Will Japan's interest rate hike trigger a global liquidity shock?

全球流動性的 “灰犀牛” 還是 “紙老虎”?西部證券認為,市場對日央行本月加息已有充分預期,其直接衝擊或有限,因為大部分日元套利交易已平倉。但真正的風險在於,日本加息可能成為一個 “催化劑”,在美股 “AI 泡沫” 擔憂和市場脆弱的背景下,引爆全球流動性衝擊。

隨着日本央行 12 月 19 日貨幣政策會議的臨近,市場對於其可能採取鷹派加息的擔憂日益加劇。這一舉動是否會終結廉價日元時代,並引爆全球流動性危機?西部證券於 12 月 16 日發佈的最新策略報告對此進行了深入剖析。

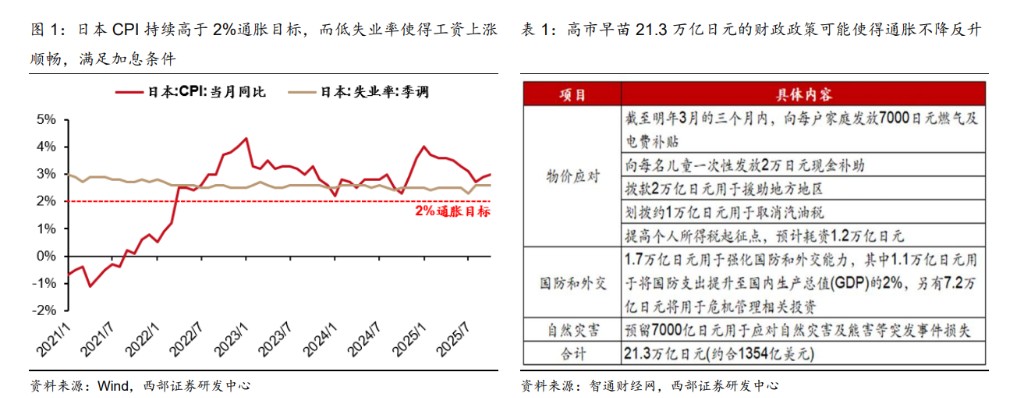

通脹高企,日本鷹派加息勢在必行

報告指出,日本央行此次加息的背後有多重驅動因素。首先,日本的 CPI 已持續高於 2% 的官方通脹目標。其次,失業率長期維持在 3% 以下的低位,為名義工資增長創造了有利條件,市場對明年 “春鬥”(春季勞資談判)的工資增長預期較高,這將進一步推升通脹壓力。最後,高市早苗推出的 21.3 萬億日元財政政策也可能加劇通脹。

