Don't celebrate too early about the cooling of U.S. CPI: Economists suspect that the government shutdown has led to data distortion, and some point out obvious errors

Multiple economists have pointed out that housing prices, a major component of the CPI, have remained basically flat over the past two months, raising doubts about the entire estimate. The "New Federal Reserve News Agency" cited economist Sharif's criticism, stating that the CPI data suggests the officials actually assumed that October's rent and Owner's Equivalent Rent (OER) were zero, which is fundamentally incorrect and "completely unacceptable." Sharif believes that the absence of October rent data may have artificially suppressed the inflation data for November. Other economists suggest that it may be necessary to wait until January to confirm the inflation situation with the release of December data

The U.S. government's official announcement of November's core inflation unexpectedly dropped to its lowest level in over four years, but this seemingly positive signal is widely questioned by economists due to the record-length government shutdown that hindered data collection, significantly undermining the credibility of the inflation report.

The report released by the U.S. Bureau of Labor Statistics (BLS) on Thursday shows that the core Consumer Price Index (CPI), excluding food and energy, rose by 2.6% year-on-year in November, marking the lowest growth rate since March 2021. The overall CPI increased by 2.7% year-on-year, while economists had expected growth rates of 3% and 3.1%, respectively.

The report indicates that the core CPI only increased by 0.2% over the two months leading up to November. However, due to the government shutdown lasting 43 days until November 12, the BLS was unable to collect most of the price data for October, making it impossible to provide month-on-month data, and the year-on-year data may also be distorted.

Federal Reserve Chairman Jerome Powell had previously warned that the CPI data "may be distorted." Following the release of this CPI, several economists pointed out that housing prices, one of the largest components of the CPI, remained essentially flat over the two months, raising questions about the entire estimate.

Omair Sharif, founder of the inflation observation and forecasting agency Inflation Insights, stated that the missing rental data for October may have artificially suppressed the inflation data for November. Nick Timiraos, a senior Fed reporter known as the "new Fed communicator," shared Sharif's comments on social media, stating:

"This is completely unacceptable. The BLS actually assumed that October's rent and Owners' Equivalent Rent (OER) were zero. I believe they must have a good technical explanation, but the only way to arrive at the conclusion that the average rent (growth) over two months is 0.06% and OER (growth) is 0.135% is to assume that October's (growth) was zero. This is, in any case, a wrong approach, but the fact is that it was done."

Despite the market's cautious attitude towards the data, U.S. stocks rebounded after the announcement, with the three major indices opening higher on Thursday. Following the CPI release, the dollar and U.S. Treasury yields hit daily lows. The interest rate futures market pricing indicates that investors expect a slight increase in the probability of a Federal Reserve rate cut in January to about 22%, with traders anticipating two rate cuts next year. The pricing fully reflects expectations of a rate cut by mid-next year.

Significant Flaws in Data Collection

Several economists have criticized the BLS's data collection process. In addition to the missing data during the government shutdown, economists believe that the delay in data collection until the "Black Friday" discount period may further distort the data.

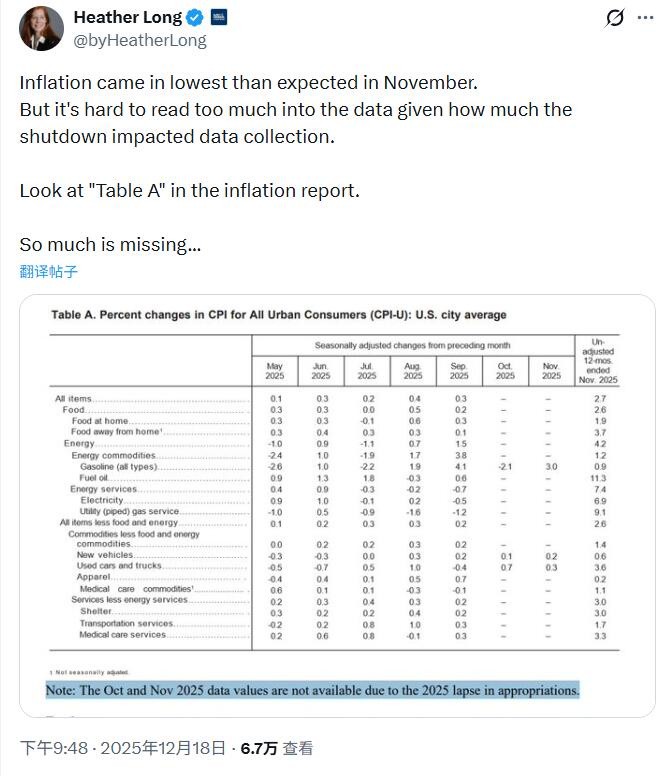

Heather Long, chief economist at Navy Federal, commented: "The inflation rate in November was lower than expected. However, considering the significant impact of the government shutdown on data collection, it is difficult to make too much interpretation of these data." "He screenshot and showed that there are many missing data points in 'Table A' of the BLS CPI report.

