The selling pressure on tech stocks has temporarily eased, U.S. stock index futures have slightly rebounded, risk aversion sentiment has driven significant increases in gold, silver, and copper, and the yen has strengthened

Global markets are shrouded in complex dual emotions: on one hand, the aftermath of last Friday's tech stock sell-off in the U.S. led to a general decline in the Asia-Pacific stock markets on Monday, with the MSCI Asia-Pacific Index falling by 1.2%; on the other hand, funds are rapidly flowing into safe-haven assets, pushing spot gold close to historical highs, silver soaring over 2%, and the yen rising to a one-week high against the dollar

The Asia-Pacific stock market fell sharply on Monday, continuing the sell-off of U.S. tech stocks from last Friday, with the MSCI Asia-Pacific (excluding Japan) index down 1.2%. U.S. stock futures rebounded slightly on Monday, attempting to recover from last Friday's decline of over 1%, while commodities such as gold, silver, and copper rebounded strongly, with gold nearing historical highs. Bitcoin reversed earlier losses, rising back to $90,000, indicating a stabilization of risk sentiment. Currently, the core of market turbulence lies in the ongoing doubts about the return on investment in artificial intelligence.

Last Friday, U.S. tech stocks led the decline, reflecting growing skepticism in the market about whether the tech stocks that drove global benchmark indices to record highs can continue to support high valuations. Marc Velan, Chief Investment Officer at Lucerne Asset Management in Singapore, pointed out that the risk-averse sentiment in the Asian market resembles an overflow effect from the U.S. tech stock sell-off last Friday, with the unwinding of AI capital expenditure trades impacting global risk appetite.

This week, global central bank decisions are densely packed, with the Bank of Japan expected to raise interest rates by 25 basis points to 0.75%, the Bank of England possibly lowering rates by the same margin to 3.75%, and the European Central Bank expected to keep rates unchanged. Investors will also be awaiting key data such as the delayed November employment report and monthly consumer price index due to the U.S. government shutdown, as the market attempts to glean clues about the health of the U.S. economy from this data void.

Kyle Rodda, Senior Analyst at Capital.com, stated: "In the new concerns over AI valuations, the 'Christmas rally' cannot get started. Although the risks are not as high as last week, there are still enough event risks to keep investors on alert, which could spark a Christmas rally or similarly deepen the sell-off."

Core Markets

S&P 500 futures rose 0.3%, and Nasdaq 100 futures rose 0.2%;

Euro Stoxx 50 futures rose 0.3%;

MSCI Asia-Pacific index fell 0.6%; Nikkei 225 index fell 1.3%, and South Korea's KOSPI index fell;

The dollar index remained basically flat; the yen appreciated 0.6% against the dollar to 154.955, close to its strongest level in a week.

The yield on 10-year U.S. Treasury bonds fell 1 basis point to 4.17%;

The yield on 10-year Japanese government bonds rose 1 basis point to 1.955%;

Spot gold rose 1.1%, quoted at $4,345.50 per ounce; spot silver rose 2.03%, quoted at $63.28 per ounce;

WTI crude oil futures rose 0.4%, quoted at $57.35 per barrel; Brent crude oil rose 0.4%, quoted at $61.35 per barrel;

Bitcoin rose 1.6%, quoted at $89,862.01; Ethereum rose 1.9%, quoted at $3,140.8;

U.S. stock futures rebound slightly in an attempt to halt the decline, while the yen rises as the market bets on a rate hike by the Bank of Japan

U.S. stock index futures rebounded 0.3% on Monday, with S&P 500 e-mini futures and Nasdaq 100 futures both recording gains, attempting to recover from last Friday's decline of over 1%

Regarding the decline of U.S. stocks last Friday, analysis pointed out that from the recent drop in NVIDIA's stock price, to Oracle Corporation's plummet after reporting a surge in AI spending, and the deteriorating sentiment surrounding OpenAI-related companies, signs of skepticism are increasing.

Ed Yardeni, founder of Yardeni Research, downgraded the so-called "seven giants" of large tech companies to underweight last week. He believes the core issues lie in the application prospects of AI, development costs, and whether consumers are ultimately willing to pay for services, as these answers will significantly impact the future direction of the stock market.

Looking ahead to this week, the market will continue to focus on the movements of AI stocks. Additionally, investors will have the opportunity to access economic data that was delayed due to the government shutdown, including the November employment report and the monthly Consumer Price Index. These reports will help answer the primary question entering 2026: Is the Federal Reserve nearing the end of its easing cycle after three consecutive rate cuts, or does it need to take more aggressive action?

Ben Bennett, Head of Asian Investment Strategy at L&G Asset Management, stated, "Given the data collection issues and the direct impact of the government shutdown on the economy, this week's data should be treated with caution. We won't have a clearer understanding of the U.S. economic situation until 2026."

