博通三天重挫 17.7%,“谷歌链” 核心遭遇 2020 年来最惨暴击

博通股價連續三個交易日下跌,累計跌幅達 17.7%,並創下自 2020 年 3 月以來最差的三日表現。此次暴跌導致其市值蒸發超過 3000 億美元,規模約等於一個 AMD 的市值。市值縮水後,博通在美國上市公司市值排行榜上的位置被 Meta 超越,跌出前六。

芯片巨頭博通在上週發佈財報後,遭遇了市場的猛烈連續拋售。

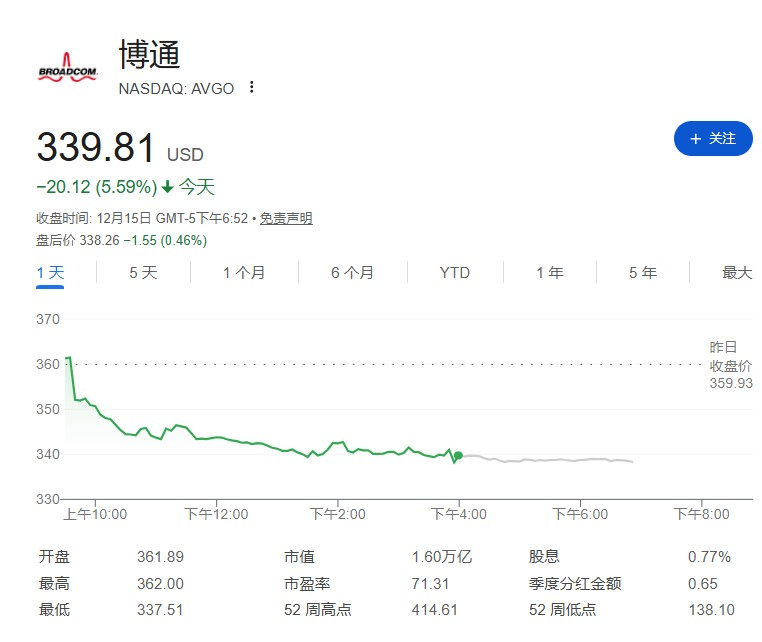

這輪拋售一直延續至本週。博通股價本週一再度下跌 5.6%,使其連續三個交易日的累計跌幅達到 17.7%。道瓊斯市場數據顯示,這一表現是該公司自 2020 年 3 月 18 日以來最差的三日跌幅。

當前,美股盤後博通的股價仍然處於微跌狀態。

此次股價重挫對投資者的直接影響是巨大的財富蒸發。在短短三個交易日內,博通的市值抹去了超過 3000 億美元,這一損失的規模約等於其競爭對手 AMD 的總市值。

市值的急劇縮水也改變了美國科技巨頭的市值排名。由於博通股價的持續承壓,Meta 的市值已重新超越博通,使這家社交媒體巨頭重返美國市值第六大公司的位置。

這一變化雖然部分源於 Meta 股價的温和上漲,但主要還是由博通自身的急劇下跌所驅動。對於市場來説,這種排名的變化是一個不容忽視的信號,反映了資本在科技巨頭之間的快速流動和重新評估。

近日,在 AI 擔憂愈發激烈之下,隨着博通股價三天大跌超 17%,“OpenAI 鏈” 和 “谷歌鏈” 都遭受了重創。

而這場拋售由兩記重拳引燃。華爾街見聞寫道,首先,“谷歌鏈” 核心標的——博通在上週公佈了財報,儘管銷售額創下歷史新高,但其對 AI 業務的收入預測未能滿足華爾街的極高期望。

其次,“OpenAI 鏈” 核心公司——甲骨文剛公佈完不及預期的財報後,其為 ChatGPT 所有者 OpenAI 建設的部分數據中心,又被曝完工日期可能從 2027 年推遲至 2028 年,這直接引發了市場對 AI 基礎設施建設速度的質疑。