特朗普关税风暴、美以伊中东 “大乱斗”、美联储 “换帅” 风云……一文盘点 2025 年全球十大宏观事件

In 2025, the global macro order experienced systemic fractures, and turmoil became the new normal: Trump's "reciprocal tariffs" severely impacted the multilateral trade system, U.S. fiscal policy expanded comprehensively under the "Inflation Reduction Act," the federal government shutdown set a new historical record, and the "Twelve-Day War" reshaped geopolitical risk pricing. For the first time, global central banks exhibited directional divergence, and the independence of the Federal Reserve faced unprecedented challenges. Institutional failures were quickly priced in by the market: gold surpassed $4,500, and the U.S. dollar recorded its worst performance in twenty years

2025 will be a year of order collapse and a year of rule reshaping.

In this year, Trump wielded the "reciprocal tariff" stick, tearing apart the post-war trade system; the Middle East saw a sudden escalation of conflict, with the US and Israel directly striking Iranian nuclear facilities; the Russia-Ukraine situation moved to the negotiation table, yet repeatedly saw tug-of-war over territorial and security boundaries. The US fiscal policy expanded comprehensively under the "Inflation Reduction Act," with the federal government shutdown setting a historical record, and the national machinery frequently stalling amid party disputes.

Similarly profound changes occurred at the monetary level: the Federal Reserve accelerated interest rate cuts under political pressure, while the Bank of Japan counter-cyclically restarted interest rate hikes, marking the first instance of directional institutional division among major global central banks.

All fissures ultimately reflected on the market—gold broke through $4,500, ushering in the most fervent bull market in forty years; the US dollar index fell towards its worst annual performance in twenty years; and risk assets learned one thing: to treat institutional failure itself as a background noise that can be priced.

Each shock had briefly suffocated the global market. When shocks repeatedly occurred, they ceased to be accidents and became the new normal. In 2026, the world will continue to explore new balances and rules in the reality of "chaos has become certainty." The only certainty is that turmoil itself has become the most stable characteristic of this era.

Trump's Tariff Stick Deals a Heavy Blow to Global Trade Order

In 2025, the "reciprocal tariff" policy implemented by the Trump administration triggered global trade turbulence, transforming tariffs from a temporary trade relief measure into a normalized tool for strategic games, profoundly impacting the multilateral trade system established post-war.

According to reports from Xinhua News Agency and CCTV News, at the beginning of the year, the Trump administration signed a memorandum on the "America First Trade Policy," generalizing the concept of national security and clearing obstacles for the full implementation of "reciprocal tariffs."

On April 2, Trump signed a tariff executive order at the White House, declaring a national emergency in the US and imposing a 10% "baseline tariff" on all countries, with differentiated higher "reciprocal tariffs" on countries with the largest trade deficits with the US.

According to the tariff list released by the White House, the tax rates faced by various countries vary significantly. The UK, Australia, and others face a 10% baseline tax rate, while Vietnam faces as high as 46%, Cambodia 49%, and South Africa's Lesotho faces punitive tariffs of 50%. The tariff levels for the EU are 20%, Japan 24%, South Korea 25%, and India 26%.

On the night the policy was announced, US stock futures plummeted, with Nasdaq 100 futures dropping over 4% at one point. The euro surged against the dollar to 1.0920, Bitcoin soared to $88,000, and spot gold quickly rebounded to break through $3,140 after a "flash crash."

The core controversy of "reciprocal tariffs" lies in its misleading calculation logic and unilateral implementation. The United States derives tariff rates solely based on trade deficits, a simplified formula that 99% of trade economists question for its lack of economic significance and even exaggerates the degree of so-called "unfair trade."

The core controversy of "reciprocal tariffs" lies in its misleading calculation logic and unilateral implementation. The United States derives tariff rates solely based on trade deficits, a simplified formula that 99% of trade economists question for its lack of economic significance and even exaggerates the degree of so-called "unfair trade."

After strong symbolic statements, Europe, Japan, and South Korea quickly shifted to negotiations, hoping to exchange industrial concessions, market access, and political coordination for exemptions. Taking Japan as an example, in early September, Trump signed a U.S.-Japan trade executive order, and the U.S. would impose a 15% baseline tariff on almost all Japanese products. In exchange, Japan agreed to establish a $550 billion investment fund and purchase U.S.-made commercial aircraft, U.S. defense equipment, and U.S. agricultural products including corn, among others.

