Next year's capital expenditure for data centers is expected to grow by over 50%! JP Morgan: Earnings expectations for AI-related stocks are underestimated

JP Morgan expects that the growth rate of capital expenditure for data centers will exceed 50% in 2026, a significant increase from the previous expectation of 30%. This means that there will be an additional expenditure of over $150 billion next year, while Wall Street's forecasts have not yet accounted for the upward potential of AI revenue brought by capital expenditure

As the market worries about a decline in AI capital expenditures, JP Morgan has significantly raised its forecast for data center capital expenditure growth, believing that the market has severely underestimated the profit potential of AI-related stocks.

According to the Wind Trading Desk, JP Morgan's North American equity research team stated in its latest report that the arms race among large technology companies is not only not slowing down but is actually accelerating.

According to the report, the growth rate of data center capital expenditures is expected to exceed 50% in 2026, a significant increase from the previous expectation of 30%. This means that there will be an additional expenditure of over $150 billion next year, essentially covering the expected revenues of core AI chip manufacturers such as NVIDIA, AMD, Broadcom, and Marvell.

More importantly, due to the continuous severe lag in AI computing power supply compared to demand, JP Morgan believes that the actual growth rate could reach over 60%, which will bring unexpected performance growth opportunities for companies related to AI infrastructure. Currently, the market's profit expectations for core targets in the AI industry chain remain overly conservative.

Significant Upgrade in Capital Expenditure Forecast: Explosive Growth Expected in 2026

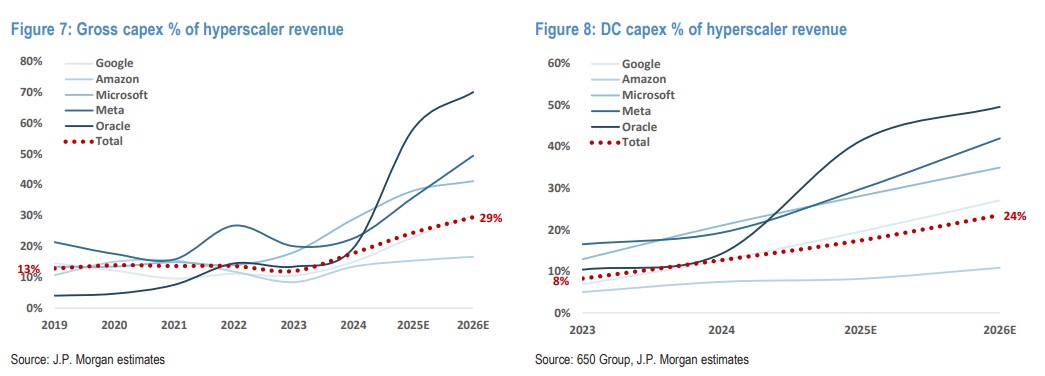

The latest analysis from JP Morgan's IT hardware team shows that the growth rate of data center expenditures in 2025 has been significantly raised from the previously predicted 55% to about 65%. The driving force behind this adjustment is the continued investment by hyperscale cloud service providers in AI infrastructure, while the fundamental reason is that the available AI computing power supply still far fails to meet market demand.

In absolute terms, the incremental expenditure in 2025 compared to 2024 is expected to exceed $115 billion, a figure significantly higher than the year-on-year increment of $75-80 billion in 2024. Notably, this $115 billion in incremental expenditure has basically covered the total expected incremental revenue from AI-related GPUs/ASICs and networking equipment for NVIDIA, AMD, Broadcom, and Marvell this year (over $85 billion).

What investors should pay more attention to is the outlook for 2026, where JP Morgan currently expects the growth rate of data center capital expenditures to exceed 50%, a significant increase from the previous expectation of 30%. Based on this growth rate, the incremental expenditure in 2026 will exceed $150 billion.

Historical data shows that upward adjustments in capital expenditure growth expectations throughout the year are the norm. This trend has been observed in both 2024 and 2025: as time progresses and visibility improves, the market continuously revises upward its expectations for capital expenditure growth in future years. JP Morgan believes that 2026 will repeat this pattern, and as confidence in sustained growth increases, market expectations for capital expenditures in 2026/2027 are likely to continue to rise.

From the total capital expenditures of the four major U.S. hyperscale cloud service providers, it is expected to reach about $363 billion in 2025, a year-on-year increase of about 65%; and is expected to reach about $447 billion in 2026, continuing to maintain strong growth momentum.

Wall Street's Blind Spot: Underestimated Chip Revenues

For core suppliers of AI infrastructure such as NVIDIA, Broadcom, AMD, and Marvell, this means that analysts' consensus expectations have lagged behind reality. JP Morgan believes that the current market revenue forecasts for these companies in 2026 do not fully reflect the upcoming $150 billion to $175 billion in new capital expenditures

"Given the strong (and urgent) demand we see for AI computing, we would not be surprised if data center capital expenditures ultimately reach a year-on-year growth range of over 60% by 2026... This will bring about an upside potential for AI revenues that is currently not accounted for in Wall Street forecasts."

In short, when capital expenditures translate into orders, Wall Street will be forced to once again raise the earnings expectations for these chip giants.

Order Backlog and Overlooked "Non-Traditional" Buyers

The report specifically names Broadcom and NVIDIA as having their backlog order values misread by the market. For instance, regarding Broadcom, JP Morgan believes that buyers have severely misinterpreted management's comments about the "18-month backlog of $73 billion," underestimating the speed at which it will convert into actual revenue. More critically, investors often focus on the four major cloud providers in the U.S., overlooking other rising forces.

Focusing solely on the spending of the top 4 or 5 U.S. hyperscale companies does not take into account significant expenditures occurring outside the realm of traditional hyperscale companies, including the increasingly influential neoclouds (new cloud service providers) and sovereign AI projects as they scale up.

This means that, in addition to the well-known tech giants, sovereign nations and emerging cloud platforms are becoming new pillars supporting AI chip demand, which will provide the industry with a longer and more vigorous growth runway than expected