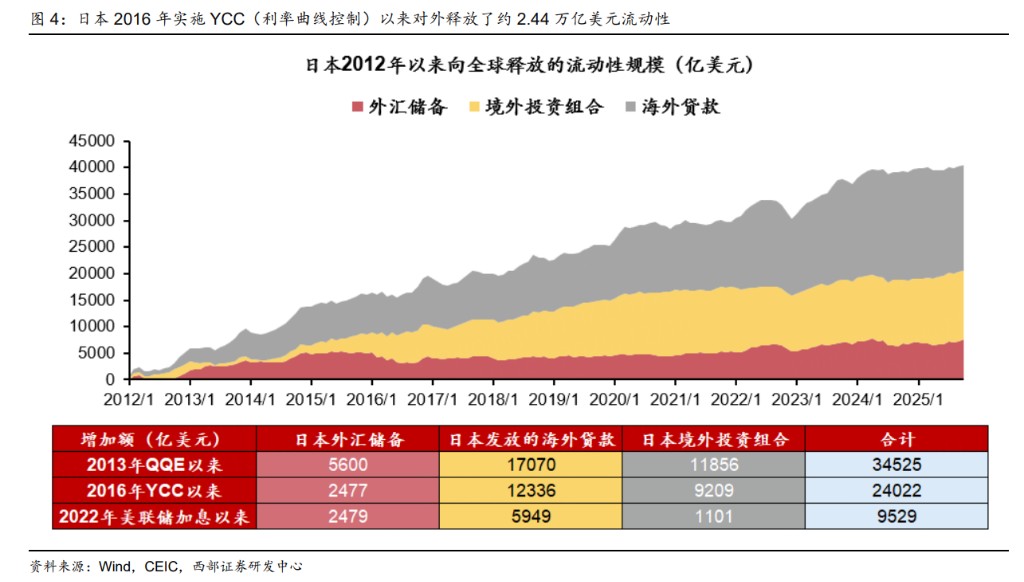

這些因素共同迫使日本央行採取更鷹派的立場。市場擔憂,一旦加息落地,將導致在日本 YCC(收益率曲線控制)時代積累的大量 “套息套匯交易” 集中平倉,從而對全球金融市場造成流動性衝擊。

理論拆解:為何流動性衝擊最危險的階段或已過去?

儘管市場憂心忡忡,但報告分析認為,從理論上看,當前日本加息對全球流動性的衝擊是有限的。

報告列舉了四點理由:

-

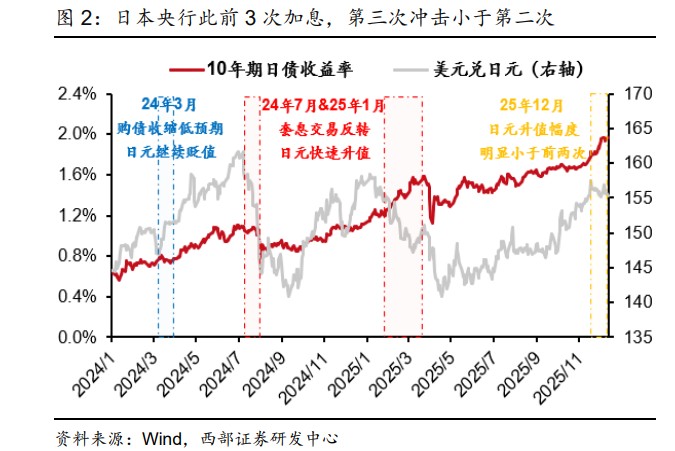

風險已部分釋放: 日本央行自去年 3 月以來已進行過 3 次加息。其中,去年 7 月的加息疊加退出 YCC 確實導致了較大的流動性衝擊,但今年 1 月的加息衝擊已明顯減弱,表明市場的適應性在增強。

-

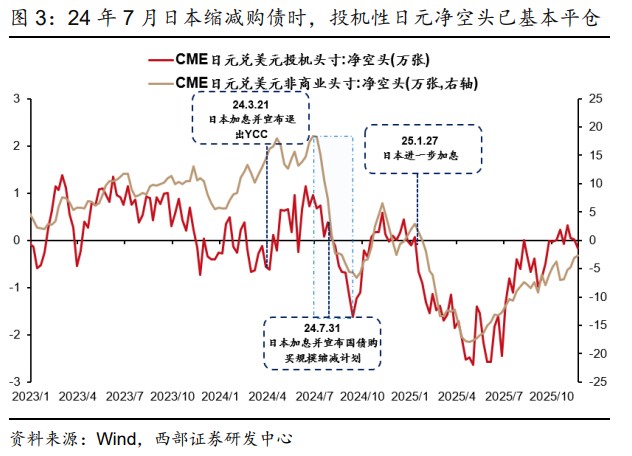

投機盤已提前離場: 從期貨市場數據看,大部分投機性日元空頭在去年 7 月已經平倉。這意味着最活躍、最可能引發連鎖反應的 “套息套匯交易” 已經退潮,流動性衝擊最危險的階段已經過去。

-

宏觀環境不同: 當前美國並未出現類似去年 7 月時的 “衰退交易”,美元貶值壓力不大,而日元自身因地緣和債務問題表現疲軟。這減弱了日元升值預期,從而緩解了 “套息套匯交易” 平倉的緊迫性。