After several rounds of intense negotiations, China and the United States returned to the negotiating table and ultimately reached a handshake agreement framework.

The Trump administration's "reciprocal tariff" policy is essentially an attempt to reconstruct trade rules through unilateral hegemony. As tariffs become a normalized tool, the path to achieving free trade shifts from global multilateralism to regional coordination and bilateral cooperation, and the global trade landscape is undergoing a profound adjustment not seen in a century.

Twelve Days of War: U.S. and Israel Join Forces to Strike Iranian Nuclear Facilities

The conflict between Israel and Iran became a significant variable in the global financial market in 2025.

The trigger for the conflict was the breakdown of U.S.-Iran nuclear negotiations. Since April, five rounds of indirect negotiations between the U.S. and Iran have stalled due to the U.S. side's harsh demands such as "zero enrichment of uranium," while a May report from the International Atomic Energy Agency indicated that Iran's enriched uranium reserves were nearing weapon-grade, completely igniting Israel's determination to take military action.

According to CCTV News, in the early hours of June 13, the Israeli Air Force launched a surprise operation codenamed "Lion's Strength," with 200 aircraft carrying 330 munitions precisely striking over 100 key targets within Iran, marking the beginning of the "Twelve Days War." On the evening of the 13th, Iran initiated a military operation called "Real Commitment-3" against Israel, and subsequently announced the cancellation of the sixth round of indirect negotiations scheduled for the 15th in Oman.

The market reacted extremely violently. The Dow Jones Industrial Average plummeted over 700 points that day, the S&P 500 index fell below 6000 points, and the VIX fear index soared above 20. WTI crude oil surged over 13%, marking the largest single-day increase since March 2022. Spot gold rose over 1.4% to surpass $3400, with risk aversion sweeping the globe.

As Israel and Iran are engaged in fierce battles, the U.S. military suddenly launched a "Midnight Hammer" military strike against Iran.

As Israel and Iran are engaged in fierce battles, the U.S. military suddenly launched a "Midnight Hammer" military strike against Iran.

According to PLA Daily, during June, the U.S. military deployed 7 B-2 bombers to drop 14 bunker busters on the Fordow and Natanz nuclear facilities; they also launched Tomahawk missiles at the Isfahan nuclear facility. In response, Iran launched missile strikes against U.S. military bases.

Under pressure from the international community and the exhaustion of both sides, a ceasefire took effect on June 25, with both countries claiming "victory."

Risk aversion sentiment quickly dissipated, and oil prices fell back to pre-conflict levels, while gold briefly dropped below $3,300 but then rebounded after Powell signaled a rate cut, indicating that market focus had shifted from geopolitical issues to monetary policy.

"Great Beautiful Act" Implemented: $3.4 Trillion Debt Increase Expected Over the Next Decade

On July 4, U.S. President Trump signed his signature legislation, the "Great Beautiful Act," on Independence Day, which officially took effect and encompasses over a trillion dollars in spending and tax cuts.

Data chart

Data chart

This act was passed after several days of intense voting.

On July 3, the House of Representatives narrowly passed the act with a vote of 218 to 214, with two Republican lawmakers "defecting" to vote against it. Prior to this, Vice President Vance cast the crucial tie-breaking vote in the Senate with a vote of 51 to 50. Before the House vote, Democratic leader Hakeem Jeffries delivered a nearly 9-hour speech protesting the act, setting a record for the longest speech in modern House history.

The act permanently extends the tax cuts introduced by Trump in 2017, raises the debt ceiling by $5 trillion, and significantly cuts social security programs such as Medicaid. According to estimates from the U.S. Congressional Budget Office, the act will increase the government budget deficit by $3.4 trillion over the next decade. Republicans claim that it will reduce taxes by $4 trillion and cut spending by at least $1.5 trillion over the next decade.

The act will exempt tips and overtime pay from taxes until 2028, raise the state and local tax deduction limit from $10,000 to $40,000, and impose an 8% tax on net investment income for private universities with large endowments, such as Harvard. The act also eliminates the electric vehicle and climate project tax credits established by the Biden administration, allocates nearly $47 billion for the construction of the U.S.-Mexico border wall, and $45 billion for detention centers. In terms of Medicaid, it will cut nearly $1 trillion over the next decade, with the Congressional Budget Office estimating that by 2034, 11.8 million Americans will lose health insurance.