Paul Ashworth, Chief North America Economist at Capital Economics, pointed out in the report:

This CPI report "may indeed reflect a reduction in inflationary pressures, but (the inflation pressure) suddenly stagnating, especially in the service sector where prices are relatively stable, such as housing rents, is very rare, at least in non-recessionary periods, this phenomenon is quite abnormal."

"As a result, it seems we all have to wait until next month when the December data is released to determine whether this is a statistical anomaly or a real decline in inflation."

Omair Sharif pointed out on social media that the main issue is that the October rent and OER data were treated as zero. "This will artificially suppress the year-on-year growth rate until April (assuming BLS does not make adjustments). Another issue is that since price collection only took place in the second half of November, many core commodity prices weakened due to more discounts. This should rebound in December."

Economists at Wells Fargo stated: "(Inflation) slowing involves almost all categories, deepening our concerns about data issues caused by the government shutdown. The data collection work did not start until late November, which may have caused sample bias beyond our previous expectations."

The BLS stated that its data collection work began two days after the government shutdown ended, whereas it usually collects data throughout the entire month. Although the agency approved additional collection time, the CPI primarily relies on field visits to retail stores and service institutions across the U.S. to collect prices, which account for about 60% of the sample. The agency stated that the number of indices compiled using non-survey data is "very limited," but has not yet responded to media requests for comments.

Wall Street Divided on Rate Cut Prospects

Despite doubts about data reliability, some market participants still believe this opens up space for the Federal Reserve to cut rates. Seema Shah of Principal Asset Management stated: "The unexpected decline in November inflation provides a strong basis for the Fed's dovish stance to cut rates in January. Although data distortion cannot be ruled out, the significant drop in annual inflation leaves the Fed with almost no reason not to respond to the rising unemployment rate." She expects two rate cuts in 2026, but today's CPI data increases the likelihood that the cuts will occur in the first half rather than the second half of the year.

Ellen Zentner of Morgan Stanley Wealth Management stated: "The Fed is in 'wait-and-see mode,' and today it sees inflation moving in the right direction. Inflation may still be above target, but today's data slightly expands the space for further rate cuts."

Economists at Bloomberg Economics expressed more caution: "While we hold reservations about this report, we do see some real signs of inflation slowing, and the possibility of a rate cut in January has increased. We expect the Fed to cut rates by a cumulative 100 basis points by 2026." However, not everyone is optimistic. UBS economist Alan Detmeister stated, "I think this report should basically be set aside. Perhaps it provides a slight downward signal for overall inflation, but the vast majority is just noise and should be ignored."

Sub-item data shows abnormal housing costs

The report shows that excluding food and energy, commodity prices rose 1.4% year-on-year, down from increases of 1.5% in August and September. With data collected from third-party sources, the BLS was able to publish monthly price changes for certain categories. New car prices increased by 0.2%, up from a 0.1% increase the previous month; the increase in used car prices has slowed.

Housing costs have become the biggest point of concern. Housing prices rose 3% year-on-year, marking the smallest increase in over four years. Another service indicator closely monitored by the Federal Reserve (excluding housing and energy costs) rose 2.7% year-on-year in November 2024, matching the smallest year-on-year increase since 2021. The service price of housing, excluding energy, rose 3% year-on-year.

Declines in hotel, leisure, and clothing prices limited the increase in core CPI, while airfares and hotel accommodation prices decreased compared to the same period last year. Prices for furniture and personal care products increased. Energy prices rose 4.2% year-on-year, electricity prices rose 6.9%, and gasoline prices only increased by 0.9%.

Tariffs and economic outlook remain key variables

Powell stated that without new significant tariff news, commodity inflation is expected to peak in the first quarter. However, Trump's comprehensive tariffs have raised prices for many goods, although the transmission of tariffs has been gradual. Samuel Tombs, chief U.S. economist at Pantheon Macroeconomics, calculated that as of September, retailers had passed on about 40% of the tariffs, and this proportion is expected to gradually rise to 70% and stabilize before March.

Olu Sonola, head of U.S. economic research at Fitch Ratings, stated, "The lack of detail and the absence of data collection during the government shutdown have brought about undeniable skepticism. We will need to wait until next month to get a clearer picture of the inflation situation."

Joseph Brusuelas, chief economist at RSM accounting firm, pointed out that from the year-on-year data details, energy prices rose 4.2%, electricity rose 6.9%, used cars rose 3.6%, housing rose 3%, and healthcare services rose 3.3%, "These data illustrate why Americans' perception of the affordability crisis is real."

It remains unclear whether this CPI report will sway Federal Reserve decision-makers, who still have differing views on the interest rate path for next year. Last week, the Federal Reserve decided to cut interest rates by 25 basis points for the third consecutive monetary policy meeting to guard against further deterioration in the labor market.

A report released this Thursday, combining inflation data with recent wage data, showed that the real average hourly wage in the U.S. increased by 0.8% year-on-year. Other data released on Thursday showed that the number of initial jobless claims in the U.S. fell from 236,000 the previous week to 222,000, highlighting the volatility of data at this time of year after a surge the previous week