-

美聯儲的 “安全墊”: 報告特別提到,美聯儲已開始重視潛在的流動性風險,並已開啓擴表(類 QE)政策,這能有效穩定市場流動性預期,為全球金融系統提供緩衝。

實際風險:脆弱市場下的 “催化劑”

報告強調,理論上的安全不代表高枕無憂。當前全球市場的脆弱性,是日本加息可能引發衝擊的真正根源。報告將其形容為“催化劑”。

報告分析,去年 7 月日本加息之所以衝擊巨大,是因為 “大量活躍的套息套匯盤平倉” 與 “美國衰退交易” 兩大因素共振。而當前,前者條件已弱化。然而,新的風險正在浮現:以美股為代表的全球股市經歷了長達 6 年的 “大水牛”,本身積累了大量獲利盤,具有脆弱性。同時,美國市場關於“AI 泡沫論”的擔憂再起,資金避險情緒濃厚。

不過,當前以美股為代表的全球股市已經 6 年 “大水牛”,本身就有脆 弱性,同時美國 “AI 泡沫論” 的擔憂又起,資金避險情緒較重,日元加息有可 能成為誘發全球流動性衝擊的 “催化劑”。

在這種背景下,日本加息這一確定性事件,很可能成為一個導火索,觸發資金的恐慌性出逃,從而誘發全球性的流動性衝擊。不過,報告也給出了一個相對樂觀的判斷:這種流動性衝擊大概率會倒逼美聯儲祭出更強的寬鬆政策(QE),因此全球股市在經歷短暫的急跌後,很有可能會快速修復。

多看少動,緊盯 “股債匯三殺” 信號

面對這種複雜的局面,報告給投資者的建議是“多看少動”。

報告認為,由於日本央行的決策基本已是 “明牌”,但資金的選擇難以預測,因此最佳策略是保持觀察。

-

情景一: 如果資金並未出現恐慌性出逃,日本加息的實際影響將非常有限,投資者無需採取行動。

-

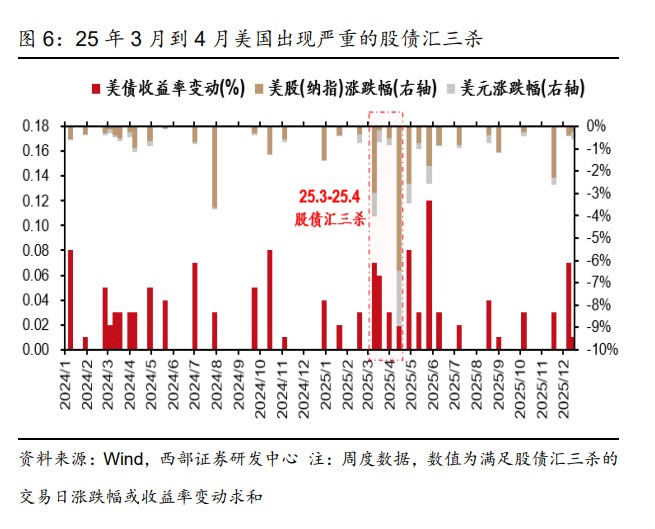

情景二: 如果資金恐慌真的誘發了全球流動性衝擊,投資者需要密切跟蹤一個關鍵信號——美國市場是否連續出現 2-3 次 “股債匯三殺”(即股市、債市、匯市同步下跌)。報告指出,類似今年 4 月初的情況一旦重演,則表明市場出現流動性衝擊的概率明顯增強。

最後,報告認為,即便日本加息短期內引發動盪,也不會改變全球中長期貨幣寬鬆的大趨勢。在此背景下,繼續看好黃金的戰略配置價值。同時,隨着中國出口順差擴張和美聯儲重啓降息,人民幣匯率有望迴歸中長期升值趨勢,加速跨境資本回流,利好中國資產。報告看好 AH 股迎來盈利和估值的 “戴維斯雙擊”。對於美股和美債,報告持震盪看法。