U.S. Treasury Secretary Basent stated that the market indicates the act has fiscal prudence and is beneficial for economic growth, bringing certainty and stability to the economy.

However, economists predict that the revenue generated by Trump's tariffs will be far less than the revenue losses caused by the act. An analysis from Yale University's Budget Lab shows that the after-tax income of the lowest fifth of Americans will decline by an average of 2.3% over the next decade, while the after-tax income of the highest fifth of Americans will increase by about 2.3%According to the current trajectory, by 2035, the U.S. debt burden will exceed 118% of the economy's size.

Elon Musk has repeatedly criticized the bill, believing it will destroy millions of American jobs and severely impact future industries such as renewable energy. The bill abolishes key rules for carbon emissions credit trading, sets fines for average fuel economy standards to zero, and eliminates the incentive for traditional automakers to purchase Tesla's carbon emissions credits. Last year, Tesla's carbon credit revenue reached $2.8 billion, accounting for 39% of its net profit. Without the $409 million in carbon credit revenue in the first quarter of this year, it would have faced losses.

U.S. Government Shutdown Crisis: The Longest Political Standoff in History

The longest federal government shutdown in U.S. history, lasting 43 days, officially ended on November 12. President Trump signed a temporary funding bill passed by both houses of Congress, providing funding for the government until January 30 of next year and retroactively paying federal employees affected by the shutdown. This shutdown, which began on October 1, forced approximately 750,000 federal employees to take unpaid leave, paused the release of key economic data, and exacerbated airport delays.

The House of Representatives completed the final vote around 7 PM Eastern Time on the 12th, and the Senate had already approved the bill on Monday. House Republican leader Steve Scalise stated that despite the slim Republican majority in the House, they secured enough Democratic support to pass the bill. Trump had previously indicated he would sign the bill.

The White House Office of Management and Budget issued a statement saying the bill "finally ends the longest government shutdown in history imposed on the American people by congressional Democrats." White House Press Secretary Karoline Leavitt cited estimates from the Congressional Budget Office, stating that the government shutdown could reduce economic growth by two percentage points in the fourth quarter and that the consumer price index and employment report for October "may never be released."

The shutdown began at midnight on October 1 due to fundamental disagreements between the two parties over the content of the temporary funding bill. The Republican proposal extended funding until November 21, while the Democratic counterproposal extended it until October 31 and included policy provisions for expanding healthcare. The healthcare expansion plan promoted by Democrats aimed to cover over 95% of the population but faced opposition from Republicans, who were concerned about increased corporate tax burdens and expanding debt. On September 30, the Senate voted on the Republican proposal with a result of 55-45, failing to meet the required 60-vote threshold.

During the shutdown, key federal services were directly impacted. Approximately 750,000 federal employees were forced to take unpaid leave, and employees in positions responsible for national security had to work without pay. Iconic sites such as the Washington Monument were closed due to staff shortages, and over 11,000 Federal Aviation Administration employees were furloughed, significantly increasing the risk of flight delays. The Bureau of Labor Statistics, responsible for releasing employment and inflation data, was closed, resulting in the delayed release of key economic data, including the employment report and CPI report, affecting the Federal Reserve's monetary policy decisions.

Market sentiment turned optimistic with the expectation of the shutdown's end, the dollar weakened slightly, and risk assets strengthened. The real change is that the systemic dysfunction itself is being "de-risked" by the market. Budget battles, funding deadlocks, and governance inefficiencies have become background noise that can be ignored

Russia-Ukraine Peace Negotiations Enter "Final Stage," Significant Discrepancies Remain on Territorial Division and Security Guarantees

The Russia-Ukraine negotiations have made significant progress, but core issues remain unresolved.

On December 28, after meeting with Ukrainian President Volodymyr Zelensky at Mar-a-Lago, Trump stated that both Russia and Ukraine are interested in ending the conflict, and the relevant negotiations have entered the "final stage", with negotiations on territorial issues "about 90% completed." He revealed that the U.S. and Ukraine will reach a "very strong" security agreement.

However, Trump acknowledged that the territorial issues concerning Ukraine "have not yet been settled," and "thorny" issues such as the demilitarization of the Donbas region remain to be resolved. According to Xinhua News Agency, in a call with Russian President Vladimir Putin before the meeting, both sides reached a consensus that using a referendum as an excuse for a temporary ceasefire would only prolong the conflict. Zelensky previously stated that if Putin agrees to a 60-day ceasefire, he would submit the entire "peace plan" to a nationwide referendum in Ukraine.