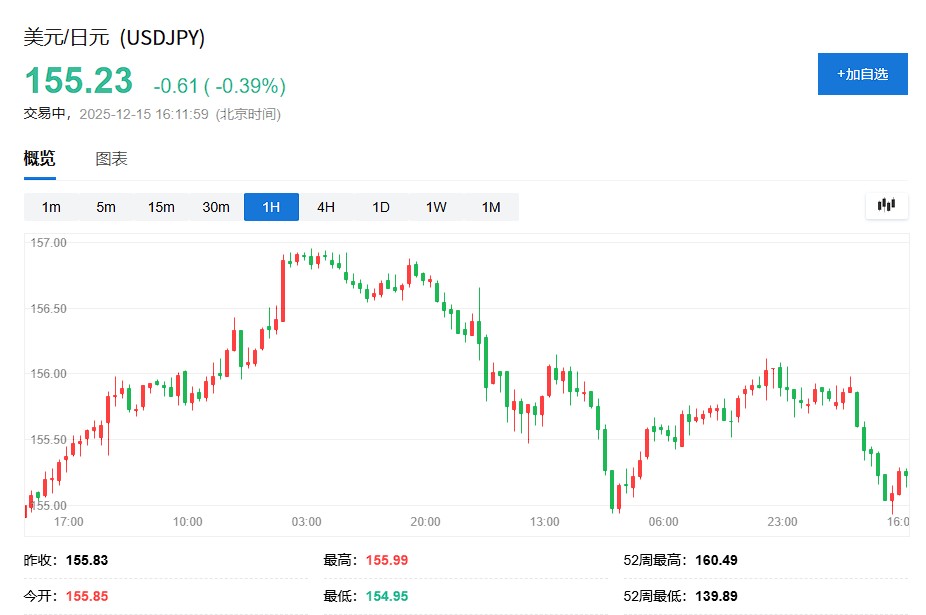

As investors increase their bets that the Bank of Japan will raise interest rates later this week, the USD/JPY significantly fell, hitting a low of 154.95.

(U.S. Dollar/Japanese Yen 1H Chart)

The quarterly Tankan survey released by the Bank of Japan on Monday showed that the confidence index for large manufacturers reached its highest level in four years, reinforcing market expectations for an imminent rate hike by the central bank. Japan's Chief Cabinet Secretary Hirokazu Matsuno also stated that the specifics of monetary policy should be left to the Bank of Japan to decide.

David Forrester, Senior Strategist at Crédit Agricole in Singapore, noted that in addition to the strong Tankan survey results, "Matsuno's comments have raised market expectations for continued rate hikes after a possible hike this week." However, he pointed out that "Ueda's recent comments tend to be dovish, which may disappoint some investors this Friday."

Analysis indicates that investors will closely watch whether Ueda provides any guidance on the future rate hike path this Friday, which could be a key factor in determining the direction of the yen. Although Japanese interest rates are expected to rise, the yield gap with the U.S. is likely to remain significant, which may limit the upside potential of the yen.

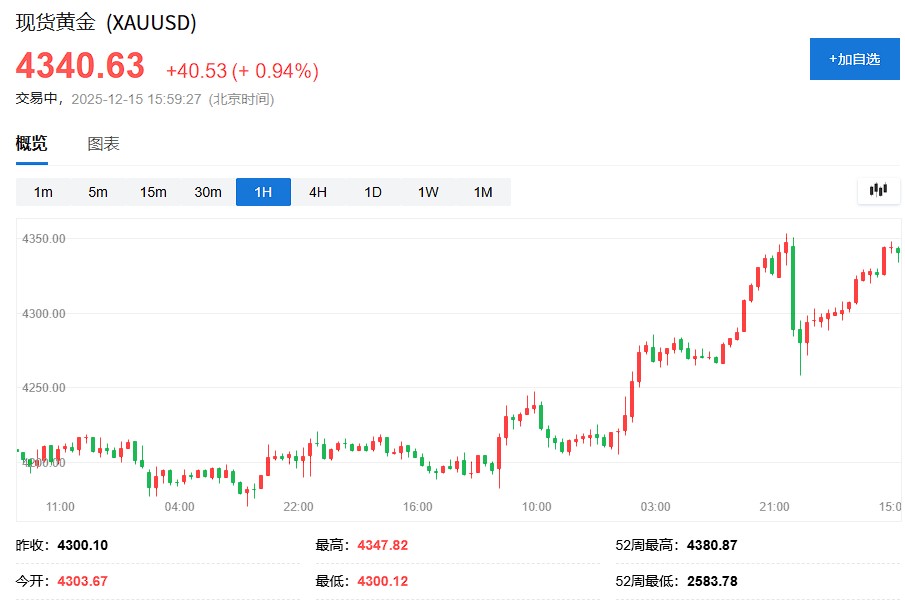

Gold, silver, copper, and oil all rise, gold approaches record high

Gold continued its recent upward trend for the fifth day, nearing the historical high of $4,381.21 per ounce. As of the time of writing, spot gold prices rose 1.0% to $4,344.89, as risk-averse investors withdrew from Asian stock markets due to concerns about the prospects of tech companies heavily investing in AI

(Current Spot Gold 1H Chart)

Spot silver also climbed again today, as of the time of writing, silver rose over 2%, reported at $63.28 per ounce.

(Current Spot Silver 1H Chart)

It is worth noting that gold has surged over 60% this year, while silver has more than doubled, both are expected to achieve their best annual performance since 1979.

Copper prices recovered some of last Friday's losses, as investors refocused on the tightening market outlook for 2026. Copper prices on the London Metal Exchange rose 1.5%, after a 3% plunge on Friday due to concerns over demand for metals used in electrical wiring and renewable energy equipment triggered by a sell-off in AI-related stocks.

(LME Copper 1H Chart)

Copper prices have risen over 30% this year, boosted by a series of mine disruptions that reduced supply and traders transporting large amounts of copper to the U.S. ahead of potential import tariffs. The wave of investment in green energy and power infrastructure has also sparked optimism about long-term demand.

ANZ analyst Brian Martin stated in a report: "Despite concerns about a global economic slowdown, demand continues to exceed expectations. We are bullish on copper prices and expect the market to further fall into deficit by 2026."

Brent crude oil rose 0.4% to $61.35, while U.S. WTI crude oil increased 0.37% to $57.35 per barrel, supported by tensions between the U.S. and Venezuela and supply concerns in other regions.

(Brent Crude Oil 1H Chart)

(WTI Crude Oil 1H Chart)