U.S. October retail sales remained flat overall, but core indicators significantly exceeded expectations, supporting fourth-quarter growth

In October, U.S. retail sales were flat month-on-month, slightly below market expectations, affected by a decline in auto sales and lower gasoline prices. However, after excluding volatile items such as automobiles and gasoline, the core retail indicators performed significantly better than expected, indicating that consumer spending is accelerating in the early stages of the holiday shopping season. The retail sales control group used for GDP calculations surged 0.8% month-on-month, marking the largest increase since June

In October, U.S. retail sales overall performance was dragged down by a decline in auto sales and falling gasoline prices. However, the core indicators, excluding more volatile categories, showed strong growth, providing evidence of accelerated consumer spending in the early holiday shopping season and laying the foundation for GDP growth in the fourth quarter.

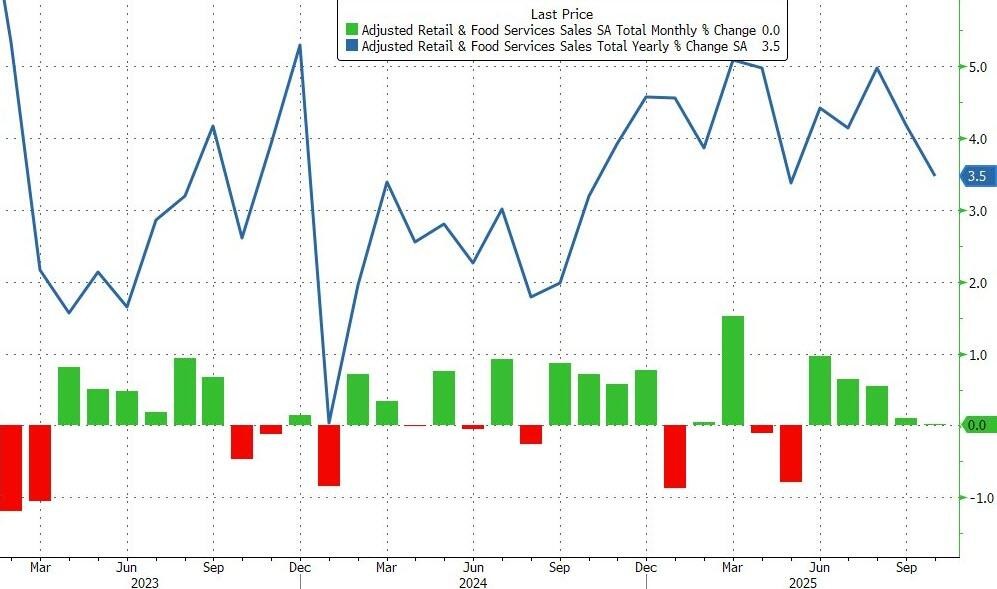

On Tuesday (December 16), data released by the U.S. Department of Commerce, delayed due to the government shutdown, showed that October retail sales were flat month-on-month, slightly below the expected 0.1% growth, which also caused the year-on-year growth rate to fall to 3.5%. September data was revised upward to a growth of 0.1%.

Strong Growth in Core Indicators, Consumer Spending Rebounds

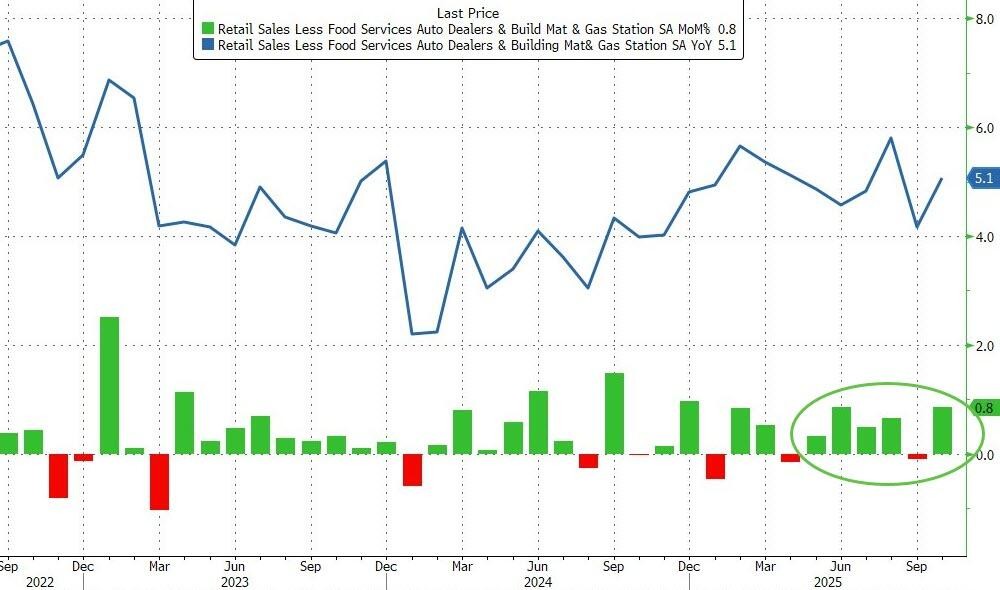

Excluding auto dealers and gas stations, sales increased by 0.5%, surpassing the expected 0.4% increase.