Regarding security guarantees, Trump revealed that the U.S. and Ukraine will reach a "very strong" security agreement, which will involve European countries, but he did not provide specific details, emphasizing the hope that Europe would "bear a large part of the responsibility." Zelensky believes that the proposed 15-year validity period from the U.S. side is still insufficient and hopes for a term exceeding 15 years. On the issue of Ukraine joining NATO, Zelensky changed his previous stance on the 24th, stating that he disagrees with the clause in the new 20-point "peace plan" that requires Ukraine to abandon its NATO membership.

According to Russian Deputy Foreign Minister Ryabkov, the 20-point "peace plan" draft published by Ukraine is "fundamentally different" from the 27 points discussed in recent weeks between Russia and the U.S. The Russian side believes that a resolution to the conflict is genuinely close, but "whether the final sprint can be completed and an agreement reached" depends on the political will of the other side. According to plan, Trump will speak with Putin again after concluding his meeting with Zelensky to discuss the latest results of the talks.

Tariff War "Judicial Chapter": Key Ruling by the Supreme Court

Trump's global taxation policy has been challenged by domestic businesses and state governments in the U.S., with the U.S. International Trade Court first questioning the president's abuse of emergency powers, ultimately pushing the case to the Supreme Court.

On May 28, the U.S. International Trade Court blocked the tariff policy announced by Trump in April, ruling that the president overstepped his authority in imposing comprehensive tariffs. Three judges, appointed by Reagan, Obama, and Trump respectively, unanimously determined that the president abused emergency powers, crossing constitutional lines.

The court provided four key conclusions: the IEEPA law does not grant the president "unlimited tariff authority"; tariffs aimed at trade deficits are strictly limited by the Trade Act of 1974, with a maximum of 15% and not exceeding 150 days; tariffs failed to directly address "special threats"; the Constitution requires tariffs to be implemented uniformly nationwide.

Facing legal challenges, the Trump administration began to adjust its strategy. In October, the government exempted tariffs on dozens of products, from gold to LED lights, and previewed hundreds of potential exemptions. The government shifted to using the more solid legal basis of Section 232, imposing a 25% tariff on trucks and a 10% tariff on busesThe U.S. Supreme Court is expected to make a key ruling in January next year, determining whether the government has the authority to impose "reciprocal tariffs" under the International Emergency Economic Powers Act. Despite cabinet officials attempting to downplay the potential legal setback, Trump's increasingly anxious remarks and widespread market predictions point to a possibility: the government may lose this lawsuit.

Goldman Sachs predicts that if the tariffs are overturned, the risks will "tilt towards lower tariff rates." Even if the government turns to Section 122 as a temporary measure, its 15% tariff ceiling means that the higher tariffs currently imposed on certain countries will have to be reduced. The firm expects that by the end of 2026, the effective U.S. tariff rate will decrease by about 2 percentage points from current levels.

A loss would also trigger a massive refund issue. Goldman Sachs estimates that the government has collected about $130 billion in tariffs through IEEPA, and is still increasing at a rate of about $20 billion per month. Companies have filed lawsuits to ensure they receive refunds, but the refund process could be very lengthy. According to Politico, the government is accelerating the deposit of tariff revenues into the U.S. Treasury, a move seen as aimed at increasing the difficulty for companies to obtain refunds.

Meanwhile, Wall Street investment banks are building a "financial gamble." According to media reports on October 25, companies like Jefferies and Oppenheimer are brokering deals for hedge funds to purchase future potential tariff refund claims from importers at a price of 20 to 40 cents per $1 claim.

The Fed's Leadership Change: Independence Under Challenge

In 2025, the independence of the Federal Reserve faces unprecedented challenges. Trump is openly discussing candidates for the next chair, with the Treasury deeply involved in the monetary policy framework.

Trump has previously made it clear that the next Federal Reserve chair must "significantly lower interest rates," stating that "disagreement will never be a path to becoming the Fed chair." In terms of timing, Trump indicated that a decision will be made "in the coming weeks."

Trump is more inclined to choose long-time advisor Hassett as the Fed chair. Hassett meets Trump's two key criteria: loyalty and market credibility. Former Fed governor Warsh and current governor Waller have also re-entered the competition due to their strong performance in previous interviews.

