Bank of America 2026 Semiconductor Outlook: Key Midpoint for AI Infrastructure Upgrade, Chip Sales Expected to Exceed $1 Trillion for the First Time

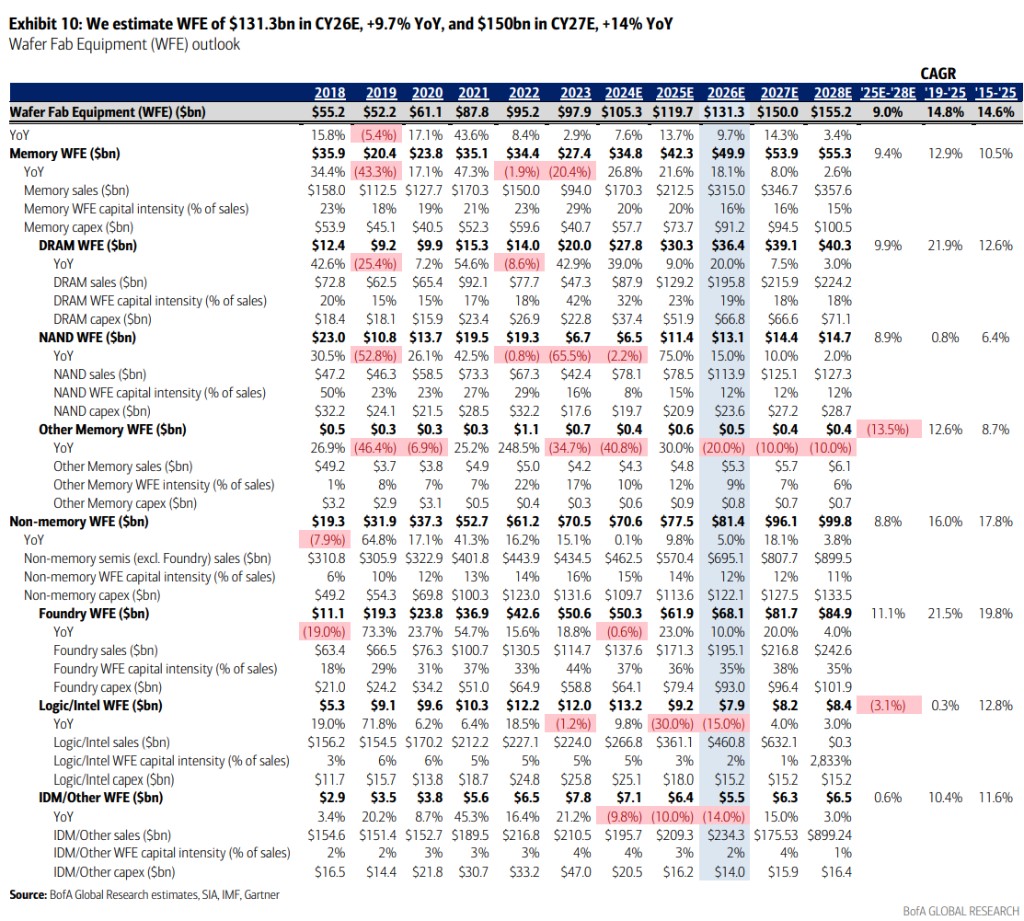

Bank of America believes that although the return on AI investments and the cash flow of hyperscale cloud service providers are under stricter scrutiny, which may lead to stock price fluctuations, faster-updating large language model builders and AI factories serving enterprise and government clients will offset this impact. Semiconductor equipment is the "unsung hero" of the AI and reshoring trends, with the report predicting that wafer fabrication equipment (WFE) sales will achieve nearly double-digit year-on-year growth by 2026