The retail sales control group surged 0.8% month-on-month, twice the market expectation and also the largest month-on-month increase since June. This indicator excludes volatile categories such as food services, auto dealers, building material stores, and gas stations. This increase brought the year-on-year growth rate of the indicator to a strong level of 5.1%.

These data indicate that consumer spending has rebounded in the early weeks of the holiday shopping season. Many consumers are concerned about job prospects and are also dissatisfied with high living costs, leading them to actively seek discounts and deals. Amid competitive promotional activities launched by retailers, consumer demand remains resilient.

Michael Pearce, Chief U.S. Economist at Oxford Economics, stated in a report:

“The partial consumption strength in October may reflect consumers shopping early for the holidays, with a noticeable increase in non-store sales in October.”

Although market concerns about a "K-shaped" economy continue to affect market sentiment, this divergence has not yet manifested in the overall data. The strong performance of core retail sales supports robust GDP growth in the fourth quarter.

Auto Sales Drag Down Overall Data

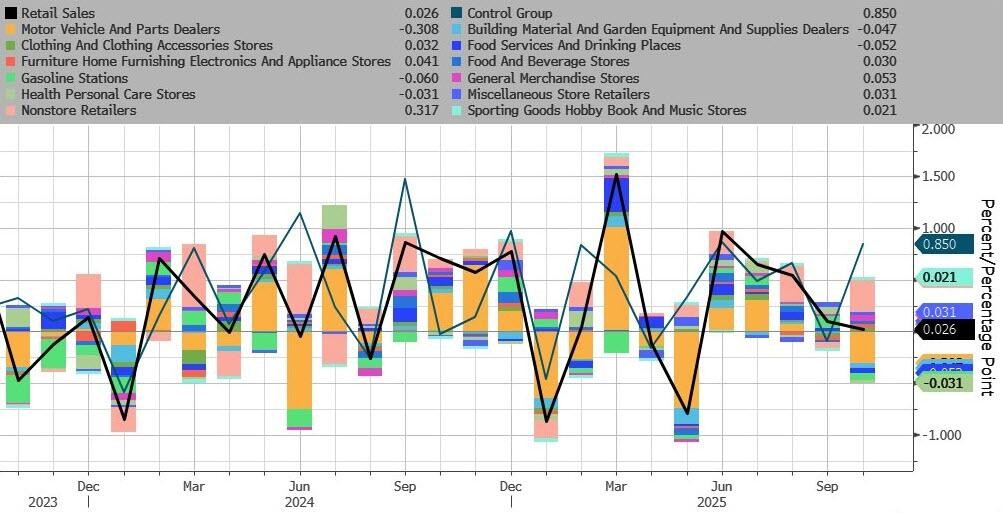

Subcategory data showed that 8 out of 13 retail categories achieved growth, with department stores and online merchants performing steadily.

Motor vehicle sales fell 1.6% month-on-month, partly due to the expiration of federal electric vehicle tax credits. Falling gasoline prices also depressed sales at gas stations.

Data not adjusted for inflation may reflect price increases

Today, October is regarded as the unofficial start of the holiday shopping season, with major retailers kicking off the festivities through aggressive promotions. The consumption performance during November's "Black Friday" is also robust, indicating that demand remains resilient.

Retail data also shows that sales performance is particularly strong among electronics and appliance stores, furniture stores, and sporting goods retailers. Spending in restaurants and bars—the only service sector category in the retail report—declined by 0.4% month-over-month.

Economists expect that after potentially strong growth in the third quarter, personal spending on goods and services will slow in the last three months of the year.

Since retail sales data is not adjusted for inflation, monthly growth may reflect price increases rather than enhanced demand. Additionally, this data primarily reflects goods consumption, which accounts for about one-third of total household spending.

Signals from major retailers are mixed. Walmart and clothing chains like Gap and T.J. Maxx reported strong performances and indicated that the holiday shopping season is expected to strengthen. However, recent data and outlooks from retailers like Home Depot and Target are weaker, showing that consumer sentiment is becoming more cautious.

At the same time, there are signs that inflation-weary consumers are resisting retailers' attempts to raise prices. Executives in the grocery industry report that consumers are opting for smaller package sizes or turning to more affordable stores. Warehouse retailers like Costco are increasingly relying on private label products to offer consumers more attractive prices