A deeper challenge is the independence of the Fed. The Trump administration is requesting the Supreme Court to authorize the dismissal of independent agency officials, attempting to overturn the precedent established by the 1935 Humphrey's Executor case. If successful, the president would gain the power to dismiss the Fed chair, fundamentally altering the independence landscape of the central bank.

Wall Street is also experiencing "undercurrents," with heavyweight figures like JPMorgan CEO Jamie Dimon frequently communicating with the government, and lobbying and competition among candidate camps intensifying. Critics argue that Hassett's current job responsibilities, which include defending presidential policies on television and criticizing the Fed, make him unsuitable to lead an independent central bank.

Global Rate Cut Cycle: An Era of Policy Divergence

Global central bank monetary policies are undergoing a historic divergence. While the Federal Reserve continues to cut rates, major central banks like the European Central Bank and the Bank of Japan are turning hawkish, with markets even betting that some central banks will start raising rates in 2026. This rare policy reversal is reshaping global asset pricingSince September, the Federal Reserve has cumulatively cut interest rates by 75 basis points, and the market expects approximately two more rate cuts in 2026. In contrast, the European Central Bank decided in December to keep interest rates unchanged, marking its fourth consecutive meeting of inaction. Swap market pricing indicates that the likelihood of the European Central Bank raising rates in 2026 now exceeds that of cutting rates. Australia and Canada are also expected to raise rates next year, while the Bank of England is anticipated to reach the bottom of its rate cycle by summer.

The divergence in policies primarily stems from regional differences in economic data. Strong employment data in Canada has led the market to price in the possibility of a rate hike early next year, while stronger-than-expected household spending in Australia has supported rate hike expectations. Inflation in the eurozone's services sector remains high, and the economy exceeded expectations in the third quarter. Germany's fiscal stimulus measures are expected to further support growth, reducing the necessity for additional rate cuts to stimulate the economy. The impact of the Trump trade war on U.S. trading partners has also been less than expected.

The Bank of Japan continues its rate hike path. Minutes from the December policy meeting show that several members believe Japan's real interest rates remain at extremely low levels, still "a considerable distance" from neutral rates. In December, the Bank of Japan raised its benchmark interest rate to 0.75%, the highest level in thirty years. A Bloomberg survey indicates that economists expect the Bank of Japan to raise rates again in about six months, with most believing the terminal rate for this rate hike cycle will be 1.25%.

David Mericle, Chief U.S. Economist at Goldman Sachs, expects the Federal Open Market Committee to implement two more 25 basis point cuts in the context of slowing inflation, bringing rates down to the 3%-3.25% range. Pooja Kumra from TD Securities describes next year as a potential "turning point" for the European Central Bank, Canada, and Australia, emphasizing that "hawkish voices are becoming louder."

Bank of Japan Resumes Rate Hikes: The Forgotten Black Swan Reappears?

On December 19, the Bank of Japan unanimously voted 9-0 to raise rates by 25 basis points to 0.75%, the highest level since 1995. This marks the first time under Governor Kazuo Ueda that "everyone bets on a rate hike," fully aligning with market expectations.

The backdrop for the rate hike is inflation consistently exceeding the 2% target, with the unemployment rate remaining below 3% for an extended period, creating conditions for wage growth. The introduction of a 21.3 trillion yen fiscal policy by Shunichi Suzuki has also intensified inflationary pressures. The weakness of the yen has become a common concern for both the government and the central bank, providing political space for the rate hike.

This rate hike has once again raised market concerns about liquidity shocks. In July of last year, the last rate hike by the Bank of Japan, combined with the exit from Yield Curve Control (YCC), triggered significant tremors in global markets, with a large number of "carry trade" positions being liquidated, resonating with U.S. recession trades and causing notable liquidity shocks.