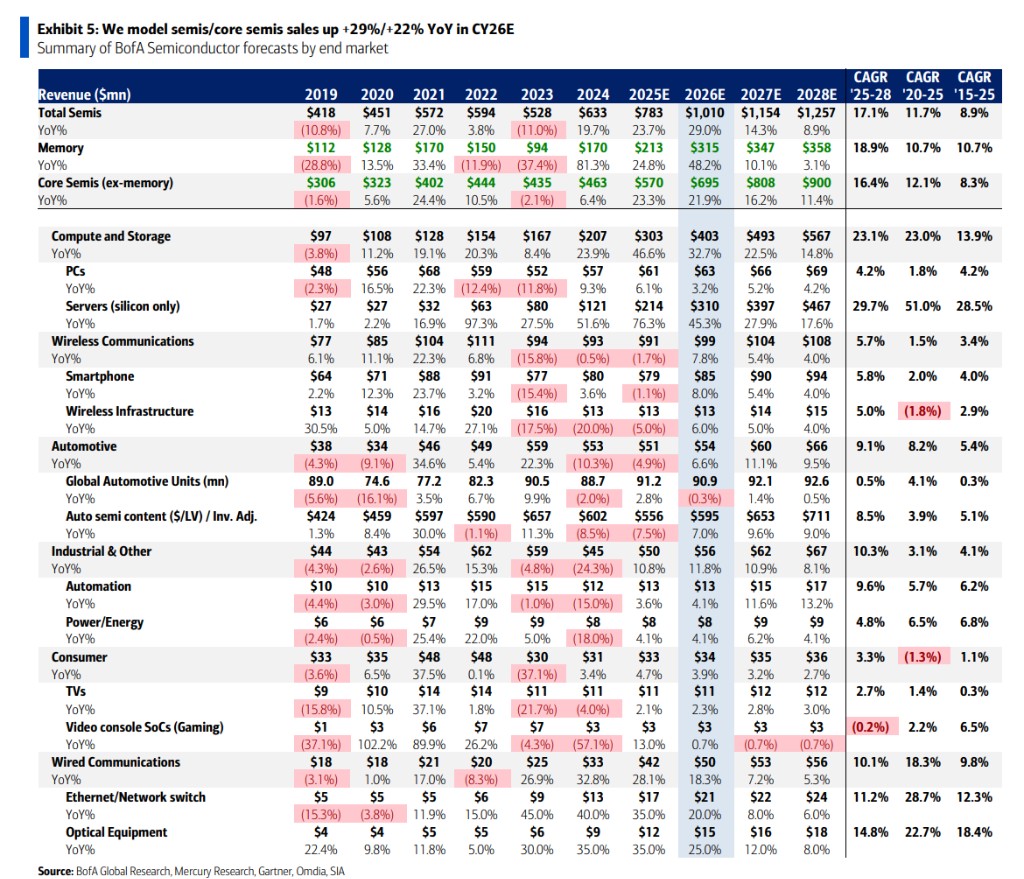

Bank of America Merrill Lynch's latest semiconductor industry outlook shows that 2026 will be a key midpoint for AI infrastructure construction, with global semiconductor sales expected to surpass the $1 trillion mark for the first time, reaching $1.01 trillion, a year-on-year increase of 29%.

According to the Wind Trading Desk, a research report released by Bank of America analysts Vivek Arya and others points out that although the return on AI investments and the cash flow of hyperscale cloud service providers are under stricter scrutiny, which may lead to stock price volatility, the faster updates from large language model builders and AI factories serving enterprise and government clients will offset this impact. The report predicts that wafer fabrication equipment (WFE) sales will achieve nearly double-digit year-on-year growth in 2026.

The AI investment race is still in its early to mid-stages, and Bank of America expects AI semiconductors to achieve over 50% year-on-year growth, driven mainly by strong data center utilization, supply constraints, enterprise adoption, and competition among large language model builders, hyperscale cloud service providers, and government clients.

Semiconductor Equipment as the "Unsung Hero" of AI and Reshoring Trends

Bank of America expects semiconductor equipment companies to perform well in 2026, benefiting as upstream players from years of capacity expansion and technological upgrades driven by AI infrastructure demand. Analysts anticipate an increase in the second half of the year and in 2027, as visibility improves regarding capital expenditure plans and wafer fab capacity enhancement timelines.

The report indicates that although current stock prices are at a premium, analysts believe that the expected WFE market size will reach $150 billion by 2027, which has not yet been fully reflected in valuations. Bank of America prefers KLA and Lam Research, optimistic about their broad share growth potential in the foundry/logical and memory sectors.

In the advanced packaging sector, Bank of America notes that this previously smaller market has grown to a size sufficient to impact the growth capabilities of major semiconductor equipment companies. Over the past year, advanced packaging sales (HBM/logical) among covered semiconductor equipment companies grew by 22%, approximately twice the overall WFE growth.

Analog Semiconductors Remain Cautious, EDA Has Catch-Up Potential

Despite experiencing multiple rounds of earnings resets, Bank of America remains cautious about the analog semiconductor sector.

Macro demand improvement is limited, with automotive production expected to decline in 2026 amid slowing EV growth, and demand from China showing signs of retreat. Most suppliers are shipping on demand and will not see a restocking impetus until end-user demand improves.

In the EDA (Electronic Design Automation) sector, Bank of America believes that Cadence Design Systems and Synopsys offer high-quality, low-beta investment opportunities, providing exposure to the increasing complexity of semiconductors and resilient R&D spending. These two companies have about 80% recurring revenue and a beta coefficient of approximately 1.4, well below the median of 1.9 for covered stocks

Emerging Themes: Optical, Robotics, and Quantum Computing

Bank of America expects three major emerging themes to continue to emerge in 2026: Co-Packaged Optical Devices (CPO), Robotics Technology, and Quantum Computing. CPO, as a novel networking technology for AI expansion, outperforms copper wires and pluggable optical devices, led by Broadcom, NVIDIA, and Marvell.

In the field of robotics, Bank of America anticipates that the White House may increase its push, with Teradyne positioned favorably due to its Universal Robots collaborative robot platform.

Although the market size for quantum computing is still relatively small, Bank of America believes that Quantum Processing Units (QPU) have the potential to disrupt the computing field in the same way GPUs have disrupted CPUs, with NVIDIA's CUDA-Q quantum development platform providing complementary opportunities.

Overall, Bank of America maintains a constructive view on chip stocks, believing that while debates around the pace of AI investment and profitability will continue, market consensus underestimates the nature of the critical, aggressive, and defensive capital expenditure investments being made by the largest and most well-funded technology companies