After the record rise in silver, analysts suggest: it's time to take profits

分析师认为,白银当前上涨呈现” 冲动” 特征,脱离经济基本面,美国赤字未变、其他对冲资产已失方向,白银表现孤立。历史数据显示,资产单年翻倍后次年回报通常惨淡。技术面上,相对强弱指数达 68 接近超买区域,移动均线显示超买状态。建议投资者获利了结,等待回调后再入场,对冲需求者可转向黄金。

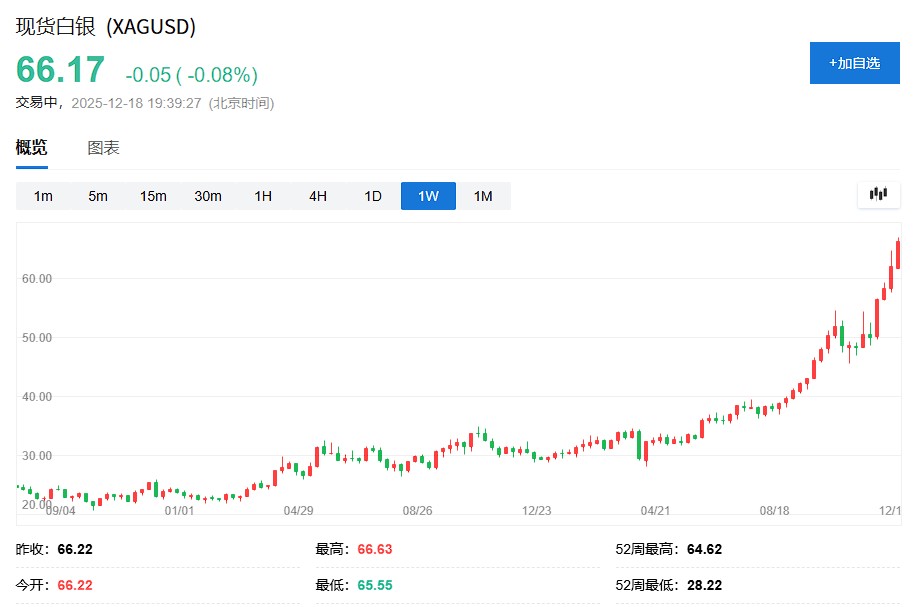

今年以来,白银价格飙升了 126%,涨幅几乎达到黄金的两倍。多位分析师认为这轮创纪录的涨势已经过度,投资者应考虑获利了结。

(现货白银周线走势图)

Wells Fargo Investment Institute 的 Sameer Samana 和独立研究机构 Spectra Markets 的 Brett Donnelly 均指出,在这一轮创纪录的上涨之后,白银需要稍作喘息。

尽管此前推动银价上涨的宏观与供需因素依然存在,但分析人士认为目前的涨势呈现出 “冲动” 特征,且已在很大程度上脱离了现实世界的经济背景。

此外,Donnelly 警告称,历史数据表明,在资产价格单年翻倍后,后续回报往往表现惨淡。

同时,技术层面的指标也发出了类似的警示信号。市场观察人士指出,当前白银的技术指标已接近超买区域,这通常预示着价格回调的临近。

基于基本面与技术面的双重考量,策略师建议投资者锁定利润,耐心等待市场回调后再寻找机会。

脱离基本面的 “冲动” 上涨

Spectra Markets 的 Brett Donnelly 指出,尽管 2025 年期间出现的物理性白银短缺在一定程度上助推了价格的剧烈波动,但当前的涨幅似乎已经超过了基本面因素所能支撑的范畴。

Donnelly 直言,这轮反弹主要是以一种 “冲动” 的方式发生的,几乎与现实世界的变化毫无关联。

他指出,虽然近几个月白银涨势如虹,但美国的赤字状况并未发生实质性变化。与此同时,其他原本被视为对冲货币贬值的交易标的,如比特币和股票指数,都已经迷失了方向。

因此,白银当前的表现显得尤为孤立且缺乏广泛的市场逻辑支撑。

历史数据预示回报趋弱

Donnelly 虽然并不倾向于在此刻建议做空白银,但他发出了一个显著的信号:在一年内经历 100% 的上涨后,资产的远期回报通常不佳。

他分析历史数据发现,在回报率达到或超过 100% 的强劲年份之后,白银在接下来的年份里往往面临更多挑战。尽管年回报率超过 100% 的案例并不多见,但一旦发生,“随后一年的表现往往平淡无奇”。

基于此,Donnelly 的观点是,投资者在进入 2026 年时应抛售白银以及巨型科技股。对于寻求对冲货币贬值的投资者而言,他建议坚持持有黄金。

技术指标显示超买

Wells Fargo Investment Institute 的 Sameer Samana 从技术分析的角度得出了类似的结论。在 Wells Fargo 的每周投资报告中,Samana 重点关注了技术指标的走势。

Samana 观察到,衡量价格动能的相对强弱指数(RSI)读数已达到 68,这一水平已非常接近超买区域。此外,白银的 50 日移动均线目前已位于 200 日移动均线之上。

在他看来,这些迹象表明白银已处于 “相当超买” 的状态。因此,他建议投资者 “可能希望获利了结,并等待回调”。