, primarily due to market skepticism about whether the tech stocks that drove global indices to record highs can continue to support their lofty valuations and aggressive AI spending. The Asian market has performed strongly this year, but it appears particularly vulnerable due to the region's significant role in the component manufacturing industry that supports the tech boom.

Nick Twidale, Chief Market Analyst at AT Global Markets in Sydney, stated that last Friday's market dynamics highlighted "the potential for an AI bubble to burst in the near future." He noted, "Despite trade concerns, the Asian market has seen good growth over the past year driven by AI and the broader tech sector, so I expect a significant pullback in today's trading."

Concerns about AI trading involve its application scenarios, enormous development costs, and whether consumers will ultimately pay for these services. The answers to these questions will have a significant impact on the future direction of the stock market. A debate is unfolding among investors: whether to reduce AI risk exposure before a potential bubble burst or to double down to capitalize on this disruptive technology.

Fed policy divergence intensifies, gold gains support

Amid stock market turbulence, the U.S. Treasury market stabilized on Monday, with the 10-year Treasury yield holding steady at around 4.18%. The debate within the market and among Federal Reserve officials about how much to loosen policy next year continues.

Cleveland Fed President Beth Hammack expressed her preference for keeping interest rates at a slightly more restrictive level to continue applying pressure on inflation. In contrast, Chicago Fed President Austan Goolsbee indicated that he expects more rate cuts in 2026 than many of his colleagues. These conflicting statements have led traders to reduce bets on further monetary easing in the U.S. next year, providing support for non-yielding assets like gold.

Market focuses on key data and central bank meetings this week

This week marks the final intensive period for major central bank policy meetings in 2025, with the Bank of England and the Bank of Japan's meetings drawing significant attention. Confidence among large Japanese manufacturers has risen to its highest level in four years, reinforcing market expectations for a rate hike by the Bank of Japan this week.

Additionally, a series of global data releases will be published to help assess the direction of monetary policy in 2026, including growth data from New Zealand, economic activity data from Europe, and inflation data from Canada and the UK. In China, a range of data including retail sales and industrial production will be in the spotlight.

Kyle Rodda, Senior Analyst at Capital.com, stated, "In the wake of renewed concerns about AI valuations, the 'Santa Claus rally' cannot get started." He believes that the event risks this week are sufficient to keep investors on alert, which could either spark the "Santa Claus rally" or trigger deeper sell-offs