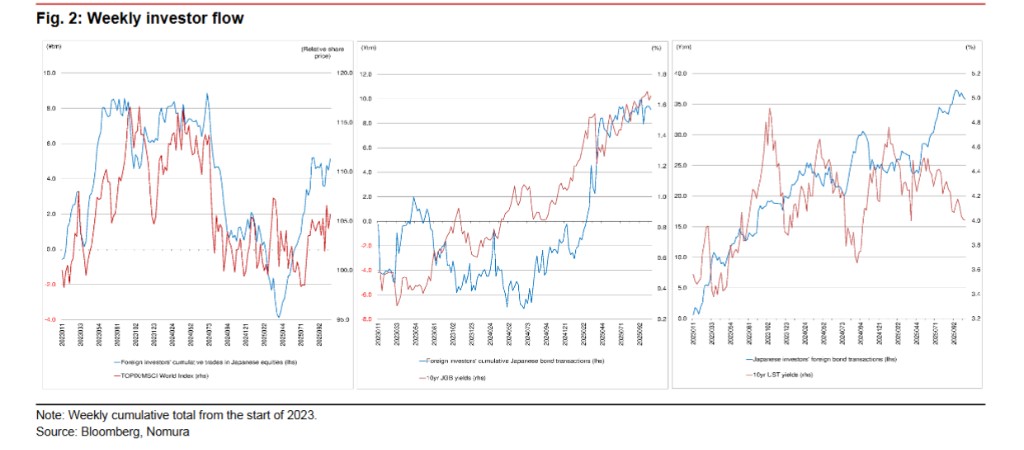

According to a strategy report released by Western Securities in mid-December, the hawkish measures taken by the Bank of Japan at that time led to the liquidation of a large number of arbitrage trades accumulated during the YCC era, causing a chain reaction in global financial markets.

However, the report analyzes that the current risk of liquidity shocks has eased. From futures market data, most speculative short positions in the yen were already liquidated in July of last year, and the most active carry trades have subsided. Additionally, the U.S. has not experienced recession trades similar to those in July of last year, as the Federal Reserve has initiated an expansionary balance sheet policy to provide liquidity buffers

However, the report also warns that the global stock market, represented by U.S. stocks, is inherently fragile after experiencing a six-year bull market, and concerns over the AI bubble theory, along with Japan's interest rate hikes, may still become a "catalyst" for triggering global liquidity shocks. The report suggests that investors closely monitor whether the U.S. market experiences 2-3 consecutive signals of "triple kill" in stocks, bonds, and currencies.

Precious Metals Frenzy: A Safe Haven Feast Amid Dollar Collapse

Driven by geopolitical risks, global supply shortages, and strong investment demand, the precious metals market is witnessing a historic moment.

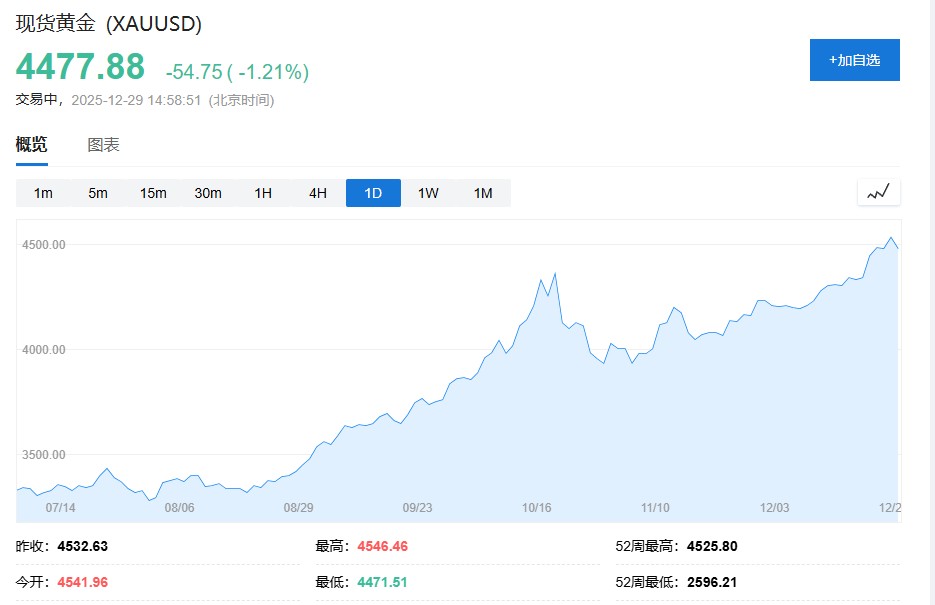

On December 24, spot gold first broke through $4,500, with an annual increase of about 70%, likely to create the best annual performance since 1979.

