The most "popular" fund further restricts "subscriptions," with the C share of the silver fund dropping to 100 yuan per day

The announcement of the National Investment Silver LOF Fund regarding premium risk indicates that the premium rate has exceeded 57%. To protect the interests of investors, the fund will suspend trading from 10:30 AM on December 24, 2025, and adjust the large purchase limit for Class C funds to 100 yuan per day. Investors need to pay attention to the net asset value of the fund shares to avoid blindly investing in funds with high premium rates

On the evening of December 23, Guotou Silver LOF once again announced a premium risk.

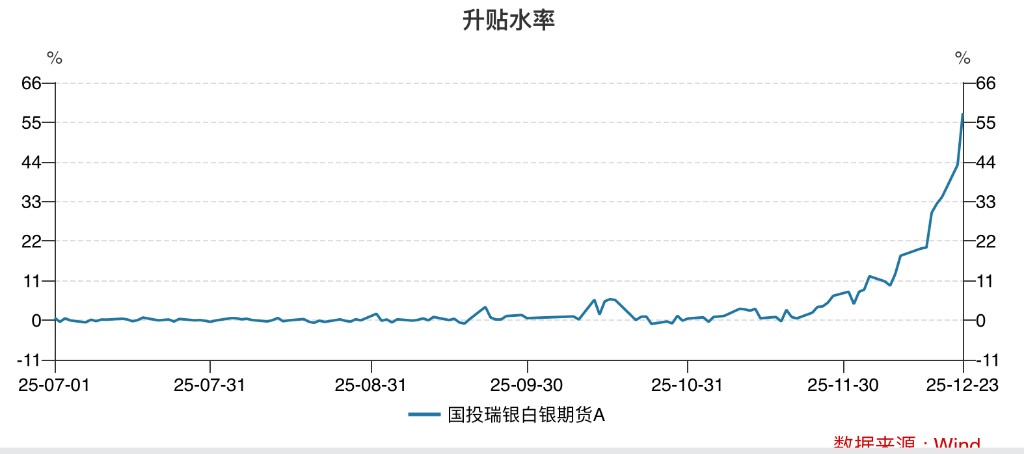

For more than a month, the premium rate of Guotou Silver LOF has been soaring. Wind data shows that based on the latest closing price and the net value on the evening of December 22, the premium rate has been estimated to exceed 57%.

Even with a daily subscription limit of only 500 yuan, it cannot suppress investors' enthusiasm for arbitrage.

Guotou Silver LOF will be suspended from trading starting from 10:30 on December 24, 2025, and will resume trading at 10:30 on the same day.

The announcement emphasized that the high premium rate of the fund's secondary market price is not sustainable.

Accompanying the premium announcement, Guotou UBS Silver LOF has separately adjusted the large subscription limit for Class C fund shares. On December 26, 2025, the regular investment amount for this fund's Class C shares will be limited to 100.00 yuan.

Premium Estimate Exceeds 50%

On the evening of December 23, Guotou UBS Fund once again announced a premium risk reminder for the secondary market trading price of Class A fund shares and the suspension and resumption of trading.

Recently, the secondary market trading price of Guotou UBS Fund's Guotou UBS Silver Futures Securities Investment Fund (LOF) Class A fund shares (hereinafter referred to as Guotou Silver LOF) has fluctuated significantly, and investors are advised to closely monitor the net value of the fund shares.

On December 22, 2025, the unit net value of Guotou Silver LOF fund shares was 1.7987 yuan. As of December 23, 2025, the closing price of Guotou Silver LOF in the secondary market was 2.833 yuan, significantly higher than the net value of the fund shares. Investors who blindly invest in fund shares with high premium rates may face substantial losses.

For more than a month, the premium rate of Guotou Silver LOF has been soaring. Wind data shows that as of December 22, the premium rate had exceeded 43%, and by the closing on December 23, based on the latest closing price and the net value on the evening of December 22, the premium rate has been estimated to exceed 57%.

Suspension from Trading on the 24th until 10:30

The announcement states that in order to protect investors' interests, Guotou Silver LOF will be suspended from trading starting from December 24, 2025, until 10:30 on the same day, and will resume trading at 10:30.

If the premium rate of Guotou Silver LOF's secondary market trading price on December 24, 2025, does not effectively decline, Guotou Silver LOF reserves the right to apply for a temporary suspension of trading during the session from the Shenzhen Stock Exchange and extend the suspension time to warn the market of risks, with specific details to be announced at that time The announcement also emphasizes that currently, the subscription limit for the State Investment Silver LOFA fund shares is set at 500.00 yuan. Subsequently, the fund manager will adjust the subscription limit for Class A fund shares, as the high premium rate in the secondary market is not sustainable.

However, the announcement from China International Capital Corporation (CICC) has made similar statements multiple times, and it has not effectively curbed investors' enthusiasm for arbitrage.

Tightening Limits on Class C Shares Alone

Accompanying the premium announcement is the adjustment notice for the large subscription (including regular fixed investment) business restrictions for the China International Capital Corporation Silver Futures Securities Investment Fund (LOF) Class C shares.

The last adjustment for the large regular fixed investment business of this fund started on December 22, 2025, limiting the regular fixed investment amount for Class A and Class C fund shares to 500 yuan each.

The latest announcement indicates that the start date for adjusting the large regular fixed investment business for Class C fund shares is December 26, 2025, with the regular fixed investment amount for Class C fund shares limited to 100.00 yuan.

This adjustment only affects the subscription (including regular fixed investment) limit for Class C fund shares, while the subscription (including regular fixed investment) limit for Class A fund shares remains at 500.00 yuan.

Risk Warning and Disclaimer

The market has risks, and investments should be made cautiously. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk