In the first 11 months, ZA ONLINE's premium growth was 5.63%, with health and auto insurance becoming the "new engines."

臨近年末,不少頭部險企的業績趨勢已漸漸清晰。 日前,眾安在線公告公司前 11 個月負債端成績,披露公司…

臨近年末,不少頭部險企的業績趨勢已漸漸清晰。

日前,眾安在線公告公司前 11 個月負債端成績,披露公司已錄得保費收入 329.04 億元,同比增長 5.63%;

對比往年同期,近 330 億元的保費已是歷史最高成績,距離 2024 年全年 334.18 億元的保費僅有一步之遙。

而此前眾安曾披露上半年錄得淨利 6.68 億元,已高於去年全年的 6.08 億元;

這意味着,該公司 2025 年極有可能實現保費、利潤的雙重超越。

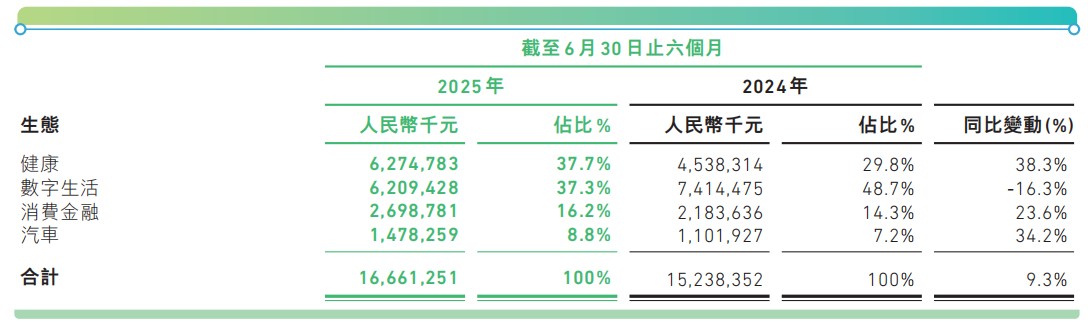

中報揭示了更多具體的負債端變化:

上半年,眾安的健康、數字生活、消金、汽車生態板塊保費貢獻率分別為 37.7%、37.3%、16.2%、8.8%,尤其健康與汽車板塊均出現收入的大幅增長。

健康生態的增長得益於醫保支付方式改革深化,以及健康險與基本醫保協同效應的增強。

2025 年上半年,國內健康險保費規模持續增長 3.1%,眾安則圍繞著百萬醫療險,構建了普惠、慢病、門急診險、重疾、中高端醫療等產品矩陣,市場佔有率進一步提升。

汽車生態則聚焦車險業務,在上半年從與平安財險的聯合經營,改為獨立經營。

據眾安在線相關負責人介紹,眾安已在上海、浙江兩個地區獨立自主經營交強險,實現交強險 “從 0 到 1” 的突破,上海地區的商業車險也已實現獨立自主經營。

除保險業務的負債端增長之外,眾安其餘幾條業務線均出現價值增長,其中銀行扭虧為盈、科技業務虧損幅度收窄;

幾重因素共同作用之下,上半年 6.68 億元的淨利潤已是上年同期的 11 倍。

值得一提的是,半個月前的董事決議中,眾安剛剛開啓了新一輪的管理層任期,確定在未來三年由原董事長尹海繼續擔任 “一把手”,併兼任戰略與投資決策委員會主任。

業績回温疊加領導層平穩交接,眾安 2025-2027 年的方向已具備連續性奠定基礎。

不過從目前看來,眾安在線仍面臨一定的業績持續性挑戰:

近五年來,該公司業績持續處於 “大起大落” 之中,2021-2024 年、2025 年上半年的利潤增速分別為 110.3%、-216.44%、466.58%、-85.2%、1103.54%;

營收增速則呈現下滑趨勢,在 2025 年上半年收窄至-0.4%。

前期業績的波動與資本市場變化掛鈎,也一定程度取決於眾安業態的複雜:

例如保險之外,該公司旗下的科技公司與虛擬銀行 ZA Bank,在前期都需要大量資金投入。

如今上述兩部分業務已出現企穩趨勢,例如,上半年科技分部淨虧損為人民幣 0.56 億元、同比改善 3 成,ZA Bank 則扭虧為盈、實現淨利潤 0.49 億港元;

不過這樣的變化能否代表業績的趨勢性上升,也還需要更多時間予以驗證。