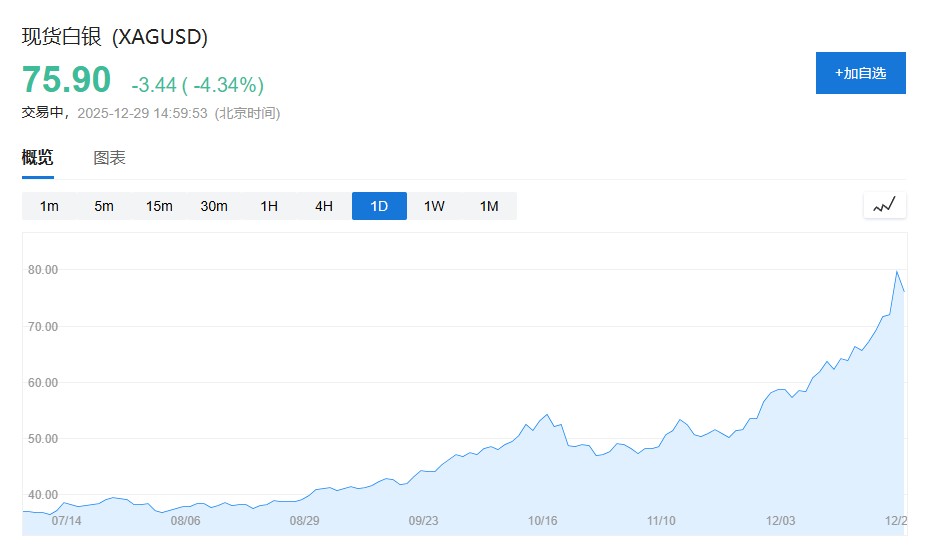

Silver once broke through the historical barrier of $80, with an annual increase of over 150%, also likely to achieve the best annual performance since 1979.

At the same time, precious metals such as platinum and palladium are also experiencing historic trends. Platinum prices soared above $2,300, rising for ten consecutive trading days, with an annual increase of over 150%.

The driving factors behind the rise in gold prices are diverse. Central banks around the world continue to buy large amounts, providing a solid foundation, with funds continuously flowing into gold ETFs. Trump's radical measures to reshape the global trade system and challenges to the independence of the Federal Reserve have all fueled gold prices. Investors are engaging in "currency depreciation trades," worrying that the global debt expansion will erode the value of sovereign bonds.

The surge in platinum is due to tight supply and demand and trade risks. Supply disruptions in South Africa have led to shortages for the third consecutive year, and high borrowing costs have made industrial users prefer leasing over purchasing. The market is paying attention to potential tariffs or trade restrictions that may result from the U.S. "Section 232" investigation.

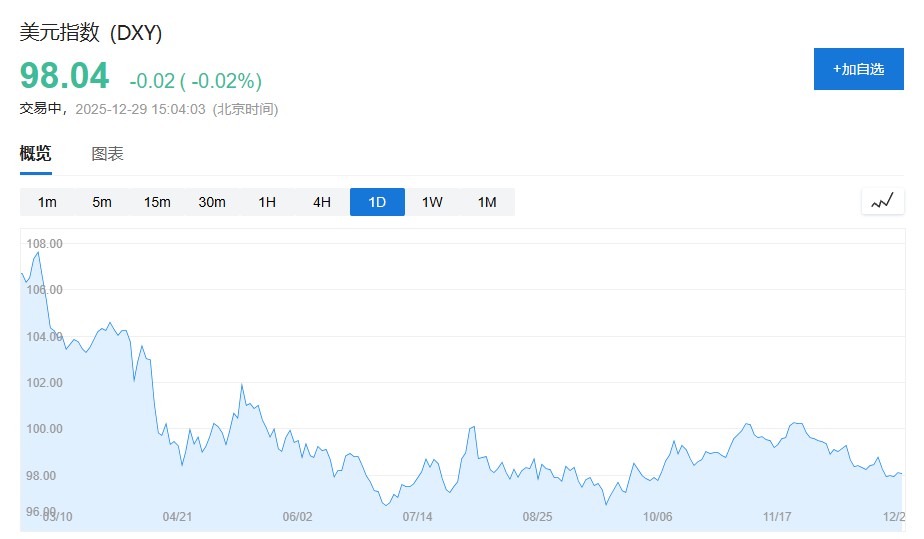

In contrast, the U.S. dollar index has fallen nearly 10% this year, approaching its worst performance since 2003. Expectations of interest rate cuts by the Federal Reserve, combined with political uncertainty, have driven non-U.S. currencies to strengthen across the board. The euro, pound, and Australian dollar have all reached multi-month highs, while the Swedish krona has achieved its strongest level since early 2022.

This historic change marks an unprecedented challenge to the dominance of the U.S. dollar, as the global financial landscape undergoes profound restructuring